Salesforce.com 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In accounting for the issuance of the Notes, the Company separated the Notes into liability and equity

components. The carrying amount of the liability component was calculated by measuring the fair value of a

similar liability that does not have an associated convertible feature. The carrying amount of the equity

component representing the conversion option was determined by deducting the fair value of the liability

component from the par value of the Notes as a whole. The excess of the principal amount of the liability

component over its carrying amount (“debt discount”) is amortized to interest expense over the term of the Note.

The equity component is not remeasured as long as it continues to meet the conditions for equity classification.

In accounting for the transaction costs related to the Note issuance, the Company allocated the total amount

incurred to the liability and equity components. Transaction costs attributable to the liability component are being

amortized to expense over the term of the Notes, and transaction costs attributable to the equity component were

netted with the equity component in additional paid-in capital. Additionally, the Company recorded a deferred

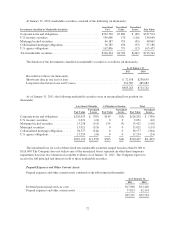

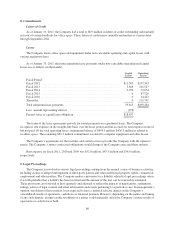

tax liability of $51.1 million in connection with the Notes. The Notes consisted of the following (in thousands):

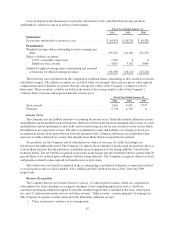

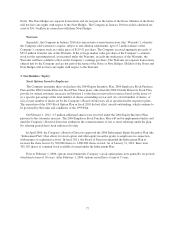

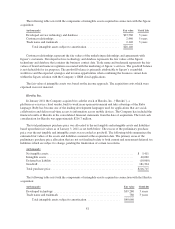

As of January 31,

2011 2010

Equity component (1) ........................................... $125,530 $ 125,530

Liability component :

Principal ................................................. $575,000 $ 575,000

Less: debt discount, net (2) ................................... (102,462) (124,802)

Net carrying amount .................................... $472,538 $ 450,198

(1) Included in the consolidated balance sheets within additional paid-in capital, net of the $1.8 million in

equity issuance costs.

(2) Included in the consolidated balance sheets within 0.75% convertible senior notes and is amortized over the

remaining life of the Notes using the effective interest rate method.

As of January 31, 2011, the remaining life of the Notes is approximately 4 years.

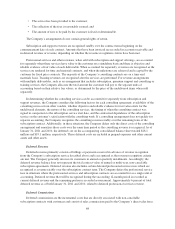

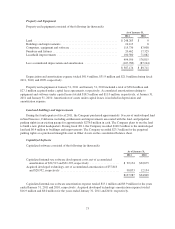

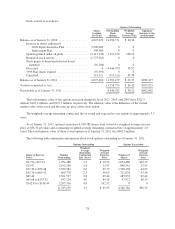

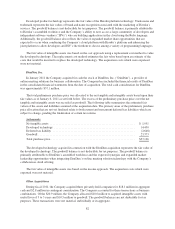

The following table sets forth total interest expense recognized related to the Notes prior to capitalization of

interest (in thousands):

Fiscal Year Ended

January 31,

2011 2010

Contractual interest expense ........................................... $ 4,313 $ 144

Amortization of debt issuance costs ..................................... 1,324 59

Amortization of debt discount .......................................... 22,396 728

$28,033 $ 931

Effective interest rate of the liability component ........................... 5.86% 5.86%

Note Hedges

To minimize the impact of potential economic dilution upon conversion of the Notes, the Company entered

into convertible note hedge transactions with respect to its common stock (the “Note Hedges”). The Company

paid, in January 2010, an aggregate amount of $126.5 million for the Note Hedges. The Note Hedges cover,

approximately 6.7 million shares of the Company’s common stock at a strike price that corresponds to the initial

conversion price of the Notes, also subject to adjustment, and are exercisable upon conversion of the Notes. The

Note Hedges will expire upon the maturity of the Notes. The Note Hedges are intended to reduce the potential

economic dilution upon conversion of the Notes in the event that the market value per share of the Company’s

common stock, as measured under the Notes, at the time of exercise is greater than the conversion price of the

76