Royal Caribbean Cruise Lines 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ticket prices, occupancy levels and onboard revenues as consumer

sentiment towards leisure travel improved in 2004. During 2004,

Net Yields increased 9.2% and Net Cruise Costs per APCD increased

5.6% compared to 2003. Gross Cruise Costs increased 17.7% in

2004 compared to 2003 primarily as a result of increases in capacity,

commission expense associated with higher cruise ticket prices and

higher fuel prices. In addition, in 2004 we incurred costs of approx-

imately $11.3 million related to the impact of hurricanes.

Our revenues are seasonal based on demand for cruises. Demand is

strongest for cruises during the summer months and holidays.

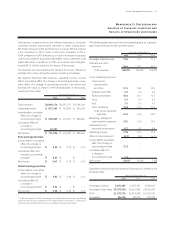

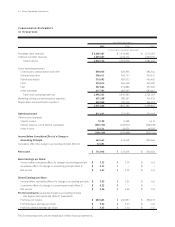

We reported historical total revenues, operating income, income

before cumulative effect of a change in accounting principle, cumu-

lative effect of a change in accounting principle, net income and

earnings per share as shown in the following table (in thousands,

except per share data):

Year Ended December 31,

2005 2004 2003

Total revenues $4,903,174 $4,555,375 $3,784,249

Operating income $ 871,565 $ 753,589 $ 526,185

Income before cumulative

effect of a change in

accounting principle $ 663,465 $ 474,691 $ 280,664

Cumulative effect of

a change in

accounting principle152,491 ––

Net income $ 715,956 $ 474,691 $ 280,664

Basic earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 3.22 $ 2.39 $ 1.45

Cumulative effect of a

change in accounting

principle1$ 0.25 $–$–

Net income $ 3.47 $ 2.39 $ 1.45

Diluted earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 3.03 $ 2.26 $ 1.42

Cumulative effect of

a change in

accounting principle1$ 0.22 $–$–

Net income $ 3.26 $ 2.26 $ 1.42

1In the third quarter of 2005, we changed our method of accounting for drydocking

costs from the accrual in advance to the deferral method (see Note 2.

Summary of

Significant Accounting Policies

to our consolidated financial statements).

The following table presents historical operating data as a percent-

age of total revenues for the last three years:

Year Ended December 31,

2005 2004 2003

Passenger ticket revenues 73.6 73.7 73.3

Onboard and other

revenues 26.4 26.3 26.7

Total revenues 100.0% 100.0% 100.0%

Cruise operating expenses

Commissions,

transportation

and other 17.5 18.1 18.1

Onboard and other 6.3 6.6 6.6

Payroll and related 10.4 10.7 11.3

Food 5.5 5.9 6.3

Fuel 7.5 5.5 5.2

Other operating 13.8 15.1 15.4

Total cruise operating

expenses 61.0 61.9 62.9

Marketing, selling and

administrative expenses 13.0 12.9 13.6

Depreciation and

amortization expenses 8.2 8.7 9.6

Operating income 17.8 16.5 13.9

Other income (expense) (4.3) (6.1) (6.5)

Income before cumulative

effect of a change in

accounting principle 13.5 ––

Cumulative effect of

a change in

accounting principle 1.1 ––

Net income 14.6% 10.4% 7.4%

Unaudited selected historical statistical information is shown in the

following table:

Year Ended December 31,

2005 2004 2003

Passengers Carried 3,476,287 3,405,227 2,990,607

Passenger Cruise Days 23,178,560 22,661,965 20,064,702

APCD 21,733,724 21,439,288 19,439,238

Occupancy 106.6% 105.7% 103.2%

Royal Caribbean Cruises Ltd. 21

Management’s Discussion and

Analysis of Financial Condition and

Results of Operations (continued)