Salesforce.com 2011 Annual Report Download - page 45

Download and view the complete annual report

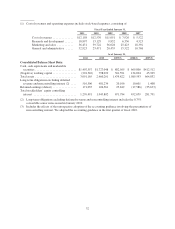

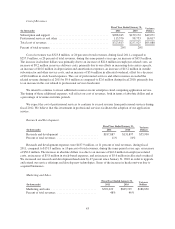

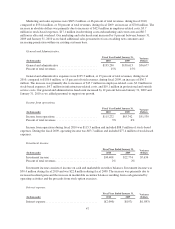

Please find page 45 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketing and Sales. Marketing and sales expenses are our largest cost and consist primarily of salaries and

related expenses, including stock-based expenses, for our sales and marketing staff, including commissions,

payments to partners, marketing programs and allocated overhead. Marketing programs consist of advertising,

events, corporate communications and brand building and product marketing activities.

We plan to continue to invest in marketing and sales by expanding our domestic and international selling

and marketing activities, building brand awareness and sponsoring additional marketing events. We expect that

in the future, marketing and sales expenses will increase in absolute dollars and continue to be our largest cost.

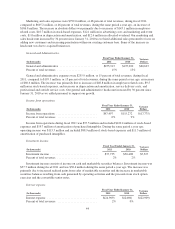

General and Administrative. General and administrative expenses consist of salaries and related expenses,

including stock-based expenses, for finance and accounting, human resources and management information

systems personnel, legal costs, professional fees, other corporate expenses and allocated overhead. We expect

that in the future, general and administrative expenses will increase in absolute dollars as we invest in our

infrastructure and we incur additional employee related costs, professional fees and insurance costs related to the

growth of our business and international expansion. We expect general and administrative costs as a percentage

of total revenues to remain flat for the next several quarters.

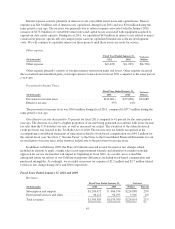

Stock-Based Expenses. Our cost of revenues and operating expenses include stock-based expenses related to

option and stock awards to employees and non-employee directors. We recognize our share-based payments as

an expense in the statement of operations based on their fair values and vesting periods. If our grant activity

remains consistent and our stock price increases in the future, stock-based expenses will rise. These charges have

been significant in the past and we expect that they will increase as we hire more employees and seek to retain

existing employees.

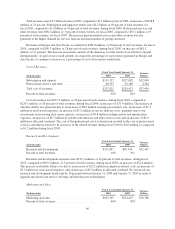

Joint Venture

In December 2000, we established a Japanese joint venture, Kabushiki Kaisha salesforce.com (“Salesforce

Japan”), with SunBridge, Inc., a Japanese corporation, to assist us with our sales efforts in Japan. During fiscal

2011, we acquired SunBridge’s and other shareholders’ interest in, and increased our ownership from 72 percent

to 100 percent of, Salesforce Japan. As a result of our purchase of the shares held by SunBridge, the joint venture

agreement terminated according to its terms. As we did not obtain 100 percent ownership until the fourth quarter

of fiscal 2011, we recorded a noncontrolling interest in our consolidated statement of operations for fiscal 2011,

which reflects the interest that we did not control in Salesforce Japan’s results in fiscal 2011 and all prior years

presented.

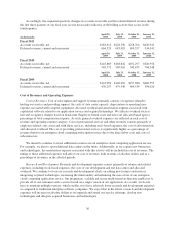

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with accounting principles generally

accepted in the United States. The preparation of these consolidated financial statements requires us to make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs and expenses,

and related disclosures. On an ongoing basis, we evaluate our estimates and assumptions. Our actual results may

differ from these estimates under different assumptions or conditions.

We believe that of our significant accounting policies, which are described in note 1 to our consolidated

financial statements, the following accounting policies involve a greater degree of judgment and complexity.

Accordingly, these are the policies we believe are the most critical to aid in fully understanding and evaluating

our consolidated financial condition and results of operations.

Revenue Recognition. We recognize revenue when all of the following conditions are satisfied: (1) there is

persuasive evidence of an arrangement; (2) the service has been provided to the customer; (3) the collection of

our fees is reasonably assured; and (4) the amount of fees to be paid by the customer is fixed or determinable.

Our arrangements do not contain general rights of return.

37