Safeway 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

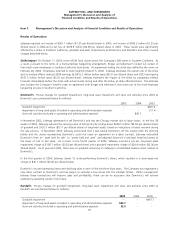

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

26

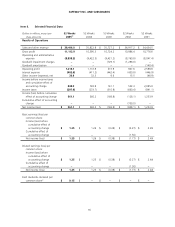

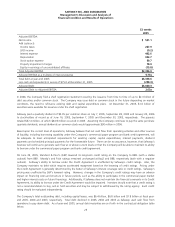

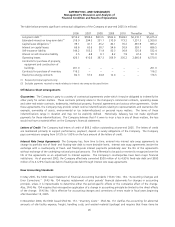

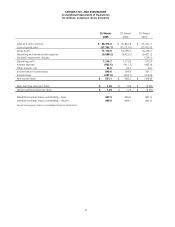

The table below presents significant contractual obligations of the Company at year-end 2005 (in millions):

2006 2007 2008 2009 2010 Thereafter Total

Long-term debt (1) $714.2 $785.4 $813.5 $502.4 $549.2 $2,310.7 $5,675.4

Estimated interest on long-term debt (2) 319.0 294.5 251.1 210.9 173.2 1,251.3 2,500.0

Capital lease obligations (1) 39.1 41.7 45.2 40.1 35.2 481.9 683.2

Interest on capital leases 66.6 62.6 58.7 54.6 50.9 393.1 686.5

Self-insurance liability 144.2 103.2 71.9 50.3 36.9 125.9 532.4

Interest on self-insurance liability 3.5 6.8 8.1 8.2 7.9 67.4 101.9

Operating leases 426.1 410.6 397.3 359.9 330.2 2,645.9 4,570.0

Contracts for purchase of property,

equipment and construction of

buildings 201.0 −−−− − 201.0

Contracts for purchase of inventory 116.2 −−−− − 116.2

Fixed price energy contracts 82.3 57.0 24.8 12.4 −−176.5

(1) Required principal payments only.

(2) Excludes payments received or made relating to interest rate swap as discussed below.

Off-Balance Sheet Arrangements

Guarantees The Company is party to a variety of contractual agreements under which it may be obligated to indemnify the

other party for certain matters. These contracts primarily relate to the Company’s commercial contracts, operating leases

and other real estate contracts, trademarks, intellectual property, financial agreements and various other agreements. Under

these agreements, the Company may provide certain routine indemnifications relating to representations and warranties (for

example, ownership of assets, environmental or tax indemnifications) or personal injury matters. The terms of these

indemnifications range in duration and may not be explicitly defined. Historically, Safeway has not made significant

payments for these indemnifications. The Company believes that if it were to incur a loss in any of these matters, the loss

would not have a material effect on the Company’s financial statements.

Letters of Credit The Company had letters of credit of $69.2 million outstanding at year-end 2005. The letters of credit

are maintained primarily to support performance, payment, deposit or surety obligations of the Company. The Company

pays commissions ranging from 0.15% to 1.00% on the face amount of the letters of credit.

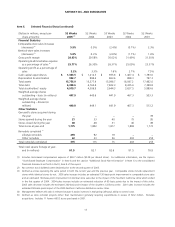

Interest Rate Swap Agreements The Company has, from time to time, entered into interest rate swap agreements to

change its portfolio mix of fixed- and floating-rate debt to more desirable levels. Interest rate swap agreements involve the

exchange with a counterparty of fixed- and floating-rate interest payments periodically over the life of the agreements

without exchange of the underlying notional principal amounts. The differential to be paid or received is recognized over the

life of the agreements as an adjustment to interest expense. The Company’s counterparties have been major financial

institutions. As of year-end 2005, the Company effectively converted $500 million of its 4.95% fixed-rate debt and $300

million of its 4.125% fixed-rate debt to floating-rate debt through interest rate swap agreements.

New Accounting Standards

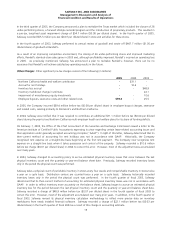

In May 2005, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 154, “Accounting Changes and

Error Corrections.” SFAS No. 154 requires restatement of prior periods’ financial statements for changes in accounting

principle, unless it is impracticable to determine either the period-specific effects or the cumulative effect of the change.

Also, SFAS No. 154 requires that retrospective application of a change in accounting principle be limited to the direct effects

of the change. SFAS No. 154 is effective for accounting changes and corrections of errors made in fiscal years beginning

after December 15, 2005.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs.” SFAS No. 151 clarifies the accounting for abnormal

amounts of idle facility expense, freight, handling costs, and wasted material (spoilage) and requires that these items be