Salesforce.com 2011 Annual Report Download - page 58

Download and view the complete annual report

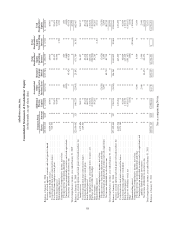

Please find page 58 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the principal amount of the Notes and, with respect to any excess conversion value greater than the principal

amount of the Notes, shares of our common stock, cash, or a combination of both. This potential repayment of

the Notes is not reflected in the timing of the payments due by period above.

We have a contractual obligation to begin construction on the undeveloped land by September 2014. If we

do not commence construction by this date we will be subject to certain penalties due to a third party. These

potential penalties are not reflected in the timing of the payments due by period above. We do not believe we will

be subject to these penalties.

Our lease agreements provide us with the option to renew. Our future operating lease obligations would

change if we exercised these options and if we entered into additional operating lease agreements as we expand

our operations.

Purchase orders are not included in the table above. Our purchase orders represent authorizations to

purchase rather than binding agreements. The contractual commitment amounts in the table above are associated

with agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or

minimum services to be used; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. Obligations under contracts that we can cancel without a significant penalty are not included in the

table above.

The timing of tax settlements are not included in the table above. We are unable to make a reasonable

estimate of the timing of payments in individual years beyond 12 months due to uncertainties in the timing of tax

settlements. For further information, see Note 7 to the notes to consolidated financial statements. We recorded

liabilities related to uncertain tax positions.

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by

operating activities will be sufficient to meet our working capital and capital expenditure needs over the next

12 months.

During fiscal 2012, we may enter into arrangements to acquire or invest in complementary businesses or

joint ventures, services or technologies. While we believe we have sufficient financial resources to do so, we may

be required to seek additional equity or debt financing. Additional funds may not be available on terms favorable

to us or at all.

Recent Accounting Pronouncement

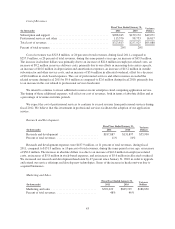

In September 2009, the Financial Accounting Standards Board, or FASB, issued Update No. 2009-13,

“Revenue Recognition (Topic 605), Multiple-Deliverable Revenue Arrangements—a consensus of the FASB

Emerging Issues Task Force” (ASU 2009-13). It updates the existing multiple-element revenue arrangements

guidance currently included under ASC 605-25. The revised guidance primarily provides two significant

changes: 1) eliminates the need for objective and reliable evidence of the fair value for the undelivered element

in order for a delivered item to be treated as a separate unit of accounting, and 2) requires the use of the relative

selling price method to allocate the entire arrangement consideration. In addition, the guidance also expands the

disclosure requirements for revenue recognition. ASU 2009-13 will be effective for us at the start of fiscal 2012.

We believe the future impact of this new accounting pronouncement will not be material to our consolidated net

income.

50