Shutterfly 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

generally the vesting period. Changes in these estimates and assumptions can materially affect the determination

of the fair value of stock-based compensation and consequently, the related amount recognized in our

consolidated statements of operations. We have not issued any stock options since the first quarter of 2013.

The cost of restricted stock awards and performance-based restricted stock awards is determined using the

fair value of our common stock on the date of grant. Compensation expense is recognized for restricted stock

awards on a straight-line basis over the vesting period. Compensation expense associated with performance-

based restricted stock awards is recognized on an accelerated attribution model, and ultimately based on whether

or not satisfaction of the performance criteria is probable. If in the future, situations indicate that the performance

criteria are not probable, then no further compensation cost will be recorded, and any previous costs will be

reversed. The cost of restricted stock awards with market conditions is estimated using a Monte-Carlo valuation

model.

Employee stock-based compensation expense is calculated based on awards ultimately expected to vest and

has been reduced for estimated forfeitures. Forfeitures are estimated at the time of grant and revised, if necessary,

in subsequent periods if actual forfeitures differ from those estimates.

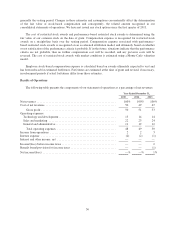

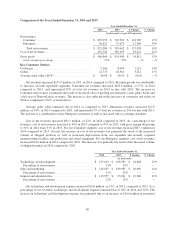

Results of Operations

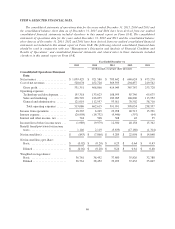

The following table presents the components of our statement of operations as a percentage of net revenues:

Year Ended December 31,

2015 2014 2013

Net revenues ...................................................... 100% 100% 100%

Cost of net revenues ................................................ 50 49 47

Gross profit ................................................... 50 51 53

Operating expenses:

Technology and development ....................................... 15 14 14

Sales and marketing .............................................. 22 23 24

General and administrative ......................................... 11 12 12

Total operating expenses ........................................ 48 49 50

Income from operations ............................................. 2 2 3

Interest expense ................................................... (2) (2) (1)

Interest and other income, net ........................................ — — —

Income/(loss) before income taxes ..................................... — — 2

Benefit from/(provision for) income taxes ............................... — — (1)

Net income/(loss) .................................................. —% —% 1%

56