Safeway 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

18

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

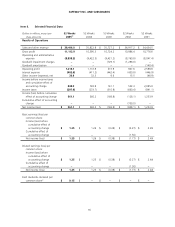

Results of Operations

Safeway reported net income of $561.1 million ($1.25 per diluted share) in 2005, net income of $560.2 million ($1.25 per

diluted share) in 2004 and a net loss of $169.8 million ($0.38 per diluted share) in 2003. These results were significantly

affected by a strike in Southern California, goodwill and asset impairments at Dominick’s and Randall’s and other unusual

charges described below.

Strike Impact On October 11, 2003, seven UFCW local unions struck the Company’s 289 stores in Southern California. As

a result, pursuant to the terms of a multi-employer bargaining arrangement, Kroger and Albertson's locked out certain of

their retail union employees in Southern California food stores. An agreement ending the strike was ratified by the union on

February 28, 2004. Employees returned to work beginning March 5, 2004. Safeway estimates the overall cost of the strike

and its residual effects reduced 2004 earnings by $412.2 million before taxes ($0.57 per diluted share) and 2003 earnings by

$167.5 million before taxes ($0.23 per diluted share). Safeway estimated the impact of the strike by comparing internal

forecasts immediately before the strike with actual results during and after the strike, at strike-affected stores. The estimate

also includes the Company’s benefit under an agreement with Kroger and Albertson’s that arises out of the multi-employer

bargaining process in Southern California.

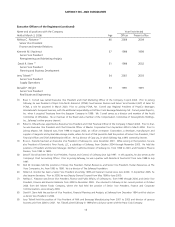

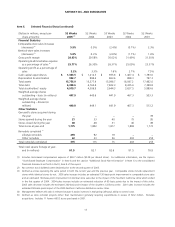

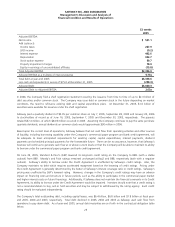

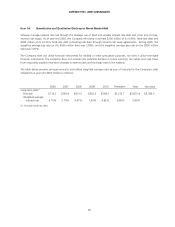

Dominick’s Pre-tax charges for goodwill impairment, long-lived asset impairment and store exit activities since 2003 at

Dominick’s are summarized below (in millions):

2005 2004 2003

Goodwill impairment - - $281.4

Impairment of long-lived assets (included in operating and administrative expense) - - 311.4

Store exit activities (included in operating and administrative expense) - $45.7 -

In November 2002, Safeway attempted to sell Dominick’s and exit the Chicago market due to labor issues. In the first 36

weeks of 2003, Safeway reduced the carrying value of Dominick’s by writing down $256.5 million ($0.56 per diluted share)

of goodwill and $120.7 million ($0.17 per diluted share) of long-lived assets, based on indications of value received during

the sale process. In November 2003, Safeway announced that it was taking Dominick’s off the market after the winning

bidder and the unions representing Dominick’s could not reach an agreement on a labor contract. Safeway reclassified

Dominick’s from an “asset held for sale” to “assets held and used” and adjusted Dominick’s individual long-lived assets to

the lower of cost or fair value. As a result, in the fourth quarter of 2003, Safeway incurred a pre-tax, long-lived asset

impairment charge of $190.7 million ($0.26 per diluted share) and a goodwill impairment charge of $24.9 million ($0.06 per

diluted share). As of year-end 2003, there was no goodwill remaining on Safeway’s consolidated balance sheet related to

Dominick’s.

In the first quarter of 2004, Safeway closed 12 under-performing Dominick’s stores, which resulted in a store-lease exit

charge of $45.7 million ($0.06 per diluted share).

Dominick’s incurred operating losses and declining sales in each of the last three fiscal years. The Company has negotiated a

new labor contract at Dominick’s and has begun to remodel a few stores into the Lifestyle format. While management

believes these transactions will improve sales and profitability, there can be no assurance that Dominick’s will achieve

satisfactory operating results in the future.

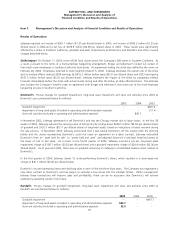

Randall’s Pre-tax charges for goodwill impairment, long-lived asset impairment and store exit activities since 2003 at

Randall’s are summarized below (in millions):

2005 2004 2003

Goodwill impairment -- $447.7

Impairment of long-lived assets (included in operating and administrative expense) $54.7 --

Store exit activities (included in operating and administrative expense) 55.5 --