Salesforce.com 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

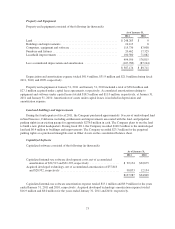

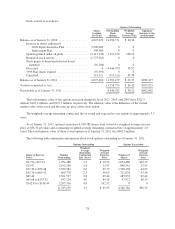

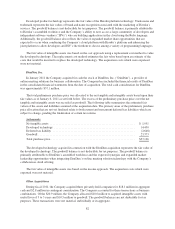

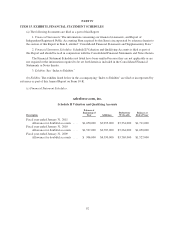

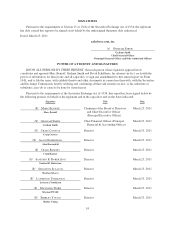

Intangible assets acquired resulting from the acquisitions described above as of January 31, 2011 are as

follows (in thousands):

Gross

Fair Value

Accumulated

Amortization

Net

Book Value

Weighted

Average Remaining

Useful Life

Acquired developed technology ....... $86,710 $ (9,324) $77,386 2.7 years

Customer relationships .............. 2,990 (412) 2,578 4.3 years

Trade name and trademark ........... 2,920 (557) 2,363 2.4 years

$92,620 $(10,293) $82,327

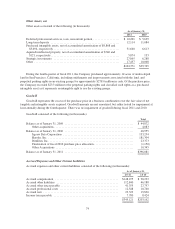

The expected future amortization expense for these intangible assets for each of the fiscal years ended

thereafter is as follows (in thousands):

Fiscal Period:

Fiscal 2012 ................................................................ $30,475

Fiscal 2013 ................................................................ 30,475

Fiscal 2014 ................................................................ 20,598

Fiscal 2015 ................................................................ 598

Fiscal 2016 ................................................................ 181

Total amortization expense ................................................... $82,327

Pro forma results of operations have not been presented because the effect of the acquisitions individually or

in the aggregate were not significant.

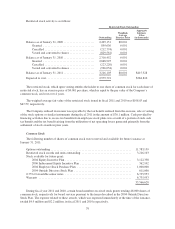

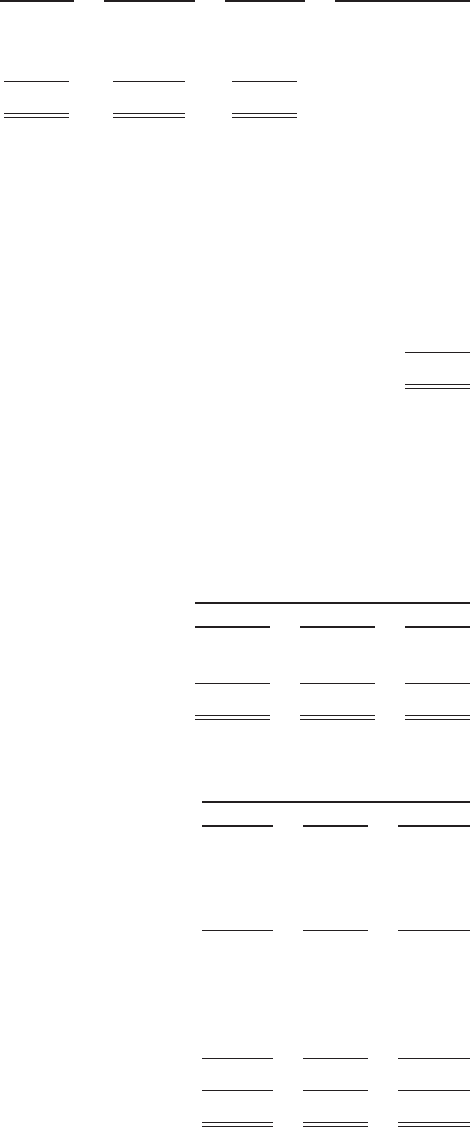

7. Income Taxes

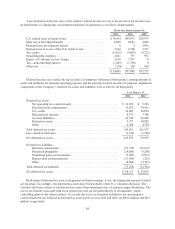

The domestic and foreign components of income before provision for income taxes and noncontrolling

interest consisted of the following (in thousands):

Fiscal Year Ended January 31,

2011 2010 2009

Domestic ............................................. $ 75,515 $125,095 $83,590

Foreign .............................................. 28,783 17,286 2,002

$104,298 $142,381 $85,592

The provision for income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2011 2010 2009

Current:

Federal ........................................... $29,992 $43,313 $ 55,228

State ............................................. 6,276 8,788 7,701

Foreign ........................................... 13,239 12,179 7,699

Total ............................................. 49,507 64,280 70,628

Deferred:

Federal ........................................... (8,687) (4,506) (26,979)

State ............................................. (4,745) (979) (5,372)

Foreign ........................................... (1,474) (1,106) (720)

Total ............................................. (14,906) (6,591) (33,071)

Provision for income taxes ........................... $34,601 $57,689 $ 37,557

83