Safeway 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

52

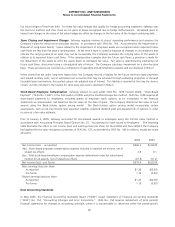

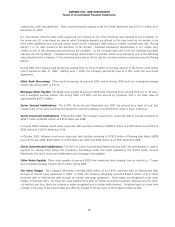

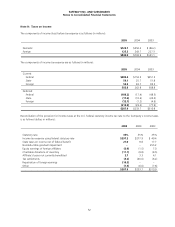

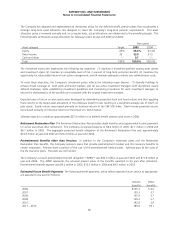

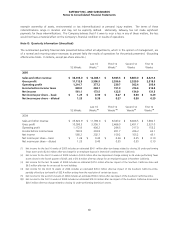

Note H: Taxes on Income

The components of income (loss) before tax expense is as follows (in millions):

2005 2004 2003

Domestic $723.7 $550.2 $ (86.2)

Foreign 125.3 243.7 227.3

$849.0 $793.9 $141.1

The components of income tax expense are as follows (in millions):

2005 2004 2003

Current:

Federal $389.4 $153.5 $251.5

State 59.1 25.7 51.8

Foreign 55.3 83.7 85.5

503.8 262.9 388.8

Deferred:

Federal (186.2) (17.4) (48.5)

State (17.6) (10.6) (24.5)

Foreign (12.1) (1.2) (4.9)

(215.9) (29.2) (77.9)

$287.9 $233.7 $310.9

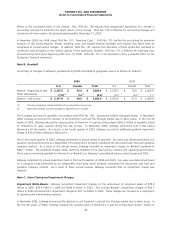

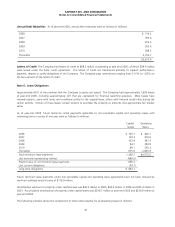

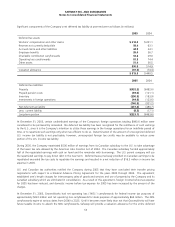

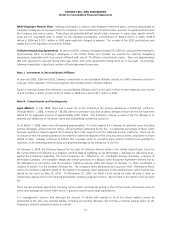

Reconciliation of the provision for income taxes at the U.S. federal statutory income tax rate to the Company's income taxes

is as follows (dollars in millions):

2005 2004 2003

Statutory rate 35% 35% 35%

Income tax expense using federal statutory rate $297.2 $277.9 $ 49.4

State taxes on income net of federal benefit 27.0 9.8 17.7

Nondeductible goodwill impairment −−255.2

Equity earnings of foreign affiliates (0.9) (1.5) 7.0

Charitable donations of inventory (11.1) (9.8) (8.5)

Affiliate’s losses not currently benefitted 2.7 3.3 4.1

Tax settlements (3.2) (40.0) (6.2)

Repatriation of foreign earnings (16.5) −−

Other (7.3) (6.0) (7.8)

$287.9 $233.7 $310.9