Safeway 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

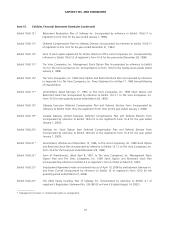

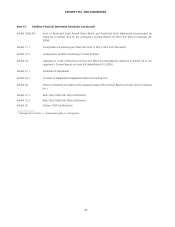

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

59

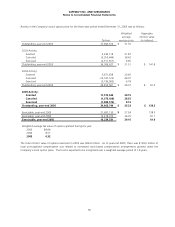

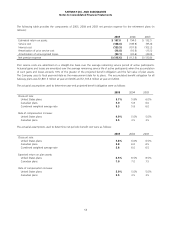

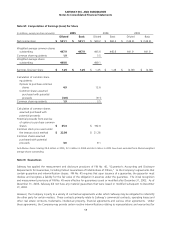

Note M: Computation of Earnings (Loss) Per Share

(In millions, except per-share amounts) 2005 2004 2003

Diluted Basic Diluted Basic Diluted Basic

Net income (loss) $ 561.1 $ 561.1 $ 560.2 $ 560.2 $ (169.8) $ (169.8)

Weighted average common shares

outstanding 447.9 447.9 445.6 445.6 441.9 441.9

Common share equivalents 1.9 3.5

Weighted average shares

outstanding 449.8 449.1

Earnings (loss) per share $ 1.25 $ 1.25 $ 1.25 $ 1.26 $ (0.38) $ (0.38)

Calculation of common share

equivalents:

Options to purchase common

shares 4.9 12.6

Common shares assumed

purchased with potential

proceeds (3.0) (9.1)

Common share equivalents 1.9 3.5

Calculation of common shares

assumed purchased with

potential proceeds:

Potential proceeds from exercise

of options to purchase common

shares $ 65.4 $ 192.8

Common stock price used under

the treasury stock method $ 22.09 $ 21.26

Common shares assumed

purchased with potential

proceeds 3.0 9.1

Anti-dilutive shares totaling 28.4 million in 2005, 22.3 million in 2004 and 26.2 million in 2003 have been excluded from diluted weighted

average shares outstanding.

Note N: Guarantees

Safeway has applied the measurement and disclosure provisions of FIN No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others,” to the Company’s agreements that

contain guarantee and indemnification clauses. FIN No. 45 requires that upon issuance of a guarantee, the guarantor must

disclose and recognize a liability for the fair value of the obligation it assumes under the guarantee. The initial recognition

and measurement provisions of FIN No. 45 were effective for guarantees issued or modified after December 31, 2002. As of

December 31, 2005, Safeway did not have any material guarantees that were issued or modified subsequent to December

31, 2002.

However, the Company is party to a variety of contractual agreements under which Safeway may be obligated to indemnify

the other party for certain matters. These contracts primarily relate to Safeway’s commercial contracts, operating leases and

other real estate contracts, trademarks, intellectual property, financial agreements and various other agreements. Under

these agreements, the Company may provide certain routine indemnifications relating to representations and warranties (for