Royal Caribbean Cruise Lines 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

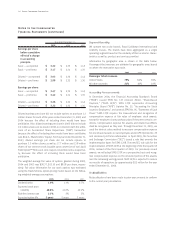

The fair values of our fuel swap agreements were estimated based

on quoted market prices for similar or identical financial instruments

to those we hold. Our exposure to market risk for changes in fuel

prices relates to the forecasted consumption of fuel on our ships.

Historically, we have used fuel swap and zero cost collar agreements

to mitigate the impact of fluctuations in fuel prices. As of December

31, 2005 and 2004, we had fuel swap agreements, designated as

cash flow hedges, to pay fixed prices for fuel with an aggregate

notional amount of $92.4 million, maturing through 2007, and

$35.4 million, maturing through 2005, respectively.

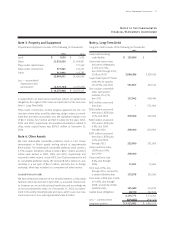

Note 11. Commitments and Contingencies

As of December 31, 2005, we had three Freedom-class ships desig-

nated for Royal Caribbean International and one Solstice-class ship,

Celebrity Solstice

, on order for an additional capacity of approxi-

mately 13,800 berths. The aggregate cost of the ships is approxi-

mately $3.2 billion, of which we have deposited $311.4 million as of

December 31, 2005. (See Note 10.

Financial Instruments.

)

As of December 31, 2005, we anticipated overall capital expendi-

tures, including the four ships on order, will be approximately $1.1

billion for 2006, $1.1 billion for 2007, $1.6 billion for 2008 and $0.3

billion for 2009. (See Note 13.

Subsequent Events.

)

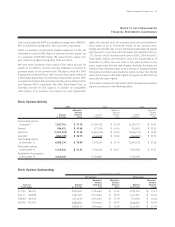

In April 2005, a purported class action lawsuit was filed in the United

States District Court for the Southern District of Florida alleging that

Celebrity Cruises improperly requires its cabin stewards to share

guest gratuities with assistant cabin stewards. The suit seeks pay-

ment of damages, including penalty wages under 46 U.S.C. Section

10113 of U.S. law and interest. We are not able at this time to esti-

mate the impact of this proceeding on us. However, we believe that

we have meritorious defenses and we intend to vigorously defend

against this action.

In May 2005, a purported class action lawsuit was filed in the United

States District Court for the Southern District of Florida alleging that

we improperly profit from shore excursions offered to our guests by

third party shore excursion operators in violation of the Florida

Deceptive and Unfair Trade Practices Act. The suit sought payment of

damages, including the difference between what we collect from our

guests for shore excursions and what we pay to the shore excursion

operators. In September 2005, the Court granted our motion to dis-

miss the lawsuit.

In January 2006, a purported class action lawsuit was filed in the

United States District Court for the Southern District of New York

alleging that we infringed rights in copyrighted works and other

intellectual property by presenting performances on our cruise ships

without securing the necessary licenses. The suit seeks payment of

damages, disgorgement of profits and a permanent injunction

against future infringement. We are not able at this time to estimate

the impact of this preceding on us.

We are routinely involved in other claims typical within the cruise

vacation industry. The majority of these claims is covered by insur-

ance. We believe the outcome of such claims, net of expected insur-

ance recoveries, will not have a material adverse effect upon our

financial condition, results of operations or liquidity.

On July 5, 2002, we added

Brilliance of the Seas

to Royal Caribbean

International’s fleet. In connection with this addition, we novated

our original ship building contract and entered into an operating

lease denominated in British pound sterling. In connection with the

novation of the contract, we received $77.7 million for reimburse-

ment of shipyard deposits previously made. The lease payments

vary based on sterling LIBOR. The lease has a contractual life of 25

years; however, the lessor has the right to cancel the lease at years

10 and 18. Accordingly, the lease term for accounting purposes is 10

years. In the event of early termination at year 10, we have the

option to cause the sale of the vessel at its fair value and use the

proceeds toward the applicable termination obligation plus any

unpaid amounts due under the contractual term of the lease.

Alternatively, we can make a termination payment of approximately

£126 million, or approximately $216.7 million based on the

exchange rate at December 31, 2005, and relinquish our right to

cause the sale of the vessel. This is analogous to a guaranteed resid-

ual value. This termination amount, which is our maximum expo-

sure, has been included in the table below for noncancelable oper-

ating leases. Under current circumstances we do not believe early

termination of this lease is probable.

In addition, we are obligated under other noncancelable operating

leases primarily for offices, warehouses and motor vehicles. As of

December 31, 2005, future minimum lease payments under non-

cancelable operating leases were as follows (in thousands):

Year

2006 $ 47,262

2007 45,776

2008 43,395

2009 41,738

2010 41,437

Thereafter 1293,891

$ 513,499

1Under the

Brilliance of the Seas

lease agreement, we may be required to make a

termination payment of approximately £126 million, or approximately $216.7 million

based on the exchange rate at December 31, 2005, if the lease is canceled in 2012.

This is analogous to a guaranteed residual value.

42 Royal Caribbean Cruises Ltd.

Notes to the Consolidated

Financial Statements (continued)