Safeway 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

23

on the Company’s selection of certain assumptions used by its actuaries in calculating these amounts. These assumptions are

disclosed in Note I to the consolidated financial statements and include, among other things, the discount rate, the expected

long-term rate of return on plan assets and the rate of compensation increases. Actual results in any given year will often

differ from actuarial assumptions because of economic and other factors. In accordance with GAAP, actual results that differ

from the actuarial assumptions are accumulated and amortized over future periods and, therefore, affect recognized expense

and recorded obligation in such future periods. While Safeway believes its assumptions are appropriate, significant

differences in actual results or significant changes in the Company’s assumptions may materially affect Safeway’s pension

and other post-retirement obligations and its future expense.

Safeway bases the discount rate on current investment yields on high quality fixed-income investments. The discount rate

used to determine 2005 pension expense was 5.8%. A lower discount rate increases the present value of benefit obligations

and increases pension expense. Expected return on pension plan assets is based on historical experience of the Company’s

portfolio and the review of projected returns by asset class on broad, publicly traded equity and fixed-income indices, as well

as target asset allocation. Safeway’s target asset allocation mix is designed to meet the Company’s long-term pension

requirements. For 2005, the Company’s assumed rate of return was 8.5% on U.S. pension assets and 7.0% on Canadian

pension assets. Over the 10-year period ended December 31, 2005, the average rate of return was approximately 10% for

U.S. and Canadian pension assets.

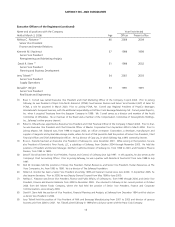

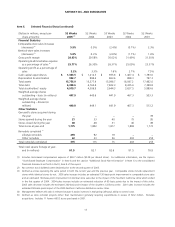

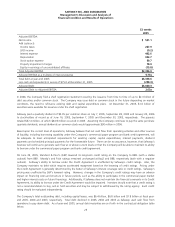

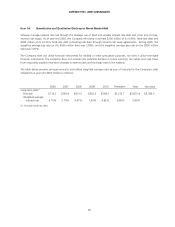

Sensitivity to changes in the major assumptions for Safeway’s pension plans are as follows (dollars in millions):

United States Canada

Percentage

point change

Projected

benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Projected

benefit

obligation

decrease

(increase)

Expense

decrease

(increase)

Expected return on assets +/-1.0 pt −$16.3/(16.3) −$2.3/(2.3)

Discount rate +/-1.0 pt $188.5/(216.2) $40.2/(26.6) $47.3/(55.8) $4.5/(5.3)

Cash contributions, primarily in Canada, to the Company’s pension plans are expected to total approximately $27.0 million in

2006 and totaled $22.4 million in 2005, $19.0 million in 2004 and $16.0 million in 2003. Safeway expects to fund future

contributions to the Company’s pension plans with cash flow from operations.

Stock-Based Employee Compensation Safeway elected to early adopt SFAS No. 123R in the first quarter of 2005 using

the modified prospective method. SFAS No. 123R requires all share-based payments to employees, including grants of

employee stock options, to be recognized in the financial statements as compensation cost based on the fair value on the

date of grant. The Company determines fair value of such awards using the Black-Scholes option pricing model. The Black-

Scholes option pricing model incorporates certain assumptions, such as risk-free interest rate, expected volatility, expected

dividend yield and expected life of options, in order to arrive at a fair value estimate.

Goodwill Safeway accounts for goodwill in accordance with SFAS No. 142, “Goodwill and Other Intangible Assets.” As

required by SFAS No. 142, Safeway tests for goodwill annually using a two-step approach with extensive use of accounting

judgments and estimates of future operating results. Changes in estimates or application of alternative assumptions and

definitions could produce significantly different results. The factors that most significantly affect the fair value calculation are

market multiples and estimates of future cash flows. Fair value is determined by an independent third-party appraiser who

primarily used the discounted cash flow method and the guideline company method.

Income Tax Contingencies The Company is subject to periodic audits by the Internal Revenue Service and other foreign,

state and local taxing authorities. These audits may challenge certain of the Company’s tax positions such as the timing and

amount of deductions and allocation of taxable income to the various tax jurisdictions. Loss and gain contingencies are

accounted for in accordance with SFAS No. 5, “Accounting for Contingencies,” and may require significant management

judgment in estimating final outcomes. Actual results could materially differ from these estimates and could significantly

affect the effective tax rate and cash flows in future years.