Safeway 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

40

the United States of America, requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Translation of Foreign Currencies Assets and liabilities of the Company's Canadian subsidiaries and Casa Ley are

translated into U.S. dollars at year-end rates of exchange, and income and expenses are translated at average rates during

the year. Adjustments resulting from translating financial statements into U.S. dollars are reported, net of applicable income

taxes, as a separate component of comprehensive income in the consolidated statements of stockholders’ equity.

Cash and Cash Equivalents Short-term investments with original maturities of less than three months are considered to be

cash equivalents. Book overdrafts at year-end 2005 and 2004 of $121.1 million and $89.9 million, respectively, are included

in accounts payable.

Merchandise Inventories Merchandise inventory of $1,943 million at year-end 2005 and at year-end 2004 is valued at the

lower of cost on a last-in, first-out (“LIFO”) basis or market value. Such LIFO inventory had a replacement or current cost of

$1,991 million at year-end 2005 and $1,992 million at year-end 2004. Liquidations of LIFO layers resulted in income of $1.6

million in 2005, income of $2.3 million in 2004 and expense of $1.9 million in 2003. All remaining inventory is valued at the

lower of cost on a first-in, first-out (“FIFO”) basis or market value. The FIFO cost of inventory approximates replacement or

current cost. The Company takes a physical count of perishable inventory in stores every four weeks and nonperishable

inventory in stores and all distribution centers twice a year. The Company records an inventory shrink adjustment upon

physical counts and also provides for estimated inventory shrink adjustments for the period between the last physical

inventory and each balance sheet date.

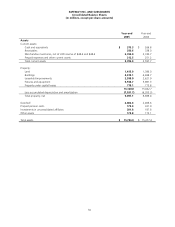

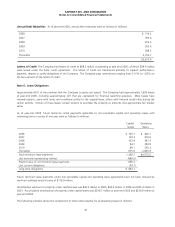

Property and Depreciation Property is stated at cost. Depreciation expense on buildings and equipment is computed on

the straight-line method using the following lives:

Stores and other buildings 7 to 40 years

Fixtures and equipment 3 to 15 years

Property under capital leases and leasehold improvements are amortized on a straight-line basis over the shorter of the

remaining terms of the lease or the estimated useful lives of the assets.

Asset Retirement Obligations In March 2005, the FASB issued FASB Interpretation (“FIN”) 47, “Accounting for

Conditional Asset Retirement Obligations.” FIN 47 clarifies that the term “conditional asset retirement obligation” as used in

FASB Statement No. 143, “Accounting for Asset Retirement Obligations,” refers to a legal obligation to perform an asset

retirement activity in which the timing and/or method of settlement are conditional on a future event that may or may not be

within the control of the entity. Accordingly, an entity is required to recognize a liability for the fair value of a conditional

asset retirement obligation if the fair value of the liability can be reasonably estimated. The Company adopted FIN 47,

effective December 31, 2005, as required. The impact was not material to Safeway’s financial statements.

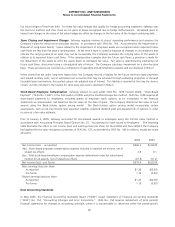

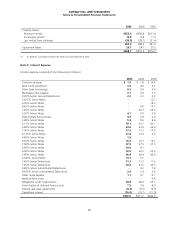

Self-Insurance The Company is primarily self-insured for workers' compensation, automobile and general liability costs.

The self-insurance liability is determined actuarially, based on claims filed and an estimate of claims incurred but not yet

reported, and is discounted using a risk-free rate of interest. The present value of such claims was calculated using a

discount rate of 4.35% in 2005, 3.25% in 2004 and 3.0% in 2003.

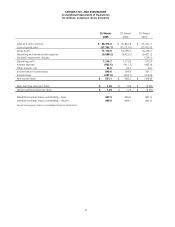

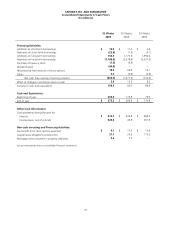

A summary of changes in Safeway’s self-insurance liability is as follows (in millions):

2005 2004 2003

Beginning balance $496.5 $407.2 $339.4

Expense 193.7 249.7 234.9

Claim payments (157.8) (160.4) (167.1)

Ending balance 532.4 496.5 407.2

Less: current portion (144.2) (140.3) (124.3)

Long-term portion $388.2 $356.2 $282.9