Safeway 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

25

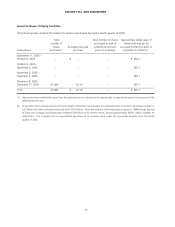

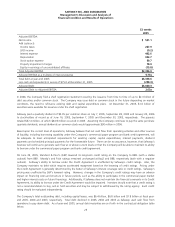

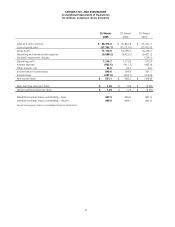

52 weeks

2005

Adjusted EBITDA:

Net income $ 561.1

Add (subtract):

Income taxes 287.9

LIFO income (0.2)

Interest expense 402.6

Depreciation 932.7

Stock option expense 59.7

Property impairment charges 78.9

Equity in earnings of unconsolidated affiliates (15.8)

Total Adjusted EBITDA $2,306.9

Adjusted EBITDA as a multiple of interest expense 5.73x

Total debt at year-end 2005 $6,358.6

Less cash and equivalents in excess of $75.0 at December 31, 2005 (298.3)

Adjusted Debt $6,060.3

Adjusted Debt to Adjusted EBITDA 2.63x

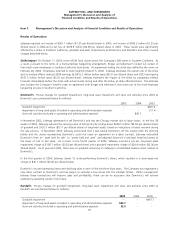

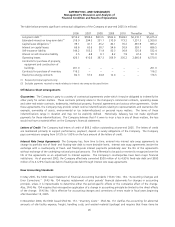

In 2004, the Company filed a shelf registration statement covering the issuance from time to time of up to $2.3 billion of

debt securities and/or common stock. The Company may issue debt or common stock in the future depending on market

conditions, the need to refinance existing debt and capital expenditure plans. At December 31, 2005, $1.6 billion of

securities were available for issuance under the shelf registration.

Safeway paid a quarterly dividend of $0.05 per common share on July 7, 2005, September 28, 2005 and January 20, 2006

to stockholders of record as of June 16, 2005, September 7, 2005 and December 30, 2005, respectively. The payouts

totaled $67.4 million, of which $44.9 million occurred in 2005. Assuming the Company continues to pay the same per-share

quarterly dividends, annual dividends on common stock would approximate $90 million in 2006.

Based upon the current level of operations, Safeway believes that net cash flow from operating activities and other sources

of liquidity, including borrowing capability under the Company’s commercial paper program and bank credit agreement, will

be adequate to meet anticipated requirements for working capital, capital expenditures, interest payments, dividend

payments and scheduled principal payments for the foreseeable future. There can be no assurance, however, that Safeway’s

business will continue to generate cash flow at or above current levels or that the Company will be able to maintain its ability

to borrow under the commercial paper program and bank credit agreement.

On June 29, 2005, Standard & Poor’s (S&P) lowered its long-term credit rating on the Company to BBB- (with a stable

outlook) from BBB. Moody’s and Fitch ratings remained unchanged at Baa2 and BBB, respectively (both with a negative

outlook). Safeway's ability to borrow under the Credit Agreement is unaffected by Safeway's credit ratings. Also, the

Company maintains no debt which requires accelerated repayment based on the lowering of credit ratings. Pricing under

the Credit Agreement is generally determined by the better of Safeway’s interest coverage ratio or credit ratings. Safeway’s

pricing was unaffected by S&P’s lowered rating. However, changes in the Company’s credit ratings may have an adverse

impact on financing costs and structure in future periods, such as the ability to participate in the commercial paper market

and higher interest costs on future financings. Additionally, if Safeway does not maintain the financial covenants in its Credit

Agreement, its ability to borrow under the Credit Agreement would be impaired. Investors should note that a credit rating is

not a recommendation to buy, sell or hold securities and may be subject to withdrawal by the rating agency. Each credit

rating should be evaluated independently.

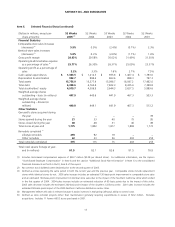

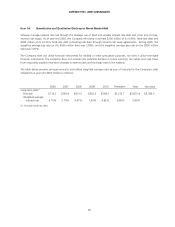

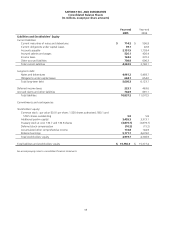

The Company’s total outstanding debt, including capital leases, was $6.4 billion, $6.8 billion and $7.8 billion at fiscal year-

end 2005, 2004 and 2003, respectively. Total debt declined in 2005, 2004 and 2003 as Safeway used cash flow from

operations to pay down debt. As of year-end 2005, annual debt maturities are set forth in the contractual obligation table

below.