Salesforce.com 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

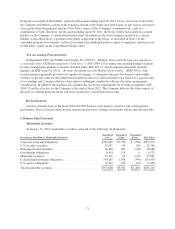

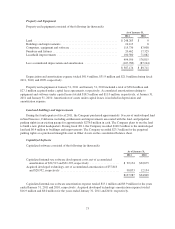

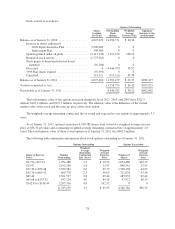

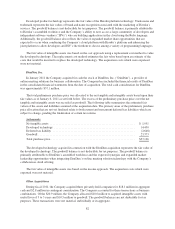

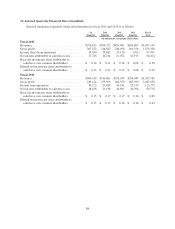

Stock activity is as follows:

Shares

Available

for Grant

Options Outstanding

Outstanding

Stock

Options

Weighted-

Average

Exercise Price

Aggregate

Intrinsic Value

(in thousands)

Balance as of January 31, 2010 .................... 4,607,929 14,036,371 $ 40.36

Increase in shares authorized:

2004 Equity Incentive Plan ............... 3,500,000 0 0

Inducement Plan ........................ 300,000 0 0

Options granted under all plans ................ (3,113,276) 3,113,276 128.33

Restricted stock activity ...................... (1,775,505) 0 0

Stock grants to board and advisory board

members ................................ (50,200) 0 0

Exercised ................................. 0 (4,646,977) 34.52

1999 Plan shares expired ..................... (92,999) 0 0

Cancelled ................................. 719,511 (719,511) 49.38

Balance as of January 31, 2011 .................... 4,095,460 11,783,159 $ 65.35 $782,437

Vested or expected to vest ........................ 11,358,774 $ 64.42 $763,923

Exercisable as of January 31, 2011 ................. 4,340,782 $ 36.32 $402,892

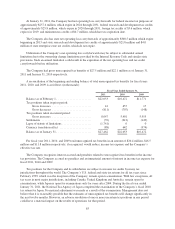

The total intrinsic value of the options exercised during the fiscal 2011, 2010, and 2009 were $322.5

million, $105.2 million, and $117.3 million, respectively. The intrinsic value is the difference of the current

market value of the stock and the exercise price of the stock option.

The weighted-average remaining contractual life of vested and expected to vest options is approximately 3.3

years.

As of January 31, 2011, options to purchase 4,340,782 shares were vested at a weighted average exercise

price of $36.32 per share and a remaining weighted-average remaining contractual life of approximately 2.6

years. The total intrinsic value of these vested options as of January 31, 2011 was $402.9 million.

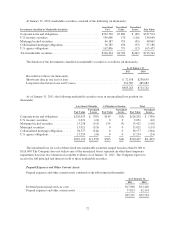

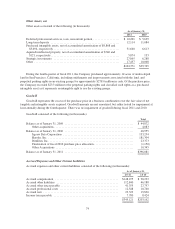

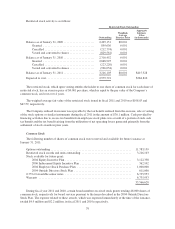

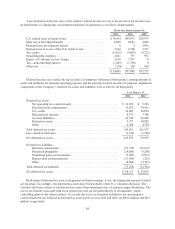

The following table summarizes information about stock options outstanding as of January 31, 2011:

Options Outstanding Options Exercisable

Range of Exercise

Prices

Number

Outstanding

Weighted-

Average

Remaining

Contractual

Life (Years)

Weighted-

Average

Exercise

Price

Number of

Shares

Weighted-

Average

Exercise

Price

$0.75 to $25.19 1,054,480 3.2 $ 10.29 1,054,480 $10.29

$25.97 2,195,260 2.8 25.97 848,361 25.97

$27.20 to $52.48 2,309,582 2.0 45.79 1,528,138 44.65

$52.76 to $65.41 669,778 2.5 56.09 321,878 55.38

$65.44 2,301,557 3.8 65.44 489,953 65.44

$65.68 to $133.32 957,126 4.0 84.78 97,972 68.15

$142.50 to $148.49 2,295,376 4.8 142.52 0 0

11,783,159 3.3 $ 65.35 4,340,782 $36.32

78