Safeway 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

43

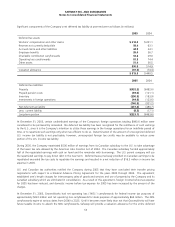

effects or the cumulative effect of the change. Also, SFAS No. 154 requires that retrospective application of a change in

accounting principle be limited to the direct effects of the change. SFAS No. 154 is effective for accounting changes and

corrections of errors made in fiscal years beginning after December 15, 2005.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs.” SFAS No. 151 clarifies the accounting for abnormal

amounts of idle facility expense, freight, handling costs, and wasted material (spoilage) and requires that these items be

recognized as current-period charges. In addition, SFAS No. 151 requires that allocation of fixed production overhead to

conversion costs be based on the normal capacity of the production facilities. SFAS No. 151 is effective for inventory costs

incurred during fiscal years beginning after June 15, 2005. SFAS No. 151 is not expected to have a material effect on the

Company’s financial statements.

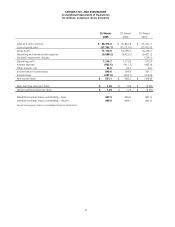

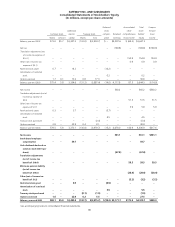

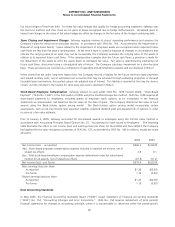

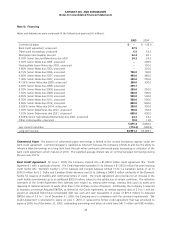

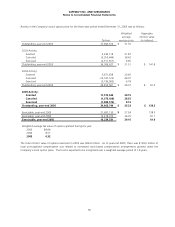

Note B: Goodwill

A summary of changes in Safeway's goodwill during 2005 and 2004 by geographic area is as follows (in millions):

2005 2004

U.S. Canada Total U.S. Canada Total

Balance – beginning of year $ 2,325.6 $ 81.0 $ 2,406.6 $ 2,328.3 $ 76.6 $ 2,404.9

Other adjustments (7.8) (1) 3.6 (2) (4.2) (2.7) (1) 4.4 (2) 1.7

Balance – end of year $ 2,317.8 $ 84.6 $ 2,402.4 $ 2,325.6 $ 81.0 $ 2,406.6

(1) Primarily represents revised estimate of pre-acquisition tax accrual.

(2) Represents foreign currency translation adjustments in Canada.

The Company accounts for goodwill in accordance with SFAS No. 142, “Goodwill and Other Intangible Assets.” In November

2002, Safeway announced the decision to sell Dominick’s and exit the Chicago market due to labor issues. In the first 36

weeks of 2003, Safeway reduced the carrying value of Dominick’s in part by writing down $256.5 million of goodwill, based

on indications of value received during the sale process. In November 2003, Safeway announced that it was taking

Dominick’s off the market. As a result, in the fourth quarter of 2003, Safeway incurred an additional goodwill impairment

charge of $24.9 million relating to Dominick’s.

Also in the fourth quarter of 2003, Safeway performed its annual review of goodwill. Fair value was determined based on a

valuation study performed by an independent third party which primarily considered the discounted cash flow and guideline

company method. As a result of this annual review, Safeway recorded an impairment charge for Randall’s goodwill of

$447.7 million. The additional charges reflect declining multiples in the retail grocery industry and operating performance.

There was no remaining goodwill for Dominick’s or Randall’s on Safeway’s consolidated balance sheet at year-end 2003.

Safeway completed its annual impairment tests in the fourth quarters of 2004 and 2005. Fair value was determined based

on a valuation study performed by an independent third party which primarily considered the discounted cash flow and

guideline company method. As a result of these annual reviews, Safeway concluded that no impairment charge was

required.

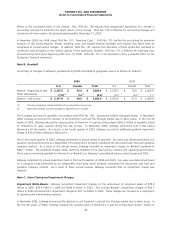

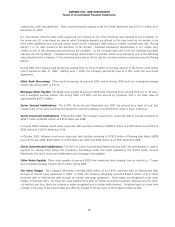

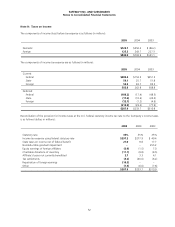

Note C: Store Closing and Impairment Charges

Impairment Write-Downs Safeway recognized impairment charges on the write-down of long-lived assets of $78.9

million in 2005, $39.4 million in 2004 and $344.9 million in 2003. This includes Randall’s impairment charges of $54.7

million in 2005 and Dominick’s impairment charges of $311.4 million in 2003. These charges are included as a component

of operating and administrative expense.

In November 2002, Safeway announced the decision to sell Dominick’s and exit the Chicago market due to labor issues. In

the first 36 weeks of 2003, Safeway reduced the carrying value of Dominick’s in part by writing down $120.7 million of