Royal Caribbean Cruise Lines 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

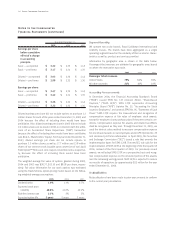

During 2005, we amended our $1.0 billion unsecured revolving

credit facility to extend its maturity date from March 27, 2008 to

March 27, 2010, and reduce the effective interest rate to LIBOR plus

1.0% and the commitment fee to 0.2% of the undrawn portion of the

facility at December 31, 2005. In addition, in 2005, we entered into

two $100.0 million unsecured term loans, due 2010, at an effective

interest rate of LIBOR plus 0.8% at December 31, 2005.

During 2004, we entered into an eight-year, $225.0 million unse-

cured term loan, at LIBOR plus 1.75%, which was amended in 2005

to reduce the effective interest rate to LIBOR plus 1.0% at December

31, 2005.

The Liquid Yield Option™ Notes and the zero coupon convertible

notes are unsecured zero coupon bonds with yields to maturity of

4.875% and 4.75%, respectively, due 2021. Each Liquid Yield

Option™ Note and zero coupon convertible note was issued at a

price of $381.63 and $391.06, respectively, and will have a principal

amount at maturity of $1,000. Each Liquid Yield Option™ Note and

zero coupon convertible note is convertible at the option of the

holder into 11.7152 and 15.6675 shares of common stock, respec-

tively, if the market price of our common stock reaches certain lev-

els. These conditions were met at December 31, 2005 and 2004 for

the zero coupon convertible notes and at December 31, 2004 for the

Liquid Yield Option™ Notes. Since February 2, 2005, we have the

right to redeem the Liquid Yield Option™ Notes and commencing on

May 18, 2006, we will have the right to redeem the zero coupon con-

vertible notes at their accreted values for cash as a whole at any

time, or from time to time in part. Holders may require us to pur-

chase any outstanding Liquid Yield Option™ Notes at their accreted

value on February 2, 2011 and any outstanding zero coupon con-

vertible notes at their accreted value on May 18, 2009 and May 18,

2014. We may choose to pay the purchase price in cash or common

stock or a combination thereof.

During 2005, holders of our Liquid Yield Option™ Notes and zero

coupon convertible notes converted approximately $10.4 million

and $285.0 million, respectively, of the accreted value of these

notes into approximately 0.3 million and 9.4 million shares, respec-

tively, of our common stock and cash for fractional shares. In addi-

tion, we called for redemption $182.3 million of the accreted bal-

ance of outstanding Liquid Yield Option™ Notes. Most holders of

the Liquid Yield Option™ Notes elected to convert into shares of our

common stock, rather than redeem for cash, resulting in the

issuance of approximately 4.5 million shares.

During 2005, we prepaid a total of $297.0 million on a term loan

secured by a certain Celebrity ship and on a variable rate unsecured

term loan.

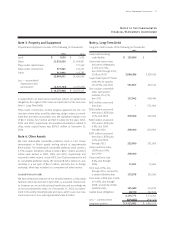

In 1996, we entered into a $264.0 million capital lease to finance

Splendour of the Seas

and in 1995 we entered into a $260.0 million

capital lease to finance

Legend of the Seas

. During 2005, we paid

$335.8 million in connection with the exercise of purchase options

on these capital lease obligations.

Under certain of our agreements, the contractual interest rate and

commitment fee vary with our debt rating.

The unsecured senior notes and senior debentures are not

redeemable prior to maturity.

Our debt agreements contain covenants that require us, among

other things, to maintain minimum net worth and fixed charge cov-

erage ratio and limit our debt to capital ratio. We are in compliance

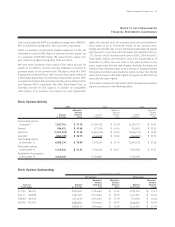

with all covenants as of December 31, 2005. Following is a schedule

of annual maturities on long-term debt as of December 31, 2005 for

each of the next five years (in thousands):

Year

2006 $ 600,883

2007 329,493

2008 245,257

2009 1361,449

2010 687,376

1The $137.9 million accreted value of the zero coupon convertible notes at December

31, 2005 is included in year 2009. The holders of our zero coupon convertible notes

may require us to purchase any notes outstanding at an accreted value of $161.7 mil-

lion on May 18, 2009. This accreted value was calculated based on the number of

notes outstanding at December 31, 2005. We may choose to pay any amounts in cash

or common stock or a combination thereof.

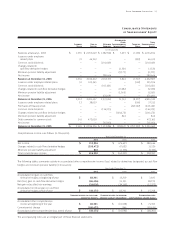

Note 6. Shareholders’ Equity

On September 25, 2005, we announced that we and an investment

bank had finalized a forward sale agreement relating to an ASR

transaction. As part of the ASR transaction, we purchased 5.5 million

shares of our common stock from the investment bank at an initial

price of $45.40 per share. Total consideration paid to repurchase

such shares, including commissions and other fees, was approxi-

mately $249.1 million and was recorded in shareholders’ equity as a

component of treasury stock.

The forward sale contract matured in February 2006. During the

term of the forward sale contract, the investment bank purchased

shares of our common stock in the open market to settle its obliga-

tion related to the shares borrowed from third parties and sold to us.

Upon settlement of the contract, we received 218,089 additional

shares of our common stock. These incremental shares will be

recorded in shareholders’ equity as a component of treasury stock in

the first quarter of 2006.

Our Employee Stock Purchase Plan (“ESPP”), which has been in

effect since January 1, 1994, facilitates the purchase by employees

of up to 800,000 shares of common stock. Offerings to employees

are made on a quarterly basis. Subject to certain limitations, the pur-

chase price for each share of common stock is equal to 90% of the

average of the market prices of the common stock as reported on

the New York Stock Exchange on the first business day of the pur-

chase period and the last business day of each month of the pur-

chase period. Shares of common stock of 14,476, 13,281 and 21,280

38 Royal Caribbean Cruises Ltd.

Notes to the Consolidated

Financial Statements (continued)