Salesforce.com 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

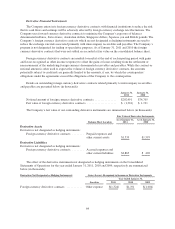

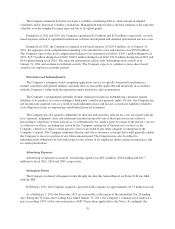

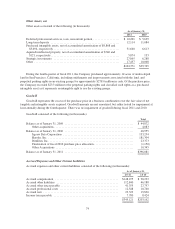

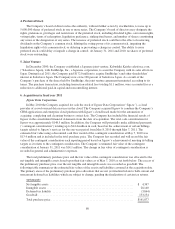

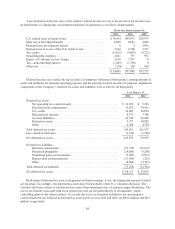

Other Assets, net

Other assets consisted of the following (in thousands):

As of January 31,

2011 2010

Deferred professional services costs, noncurrent portion .................. $ 10,201 $ 5,639

Long-term deposits ............................................... 12,114 11,084

Purchased intangible assets, net of accumulated amortization of $9,868 and

$5,694, respectively ............................................. 31,660 6,613

Aquired intellectual property, net of accumulated amortization of $746 and

$121, respectively. .............................................. 5,874 133

Strategic investments ............................................. 27,065 6,288

Other .......................................................... 17,457 10,008

$104,371 $39,765

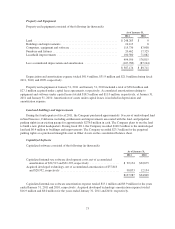

During the fourth quarter of fiscal 2011, the Company purchased approximately 14 acres of undeveloped

land in San Francisco, California, including entitlements and improvements associated with the land, and

perpetual parking rights in an existing garage for approximately $278.0 million in cash. Of the purchase price,

the Company recorded $23.3 million to the perpetual parking rights and classified such rights as a purchased

intangible asset as it represents an intangible right to use the existing garage.

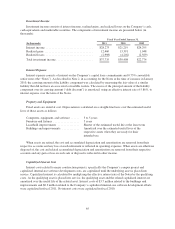

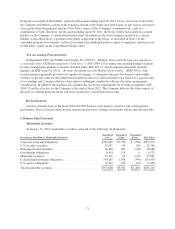

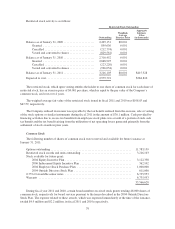

Goodwill

Goodwill represents the excess of the purchase price in a business combination over the fair value of net

tangible and intangible assets acquired. Goodwill amounts are not amortized, but rather tested for impairment at

least annually during the fourth quarter. There was no impairment of goodwill during fiscal 2011 and 2010.

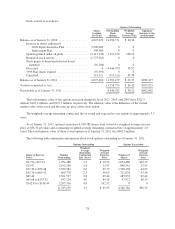

Goodwill consisted of the following (in thousands):

Total

Balance as of January 31, 2009 ............................................... $ 44,872

Other acquisitions ...................................................... 4,083

Balance as of January 31, 2010 ............................................... 48,955

Jigsaw Data Corporation ................................................ 133,254

Heroku, Inc. .......................................................... 181,304

DimDim, Inc. ......................................................... 23,373

Finalization of fiscal 2010 purchase price allocation ........................... (1,150)

Other Acquisitions ..................................................... 10,345

Balance as of January 31, 2011 ............................................... $396,081

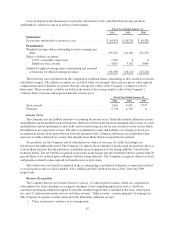

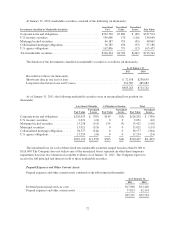

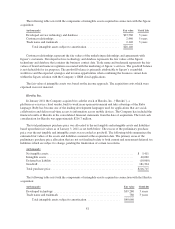

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

As of January 31,

2011 2010

Accrued compensation ........................................... $148,275 $ 90,223

Accrued other liabilities .......................................... 112,840 46,188

Accrued other taxes payable ....................................... 41,355 27,757

Accrued professional costs ........................................ 12,548 10,740

Accrued rent ................................................... 22,323 19,830

Income taxes payable ............................................ 7,780 8,424

$345,121 $203,162

74