Shutterfly 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

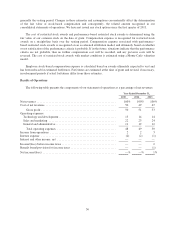

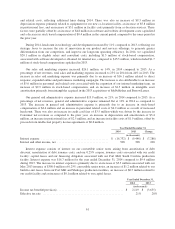

was driven by the increase in Consumer net revenues as compared to the prior year. This was partially offset by a

decrease in depreciation and amortization of $1.8 million.

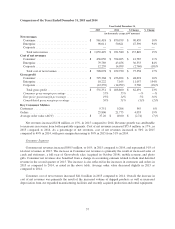

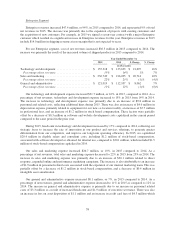

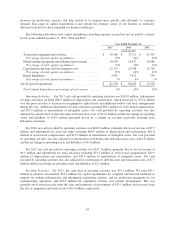

Year Ended December 31,

2015 2014 Change

(in thousands)

Interest expense ............................................. $ (20,998) $ (16,732) $ (4,266)

Interest and other income, net .................................. 744 508 236

Interest expense consists of interest on our convertible senior notes arising from amortization of debt

discount, amortization of debt issuance costs, our 0.25% coupon, issuance costs associated with our credit

facility, capital leases, and our financing obligations associated with our production facilities in Fort Mill, South

Carolina; Shakopee, Minnesota; and Tempe, Arizona. Interest expense was $21.0 million for the year ended

December 31, 2015 compared to $16.7 million during 2014. The increase in interest expense is primarily due to

an increase of $1.9 million related to our build-to-suit leases from our three production facilities, an increase of

$1.8 million related to our manufacturing equipment capital leases, and an increase of $0.7 million related to our

convertible senior notes.

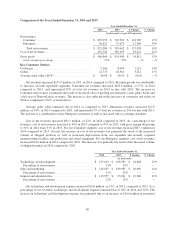

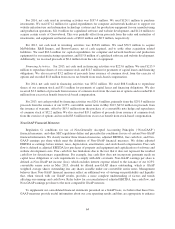

Year Ended December 31,

2015 2014

(in thousands)

Income tax benefit ...................................................... $ 1,146 $ 2,119

Effective tax rate ....................................................... 58% 21%

The benefit for income taxes was $1.1 million for 2015, compared to a benefit of $2.1 million for 2014. The

current year tax benefit was mainly due to the loss before income taxes. Our effective tax rate was 58% in 2015

and 21% in 2014. The year over year change in our effective tax rate was primarily the result of a higher federal

research and development credit benefit, the release and re-measurement of reserves related to the settlement of

our 2010 IRS audit, a reduced limitation on executive compensation, and the establishment of valuation

allowances on certain Arizona deferred tax assets.

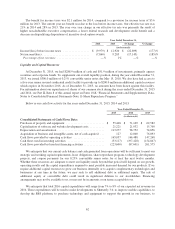

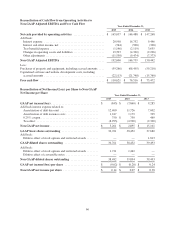

Year Ended December 31,

2015 2014 $ Change % Change

(in thousands)

Income/(loss) before income taxes ........................ $ (1,989) $ (9,979) $ 7,990 (80)%

Net income/(loss) ..................................... (843) (7,860) 7,017 (89)%

Percentage of net revenues ............................ —% —% — —%

59