Salesforce.com 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

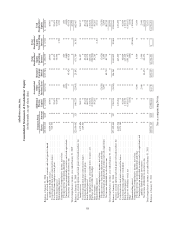

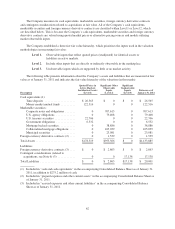

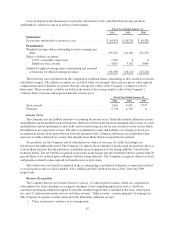

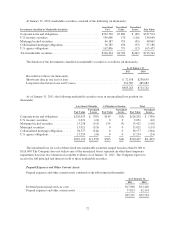

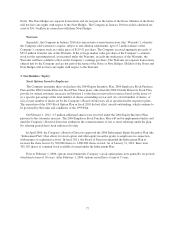

A reconciliation of the denominator used in the calculation of basic and diluted net income per share

attributable to salesforce.com is as follows (in thousands):

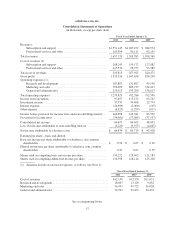

Fiscal Year Ended January 31,

2011 2010 2009

Numerator:

Net income attributable to salesforce.com .................. $ 64,474 $ 80,719 $ 43,428

Denominator:

Weighted-average shares outstanding for basic earnings per

share ............................................. 130,222 124,462 121,183

Effect of dilutive securities:

0.75% convertible senior notes ...................... 1,561 0 0

Employee stock awards ............................ 4,815 3,652 4,045

Adjusted weighted-average shares outstanding and assumed

conversions for diluted earnings per share ................ 136,598 128,114 125,228

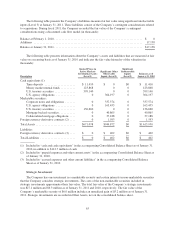

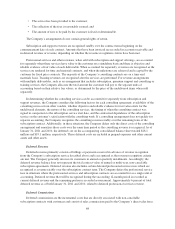

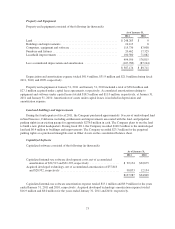

The following were excluded from the computation of diluted shares outstanding as they would have had an

anti-dilutive impact. The dilutive securities are excluded when, for example, their exercise prices, unrecognized

compensation and tax benefits are greater than the average fair values of the Company’s common stock (in

thousands). These securities could be included in the future if the average market value of the Company’s

common shares increases and is greater than the exercise price.

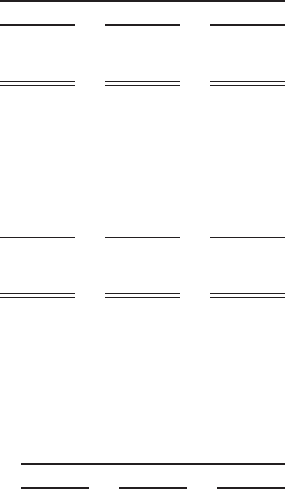

Fiscal Year Ended January 31,

2011 2010 2009

Stock awards ........................................... 1,061 4,455 3,797

Warrants .............................................. 6,736 6,736 0

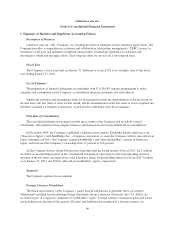

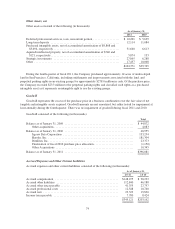

Income Taxes

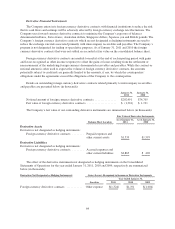

The Company uses the liability method of accounting for income taxes. Under this method, deferred tax assets

and liabilities are determined based on temporary differences between the financial statement and tax basis of assets

and liabilities and net operating loss and credit carryforwards using enacted tax rates in effect for the year in which

the differences are expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in income in the period that includes the enactment date. Valuation allowances are established when

necessary to reduce deferred tax assets to the amounts more likely than not expected to be realized.

Tax positions for the Company and its subsidiaries are subject to income tax audits by multiple tax

jurisdictions throughout the world. The Company recognizes the tax benefit of an uncertain tax position only if it

is more likely than not that the position is sustainable upon examination by the taxing authority, based on the

technical merits. The tax benefit recognized is measured as the largest amount of benefit which is greater than 50

percent likely to be realized upon settlement with the taxing authority. The Company recognizes interest accrued

and penalties related to unrecognized tax benefits in its tax provision.

The total income tax benefit recognized in the accompanying consolidated statements of operations related

to stock-based awards was $44.1 million, $32.1 million and $26.3 million for fiscal 2011, 2010 and 2009,

respectively.

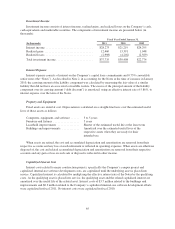

Revenue Recognition

The Company derives its revenues from two sources: (1) subscription revenues, which are comprised of

subscription fees from customers accessing its enterprise cloud computing application service, and from

customers purchasing additional support beyond the standard support that is included in the basic subscription

fee; and (2) related professional services and other revenue. “Other revenue” consists primarily of training fees.

The Company recognizes revenue when all of the following conditions are met:

• There is persuasive evidence of an arrangement;

67