Safeway 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

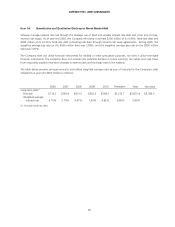

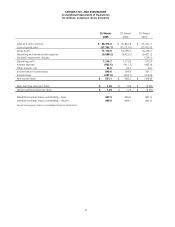

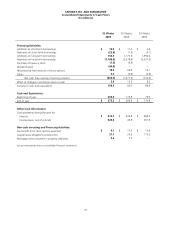

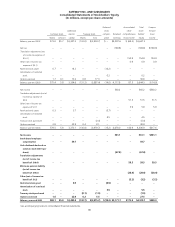

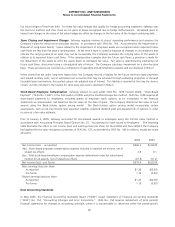

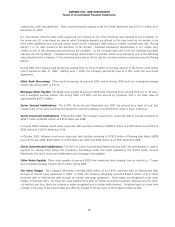

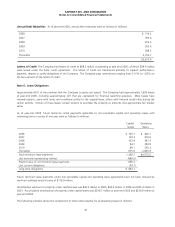

SAFEWAY INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(In millions)

37

52 Weeks

2005

52 Weeks

2004

53 Weeks

2003

Financing Activities:

Additions to short-term borrowings $ 13.0 $ 11.2 $ 2.6

Payments on short-term borrowings (23.8) (1.5) (3.1)

Additions on long-term borrowings 754.5 1,173.5 1,592.0

Payments on long-term borrowings (1,188.6) (2,278.6) (2,331.0)

Purchase of treasury stock (1.5) (0.4) −

Dividends paid (44.9) −−

Net proceeds from exercise of stock options 18.9 24.8 19.1

Other 5.5 (6.6) (3.6)

Net cash flow used by financing activities (466.9) (1,077.6) (724.0)

Effect of changes in exchange rates on cash 5.9 13.5 8.2

Increase in cash and equivalents 106.5 92.0 98.8

Cash and Equivalents:

Beginning of year 266.8 174.8 76.0

End of year $ 373.3 $ 266.8 $ 174.8

Other Cash Information:

Cash payments during the year for:

Interest $ 412.1 $ 434.8 $ 464.2

Income taxes, net of refunds 624.4 43.8 361.6

Non-cash Investing and Financing Activities:

Tax benefit from stock options exercised $9.1$ 17.4 $ 13.6

Capital lease obligations entered into 27.1 35.9 113.2

Mortgage notes assumed in property additions 3.2 5.5 −

See accompanying notes to consolidated financial statements.