Salesforce.com 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4. Preferred Stock

The Company’s board of directors has the authority, without further action by stockholders, to issue up to

5,000,000 shares of preferred stock in one or more series. The Company’s board of directors may designate the

rights, preferences, privileges and restrictions of the preferred stock, including dividend rights, conversion rights,

voting rights, terms of redemption, liquidation preference, sinking fund terms, and number of shares constituting

any series or the designation of any series. The issuance of preferred stock could have the effect of restricting

dividends on the Company’s common stock, diluting the voting power of its common stock, impairing the

liquidation rights of its common stock, or delaying or preventing a change in control. The ability to issue

preferred stock could delay or impede a change in control. At January 31, 2011 and 2010, no shares of preferred

stock were outstanding.

5. Joint Venture

In December 2000, the Company established a Japanese joint venture, Kabushiki Kaisha salesforce.com,

(“Salesforce Japan), with SunBridge, Inc., a Japanese corporation, to assist the Company with its sales efforts in

Japan. During fiscal 2011, the Company paid $172.0 million to acquire SunBridge’s and other shareholders’

interest in Salesforce Japan. The Company now owns 100 percent of Salesforce Japan. As a result of the

Company’s purchase of the shares held by SunBridge, the joint venture agreement terminated according to its

terms. The purchase transaction, including transaction-related fees totaling $1.1 million, were accounted for as a

reduction to additional paid-in capital and noncontrolling interest.

6. Acquisitions in fiscal year 2011

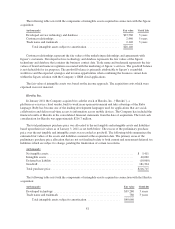

Jigsaw Data Corporation

In May 2010 the Company acquired for cash the stock of Jigsaw Data Corporation (“Jigsaw”), a cloud

provider of crowd-sourced data services in the cloud. The Company acquired Jigsaw to combine the Company’s

CRM applications and enterprise cloud platform with Jigsaw’s cloud-based model for the automation of

acquiring, completing and cleansing business contact data. The Company has included the financial results of

Jigsaw in the consolidated financial statements from the date of acquisition. The total cash consideration for

Jigsaw was approximately $148.5 million. In addition, the Company will potentially make additional payments

(“contingent consideration”) totaling up to $14.4 million in cash, based on the achievement of certain billings

targets related to Jigsaw’s services for the one-year period from May 8, 2010 through May 7, 2011. The

estimated fair value using a discounted cash flow model of the contingent consideration at May 7, 2010 was

$13.4 million and is included in the total purchase price. The Company has recorded and will record the fair

value of the contingent consideration each reporting period based on Jigsaw’s achievement of meeting its billing

targets as it relates to the contingent consideration. The Company’s estimated fair value of the contingent

consideration at January 31, 2011 was $14.1 million. The change in fair value of contingent consideration is

recorded in general and administrative expenses.

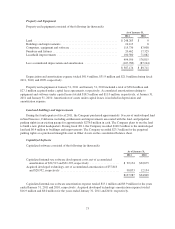

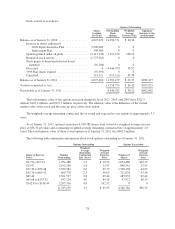

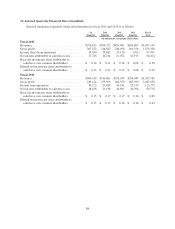

The total preliminary purchase price and the fair value of the contingent consideration was allocated to the

net tangible and intangible assets based upon their fair values as of May 7, 2010 as set forth below. The excess of

the preliminary purchase price over the net tangible and intangible assets was recorded as goodwill. The

following table summarizes the estimated fair values of the assets and liabilities assumed at the acquisition date.

The primary areas of the preliminary purchase price allocation that are not yet finalized relate to both current and

noncurrent deferred tax liabilities which are subject to change, pending the finalization of certain tax returns.

(in thousands)

Net tangible assets ......................................................... $ 4,347

Intangible assets ........................................................... 28,140

Deferred tax liability ....................................................... (3,864)

Goodwill ................................................................. 133,254

Total purchase price ........................................................ $161,877

80