Royal Caribbean Cruise Lines 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in foreign currency exchange rates and fuel prices. Generally these

instruments are designated as hedges and are recorded on the bal-

ance sheet at their fair value. Our derivative instruments are not held

for trading or speculative purposes.

At inception of the hedge relationship, a derivative instrument that

hedges the exposure to changes in the fair value of a recognized

asset or liability, or a firm commitment is designated as a fair value

hedge. A derivative instrument that hedges a forecasted transaction

or the variability of cash flows related to a recognized asset or liabil-

ity is designated as a cash flow hedge.

Changes in the fair value of derivatives that are designated as fair

value hedges are offset against changes in the fair value of the

underlying hedged assets, liabilities or firm commitments. Changes

in fair value of derivatives that are designated as cash flow hedges

are recorded as a component of accumulated other comprehensive

(loss) income until the underlying hedged transactions are recog-

nized in earnings. On an ongoing basis, we assess whether deriva-

tives used in hedging transactions are “highly effective” in offsetting

changes in fair value or cash flow of hedged items. If it is determined

that a derivative is not highly effective as a hedge, changes in fair

value of the derivatives are recognized in earnings immediately. The

ineffective portion of hedges is recognized in earnings immediately.

The majority of our transactions are settled in United States dollars.

Gains or losses resulting from transactions denominated in other

currencies are recognized in income at each balance sheet date.

Basic earnings per share is computed by dividing net income by the

weighted-average number of shares of common stock outstanding

during each period. Diluted earnings per share incorporates the

incremental shares issuable upon the assumed exercise of stock

options and conversion of potentially dilutive securities, including

shares contingently issuable under our convertible debt instru-

ments. In addition, net income is adjusted to add back the amount

of interest recognized in the period associated with the dilutive

securities. (See Note 7.

Earnings Per Share.

)

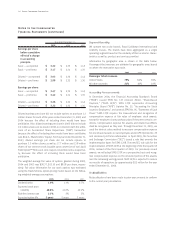

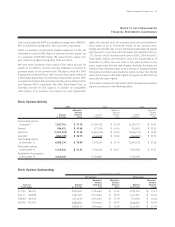

We use the intrinsic value method to account for stock-based

employee compensation. The following table illustrates the effect on

income before cumulative effect of a change in accounting principle,

net income and earnings per share as if we had applied the fair

value recognition provisions of Statement of Financial Accounting

Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation,” to such compensation (in thousands, except per

share data):

Year Ended December 31,

2005 2004 2003

Income before cumulative

effect of a change in

accounting principle $ 663,465 $ 474,691 $ 280,664

Deduct: Total stock-based

employee compensation

expense determined

under fair value

method for all awards (9,732) (9,502) (11,834)

Pro forma income before

cumulative effect of a

change in accounting

principle 653,733 465,189 268,830

Add: Interest on dilutive

convertible notes 48,128 54,530 –

Pro forma income before

cumulative effect of a

change in accounting

principle for diluted

earnings per share $ 701,861 $ 519,719 $ 268,830

Net income, as reported $ 715,956 $ 474,691 $ 280,664

Deduct: Total stock-based

employee compensation

expense determined

under fair value

method for all awards (9,732) (9,502) (11,834)

Pro forma net income 706,224 465,189 268,830

Add: Interest on dilutive

convertible notes 48,128 54,530 –

Pro forma net income

for diluted earnings

per share $ 754,352 $ 519,719 $ 268,830

Weighted-average

common shares

outstanding 206,217 198,946 194,074

Dilutive effect of stock

options and restricted

stock awards 2,498 3,888 3,023

Dilutive effect of

convertible notes 25,772 31,473 –

Diluted weighted-average

shares outstanding 234,487 234,307 197,097

Royal Caribbean Cruises Ltd. 35

Notes to the Consolidated

Financial Statements (continued)