Salesforce.com 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.goodwill. Upon the conclusion of the measurement period or final determination of the fair value of assets

acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded to our

consolidated statements of operations.

In addition, uncertain tax positions and tax related valuation allowances assumed in connection with a

business combination are initially estimated as of the acquisition date. We reevaluate these items quarterly and

record any adjustments to the preliminary estimates to goodwill provided that we are within the measurement

period and we continue to collect information in order to determine their estimated fair values as of the date of

acquisition. Subsequent to the measurement period or our final determination of the tax allowance’s or

contingency’s estimated value, changes to these uncertain tax positions and tax related valuation allowances will

affect our provision for income taxes in the consolidated statement of operations.

Accounting for Stock-Based Awards. We recognize the fair value of our stock awards on a straight-line basis

over the requisite service period of the award which is the vesting term of four years.

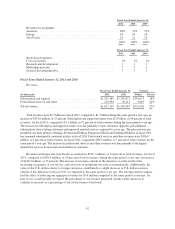

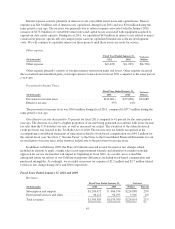

We recognized stock-based expense of $120.4 million, or 7 percent of revenue, during fiscal 2011. The

requirement to expense stock-based awards will continue to materially reduce our reported results of operations.

As of January 31, 2011, we had an aggregate of $559.8 million of stock compensation remaining to be amortized

to expense over the remaining requisite service period of the underlying awards. We currently expect this stock

compensation balance to be amortized as follows: $195.1 million during fiscal 2012; $157.9 million during fiscal

2013; $129.6 million during fiscal 2014; $76.8 million during fiscal 2015 and $0.4 million during fiscal 2016.

These amounts reflect only outstanding stock awards as of January 31, 2011 and assume no forfeiture activity.

We expect to continue to issue share-based awards to our employees in future periods, which will increase the

stock compensation amortization in such future periods.

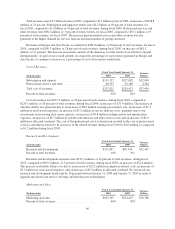

We recognize as an operating expense the payroll and social tax costs, as applicable by jurisdiction, when

stock options are exercised. The impact of stock-based expense in the future is dependent upon, among other

things, the timing of when we hire additional employees, the effect of long-term incentive strategies involving

stock awards in order to continue to attract and retain employees, the total number of stock awards granted, the

fair value of the stock awards at the time of grant, changes in estimated forfeiture assumption rates and the tax

benefit that we may or may not receive from stock-based expenses. Additionally, we are required to use an

option-pricing model to determine the fair value of stock option awards. This determination of fair value is

affected by our stock price as well as assumptions regarding a number of highly complex and subjective

variables. These variables include, but are not limited to, our expected stock price volatility over the term of the

awards.

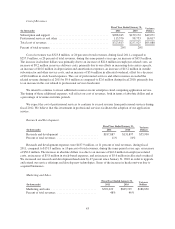

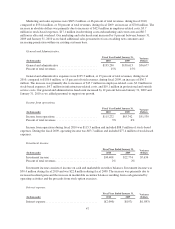

As of January 31, 2011, there were 3.2 million restricted stock awards and units outstanding. We plan to

continue awarding restricted stock to our employees in the future. The restricted stock, which upon vesting

entitles the holder to one share of common stock for each restricted stock, has an exercise price of $0.001 per

share, which is equal to the par value of our common stock, and vest over 4 years. The fair value of the restricted

stock is based on our closing stock price on the date of grant, and compensation expense, net of estimated

forfeitures, is recognized on a straight-line basis over the vesting period.

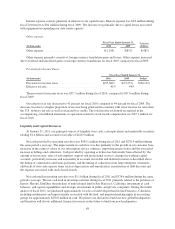

Accounting for Income Taxes. We account for income taxes using the liability method, which requires the

recognition of deferred tax assets or liabilities for the tax-effected temporary differences between the financial

reporting and tax bases of our assets and liabilities and for net operating loss and tax credit carryforwards. The

tax expense or benefit for unusual items, or certain adjustments to the valuation allowance are treated as discrete

items in the interim period in which the events occur.

Our effective tax rate could be adversely affected by changes in the mix of earnings and losses in countries

with differing statutory tax rates, certain non-deductible expenses as a result of acquisitions, the calculation of

deferred tax assets and liabilities, and changes in tax laws and accounting principles.

39