Royal Caribbean Cruise Lines 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Higher fuel costs account for approximately 7.0 to 8.0 percent-

age points of the increase. As announced on February 2, 2006,

“at-the-pump” fuel price was $425 per metric ton, which is 50%

higher than the average price for the first quarter of 2005 of

$284 per metric ton. If fuel prices for the rest of the quarter

remain at that level, we estimate that our first quarter 2006 fuel

costs (net of hedging and fuel savings initiatives) will increase

approximately $45 million. Fuel prices have not changed signif-

icantly since our announcement on February 2, 2006.

•Timing of refurbishment expenses due to a larger portion of

annual drydocks scheduled in the first quarter.

•Timing of marketing, selling and administrative expenses main-

ly due to rescheduling of marketing expenses.

Based upon the expectations and assumptions contained in this

outlook section (including the legal settlement with Alstom of $0.16

per share), we expect first quarter 2006 earnings per share to be in

the range of $0.45 to $0.50.

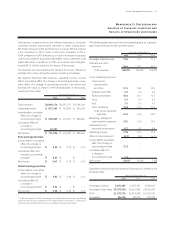

Year Ended December 31, 2005 Compared to Year

Ended December 31, 2004

Net Revenues increased 8.8% in 2005 compared to 2004 due to a

7.4% increase in Net Yields and, to a lesser extent, a 1.4% increase

in capacity. The increase in Net Yields was primarily due to higher

cruise ticket prices and amounts spent per passenger onboard.

Higher cruise ticket prices were primarily attributable to a strong

demand environment and a decrease in capacity growth within the

industry. The increase in capacity was primarily attributed to the

addition of

Jewel of the Seas

in 2004, partially offset by

Enchantment of the Seas

, which was out of service for 53 days due

to its lengthening. In addition, capacity in 2004 was negatively

impacted by the cancellation of certain sailings primarily due to hur-

ricanes and unscheduled drydocks. Occupancy in 2005 was 106.6%

compared to 105.7% in 2004. Gross Yields increased 6.2% in 2005

compared to 2004 primarily due to the same reasons discussed

above for Net Yields.

Onboard and other revenues included concession revenues of

$223.0 million and $196.3 million in 2005 and 2004, respectively.

The increase in concession revenues was primarily due to higher

amounts spent per passenger onboard and the increase in capacity

mentioned above.

Net Cruise Costs increased 7.8% in 2005 compared to 2004 due to

a 6.3% increase in Net Cruise Costs per APCD and the 1.4% increase

in capacity mentioned above. Approximately 4.9 percentage points

of the increase in Net Cruise Costs per APCD was attributed to

increases in fuel costs. Total fuel costs (net of the financial impact of

fuel swap agreements) increased 46.0% in 2005 as compared to an

increase of 27.5% in 2004. As a percentage of total revenues, fuel

costs were 7.5% and 5.5% in 2005 and 2004, respectively. The

remaining 1.4 percentage points of the increase in Net Cruise Costs

per APCD was primarily attributed to increases in payroll costs asso-

ciated with benefits. In addition, Net Cruise Costs in 2004 included

approximately $11.3 million in costs related to the impact of hurri-

canes. Gross Cruise Costs increased 6.5% in 2005 compared to

2004, which was a lower percentage increase than Net Cruise Costs

primarily due to a lower proportion of passengers who purchased air

transportation from us in 2005.

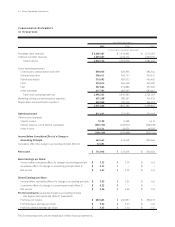

Depreciation and amortization expenses increased 2.0% in 2005

compared to 2004. The increase was primarily due to incremental

depreciation associated with the addition of

Jewel of the Seas

in

2004 as well as depreciation associated with other capital expendi-

tures, including the lengthening of

Enchantment of the Seas

in 2005.

In July 2005, First Choice redeemed in full its 6.75% convertible pre-

ferred shares. We received $348.1 million in cash, resulting in a net

gain of $44.2 million, primarily due to foreign exchange.

Gross interest expense decreased to $287.4 million in 2005 from

$317.2 million in 2004. The decrease was primarily attributable to

lower average debt level, partially offset by higher interest rates.

Interest capitalized increased to $17.7 million in 2005 from $7.2 mil-

lion in 2004 due to a higher average level of investment in ships

under construction.

In the third quarter of 2005, we changed our method of accounting

for drydocking costs from the accrual in advance to the deferral

method (see Note 2.

Summary of Significant Accounting Policies

to

our consolidated financial statements). The change resulted in a

one-time gain of $52.5 million, or $0.22 per share on a diluted basis,

to recognize the cumulative effect of the change on prior years,

which we reflected as part of our results in 2005. Other than this

one-time gain, the change did not have a material impact on our

consolidated statement of operations.

Year Ended December 31, 2004 Compared to Year

Ended December 31, 2003

Net Revenues increased 20.4% in 2004 compared to 2003. The

increase was due to a 10.3% increase in capacity and a 9.2%

increase in Net Yields. The increase in capacity was primarily associ-

ated with the full year effect of the additions of

Serenade of the Seas

and

Mariner of the Seas

in 2003 and delivery of

Jewel of the Seas

in

2004. The increase in capacity was partially offset by the cancella-

tion of 54 days of sailings in 2004 due to hurricanes and unsched-

Royal Caribbean Cruises Ltd. 23

Management’s Discussion and

Analysis of Financial Condition and

Results of Operations (continued)