Safeway 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

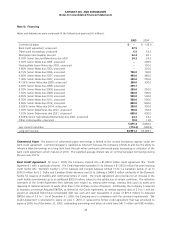

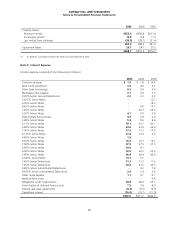

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

47

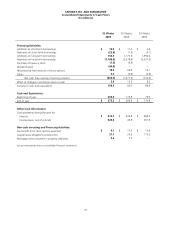

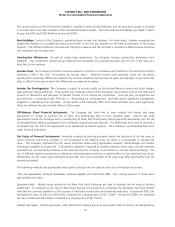

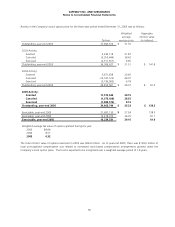

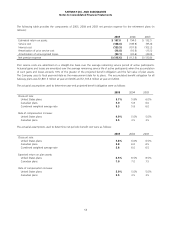

Annual Debt Maturities As of year-end 2005, annual debt maturities were as follows (in millions):

2006 $ 714.2

2007 785.4

2008 813.5

2009 502.4

2010 549.2

Thereafter 2,310.7

$5,675.4

Letters of Credit The Company had letters of credit of $69.2 million outstanding at year-end 2005, of which $38.4 million

were issued under the bank credit agreement. The letters of credit are maintained primarily to support performance,

payment, deposit or surety obligations of the Company. The Company pays commissions ranging from 0.15% to 1.00% on

the face amount of the letters of credit.

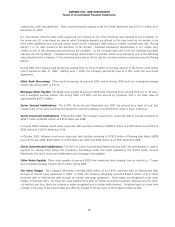

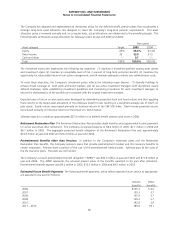

Note E: Lease Obligations

Approximately 62% of the premises that the Company occupies are leased. The Company had approximately 1,600 leases

at year-end 2005, including approximately 225 that are capitalized for financial reporting purposes. Most leases have

renewal options, some with terms and conditions similar to the original lease, others with reduced rental rates during the

option periods. Certain of these leases contain options to purchase the property at amounts that approximate fair market

value.

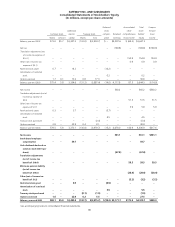

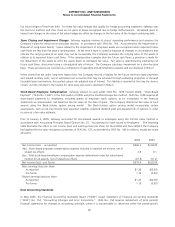

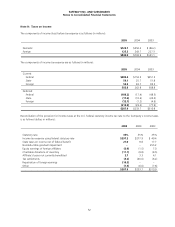

As of year-end 2005, future minimum rental payments applicable to non-cancelable capital and operating leases with

remaining terms in excess of one year were as follows (in millions):

Capital Operating

leases leases

2006 $ 105.7 $ 426.1

2007 104.3 410.6

2008 103.9 397.3

2009 94.7 359.9

2010 86.1 330.2

Thereafter 875.0 2,645.9

Total minimum lease payments 1,369.7 $4,570.0

Less amounts representing interest (686.5)

Present value of net minimum lease payments 683.2

Less current obligations (39.1)

Long-term obligations $ 644.1

Future minimum lease payments under non-cancelable capital and operating lease agreements have not been reduced by

minimum sublease rental income of $176.9 million.

Amortization expense for property under capital leases was $43.0 million in 2005, $43.4 million in 2004 and $35.4 million in

2003. Accumulated amortization of property under capital leases was $256.7 million at year-end 2005 and $230.9 million at

year-end 2004.

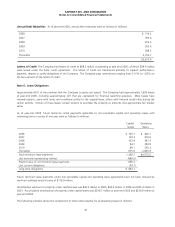

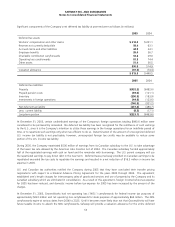

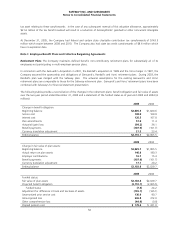

The following schedule shows the composition of total rental expense for all operating leases (in millions).