Safeway 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

each Lifestyle store with extensive promotional

support. During the past year we have refined these

activities so we can reduce the cost of promotions

without diminishing operating results. Nevertheless, as

anticipated, the cost of promoting Lifestyle openings in

2005 reduced gross margin and increased operating

and administrative expense as a percentage of sales.

As the Lifestyle stores opened last year mature in 2006,

we expect their margins to improve and their contri-

bution to operating profit to increase.

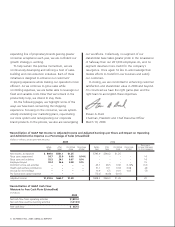

Gross Profit

Gross profit in 2005 decreased 65 basis points to

28.93% of sales. Higher fuel sales (which have a lower

gross margin) accounted for 39 basis points of the

decline. The remaining 26 basis-point reduction was

due to grand openings of Lifestyle stores, targeted

price investments, increased advertising expense and

higher energy costs.

Operating and Administrative Expense

Operating and administrative expense last year decreased

53 basis points to 25.77% of sales. The significant pre-tax

charges in 2005 and 2004 reflected in the table on page 4

(other than pro forma stock option expense) increased

operating and administrative expense as a percentage of

sales by a net 20 basis points. Stock option expense,

labor costs associated with Lifestyle grand openings and

higher energy costs also increased our O&A expense-to-

sales ratio. However, these items were more than offset

by the restructured labor agreements, increased fuel

sales and reduced workers’ compensation costs.

Interest Expense

Interest expense decreased $8.6 million to $402.6

million in 2005 despite higher average interest rates,

primarily because total debt declined to $6.4 billion.

Capital Spending

Cash capital investments increased to $1.4 billion in 2005.

During the year we opened 21 new Lifestyle stores,

completed 293 Lifestyle remodels and closed

48 older stores. In 2006 we plan to invest approxi-

mately $1.6 billion in cash capital expenditures and

open 20 to 25 new Lifestyle stores while completing

some 280 Lifestyle remodels.

We also opened 20 fuel stations adjacent to our

stores. As of year-end 2005, 314 of our stores sold

gasoline, boosting sales at these locations while

enhancing one-stop shopping convenience for

our customers.

Cash Flow

Net cash flow from operating activities was $1.9 billion

in 2005, down from $2.2 billion in 2004. Working

capital contributed to cash flow in 2005, but at a lower

level than in 2004. Net cash flow used by investing

activities, which consists principally of cash paid for

property additions, increased $243 million to $1.3

billion in 2005. Net cash flow used by financing

activities – mainly cash used to retire debt – was

$467 million in 2005, down from $1.1 billion the

prior year.

Free cash flow was $567.5 million in 2005.2As a

result, debt declined $404.8 million, cash and cash

equivalents increased $106.5 million and we paid

$44.9 million in dividends to stockholders.

Outlook

Looking ahead, we are encouraged by the strong

rebound in our sales over the past year and by the

unprecedented

success of our

Lifestyle stores. With

our operating results

steadily improving,

our capital invest-

ments continuing to

exceed targeted rates

of return, and our

NET INCOME

IN 2005:

$561

Million