Royal Caribbean Cruise Lines 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

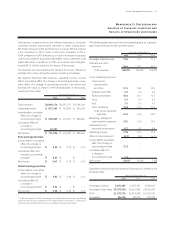

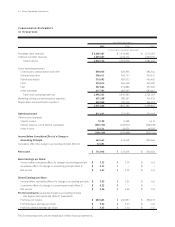

Gross Yields and Net Yields were calculated as follows (in thousands,

except APCD and Yields):

Year Ended December 31,

2005 2004 2003

Passenger ticket $ 3,609,487 $ 3,359,201 $ 2,775,055

revenues

Onboard and

other revenues 1,293,687 1,196,174 1,009,194

Total revenues 4,903,174 4,555,375 3,784,249

Less:

Commissions,

transportation

and other 858,606 822,206 684,344

Onboard and other 308,611 300,717 249,537

Net revenues $ 3,735,957 $ 3,432,452 $ 2,850,368

APCD 21,733,724 21,439,288 19,439,238

Gross Yields $225.60 $212.48 $194.67

Net Yields $171.90 $160.10 $146.63

Gross Cruise Costs and Net Cruise Costs were calculated as follows

(in thousands, except APCD and costs per APCD):

Year Ended December 31,

2005 2004 2003

Total cruise operating

expenses $2,994,232 $2,819,383 $2,381,035

Marketing, selling

and administrative

expenses 635,308 588,267 514,334

Gross Cruise Costs 3,629,540 3,407,650 2,895,369

Less:

Commissions,

transportation

and other 858,606 822,206 684,344

Onboard and other 308,611 300,717 249,537

Net Cruise Costs $2,462,323 $2,284,727 $ 1,961,488

APCD 21,733,724 21,439,288 19,439,238

Gross Cruise Costs

per APCD $167.00 $158.94 $148.94

Net Cruise Costs

per APCD $113.30 $106.57 $100.90

Bookings and pricing levels continue to be solid. As a result, we fore-

cast Net Yields for the full year 2006 will increase in the range of 2%

to 4% compared to 2005. As announced on February 2, 2006, “at-

the-pump” fuel price was $425 per metric ton, which is 19% higher

than the average price for 2005 of $358 per metric ton. If fuel prices

for the rest of the year remain at that level, we estimate that our

2006 fuel costs (net of hedging and fuel savings initiatives) will

increase approximately $90 million. Fuel prices have not changed

significantly since our announcement on February 2, 2006.

Commencing with the first quarter of 2006, we will adopt the new

stock-based compensation accounting standard and begin expens-

ing stock options, which is expected to increase 2006 full year

expenses by $12 million.

Based on the above, we estimate that Net Cruise Costs per APCD for

2006 will increase in the range of 3% to 5% as compared to the prior

year. Higher fuel costs account for 3.0 to 4.0 percentage points of

this increase. Additionally, 2006 will be another year of minimal

capacity increases. Capacity will grow more substantially in 2007

and beyond, providing us with improved economies of scale to off-

set normal cost increases.

Depreciation and amortization is expected to be in the range of

$425 to $445 million and net interest expense is expected to be in

the range of $245 to $265 million.

In January 2006, we partially settled a pending lawsuit against Rolls

Royce and Alstom Power Conversion, (“Alstom”) co-producers of the

Mermaid pod-propulsion system on Millennium-class ships, for the

recurring Mermaid pod failures. Under the terms of the partial settle-

ment, we received $38.0 million from Alstom and released them

from the suit, which remains pending against Rolls Royce. The $38.0

million settlement resulted in an estimated gain of $36.0 million, net of

estimated reimbursements to insurance companies, which will be

recorded in other income during the first quarter of 2006.

Based upon the expectations and assumptions contained in this

outlook section (including the legal settlement with Alstom of $0.16

per share), we expect full year 2006 earnings per share to be in the

range of $2.95 to $3.15.

Expectations for the first quarter of 2006 are somewhat different

than the full year due to seasonal revenue patterns and the timing

of certain expenses. We expect Net Yields for the first quarter of

2006 will increase in the range of 1% to 2% compared to the first

quarter of 2005.

We estimate that Net Cruise Costs per APCD for the first quarter of

2006 will increase in the range of 12% to 13% compared to the

same quarter in 2005. This increase is primarily due to the following:

22 Royal Caribbean Cruises Ltd.

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations (continued)