Shutterfly 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.be no longer than five years for ISOs for which the grantee owns greater than 10% of the voting power of all

classes of stock and no longer than ten years for all other options. Options granted under the 1999 Plan generally

vested over four years. The Board of Directors determined that no further grants of awards under the 1999 Plan

would be made after the Company’s IPO.

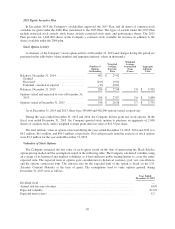

2006 Equity Incentive Plan

In June 2006, the Board adopted, and in September 2006 the Company’s stockholders approved, the 2006

Equity Incentive Plan (the “2006 Plan”), and all shares of common stock available for grant under the 1999 Plan

transferred to the 2006 Plan. The 2006 Plan provides for the grant of ISOs to employees (including officers and

directors who are also employees) of the Company or of a parent or subsidiary of the Company, and for the grant

of all other types of awards to employees, officers, directors, consultants, independent contractors and advisors of

the Company or any parent or subsidiary of the Company, provided such consultants, independent contractors

and advisors render bona-fide services not in connection with the offer and sale of securities in a capital-raising

transaction. Other types of awards under the 2006 Plan include NSOs, restricted stock awards, stock bonus

awards, restricted stock units, and performance shares.

Options issued under the 2006 Plan are generally for periods not to exceed 10 years and are issued at the fair

value of the shares of common stock on the date of grant as determined by the Board. The fair value of the

Company’s common stock is determined by the last sale price of such stock on the NASDAQ Global Select

Market. Options issued under the 2006 Plan typically vest with respect to 25% of the shares one year after the

options’ vesting commencement date, and the remainder ratably on a monthly basis over the following three

years.

The 2006 Plan provides for automatic increases in the maximum number of shares available for issuance on

January 1, 2011, 2012, and 2013 by 3.5%, 3.3%, and 3.1%, respectively, of the number of shares of the

Company’s common stock issued and outstanding on the December 31 immediately prior to the date of increase

and for automatic increases on January 1, 2014 and January 1, 2015 by 1,200,000 shares of the Company’s

common stock.

In December 2015, the 2006 Plan was superseded by the 2015 Equity Incentive Plan (the “2015 Plan”).

Tiny Prints 2008 Equity Incentive Plan

In April 2011, in connection with the acquisition of Tiny Prints, the Company converted and assumed the

equity awards granted under the Tiny Prints 2008 Equity Incentive Plan (the “Tiny Prints Plan”). Awards granted

under the Tiny Prints Plan include ISO, NSO, and restricted share awards, all of which generally vest with

respect to 25% of the shares one year after the options’ vesting commencement date, and the remainder ratably

on a monthly basis over the following three years. Options under this plan will expire if not exercised within 10

years from the date of grant, and options and awards will expire if forfeited due to termination.

2015 Equity Inducement Plan

In October 2015, the Board adopted the 2015 Equity Inducement Plan (the “2015 Inducement Plan”). Under

the Inducement Plan, the Company issued awards to newly hired officers and to certain new employees from

acquired companies. The 2015 Inducement Plan awards included time-based and performance based awards

issued to two newly hired officers and vest over four years. The 2015 Inducement Plan provides for 300,000

shares of the Company’s common stock available for issuance.

98