Safeway 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

54

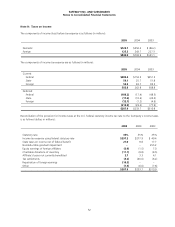

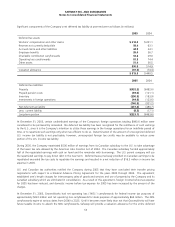

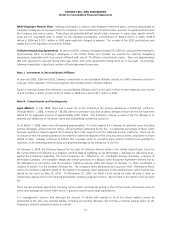

tax asset relating to these carryforwards. In the case of any subsequent reversal of this valuation allowance, approximately

$21.6 million of the tax benefit realized will result in a reduction of GroceryWorks’ goodwill or other noncurrent intangible

assets.

At December 31, 2005, the Company had federal and certain state charitable contribution tax carryforwards of $143.5

million which expire between 2008 and 2010. The Company also had state tax credit carryforwards of $8.4 million which

have no expiration date.

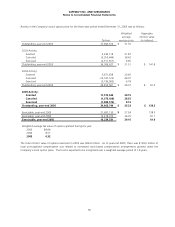

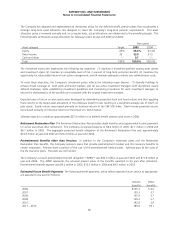

Note I: Employee Benefit Plans and Collective Bargaining Agreements

Retirement Plans The Company maintains defined benefit, non-contributory retirement plans for substantially all of its

employees not participating in multi-employer pension plans.

In connection with the Genuardi's Acquisition in 2001, the Randall’s acquisition in 1999 and the Vons merger in 1997, the

Company assumed the sponsorship and obligations of Genuardi's, Randall’s and Vons’ retirement plans. During 2003, the

Randall’s plan was merged with the Safeway plan. The actuarial assumptions for the existing Genuardi's and Vons’

retirement plans are comparable to those for the Safeway retirement plan. Genuardi's and Vons’ retirement plans have been

combined with Safeway’s for financial statement presentation.

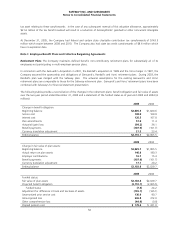

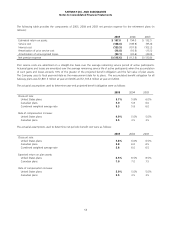

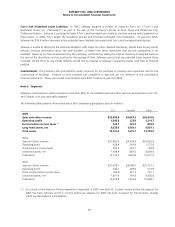

The following tables provide a reconciliation of the changes in the retirement plans’ benefit obligation and fair value of assets

over the two-year period ended December 31, 2005 and a statement of the funded status as of year-end 2005 and 2004 (in

millions):

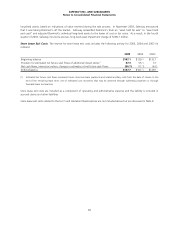

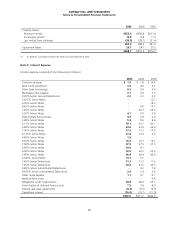

2005 2004

Change in benefit obligation:

Beginning balance $2,005.5 $1,820.6

Service cost 108.0 109.9

Interest cost 125.5 107.8

Plan amendments 57.0 11.4

Actuarial (gain) loss (99.2) 34.1

Benefit payments (107.9) (101.7)

Currency translation adjustment 21.2 23.4

Ending balance $2,110.1 $2,005.5

2005 2004

Change in fair value of plan assets:

Beginning balance $2,029.7 $1,905.5

Actual return on plan assets 146.6 190.3

Employer contributions 16.7 15.4

Benefit payments (107.9) (101.7)

Currency translation adjustment 17.7 20.2

Ending balance $2,102.8 $2,029.7

2005 2004

Funded status:

Fair value of plan assets $2,102.8 $2,029.7

Projected benefit obligation (2,110.1) (2,005.5)

Funded status (7.3) 24.2

Adjustment for difference in book and tax basis of assets (165.1) (165.1)

Unamortized prior service cost 130.9 90.7

Unrecognized loss 265.8 372.0

Other comprehensive loss (44.9) (0.8)

Prepaid pension cost $ 179.4 $ 321.0