Royal Caribbean Cruise Lines 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

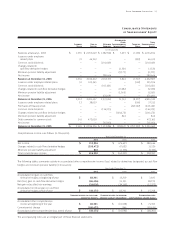

uled drydocks. The increase in Net Yields was primarily due to high-

er cruise ticket prices, occupancy levels and amounts spent per pas-

senger onboard. These increases were primarily attributable to

improved consumer sentiment towards leisure travel. In 2003, we

experienced lower cruise ticket prices due to consumer apprehen-

sion towards travel prior to and during the war in Iraq and econom-

ic uncertainty. Occupancy in 2004 was 105.7% compared to 103.2%

in 2003. Gross Yields increased 9.1% in 2004 compared to 2003 pri-

marily due to the same reasons discussed above for Net Yields.

Onboard and other revenues included concession revenues of

$196.3 million and $163.0 million in 2004 and 2003, respectively,

which increased in 2004 primarily due to the same reasons dis-

cussed above for Net Revenues.

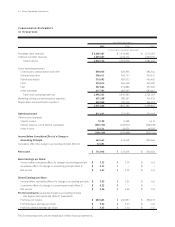

Net Cruise Costs increased 16.5% in 2004 compared to 2003. The

increase was due to the 10.3% increase in capacity mentioned

above and a 5.6% increase in Net Cruise Costs per APCD. The

increase in Net Cruise Costs per APCD was primarily attributed

to increases in fuel prices, marketing, selling and administrative

expenses, crew salaries and medical expenses, port expenses and

costs associated with hurricanes. The weighted-average fuel price

(net of the financial impact of fuel swap agreements) for the year

ended December 31, 2004 increased 14% per metric ton from the

year ended December 31, 2003. As a percentage of total revenues,

fuel costs were 5.5% and 5.2% for 2004 and 2003, respectively. The

increase in marketing, selling and administrative expenses was pri-

marily attributable to increases in general and administrative costs

associated with the expansion of our reservations and sales force

and additional information technology projects. In addition, adver-

tising costs increased primarily due to an increase in television

media spending and the launch of the Cirque du Soleil and Celebrity

Xpeditions marketing campaigns for Celebrity Cruises. The increase

in port expenses was primarily attributed to itinerary changes. In

2004, we incurred approximately $11.3 million in costs related to

the impact of hurricanes. In contrast, other operating expenses in

2003 were reduced by approximately $5.8 million in connection

with a litigation settlement. Gross Cruise Costs per APCD increased

6.7% in 2004 compared to 2003 primarily due to the same reasons

discussed above for Net Cruise Costs per APCD.

Depreciation and amortization expenses increased 8.7% in 2004

compared to 2003. The increase was primarily due to incremental

depreciation associated with the full year effect of the addition of

Mariner of the Seas

and

Serenade of the Seas

in 2003 and

Jewel of

the Seas

in 2004.

Gross interest expense increased to $317.2 million in 2004 from

$284.3 million in 2003. The increase was primarily attributable to a

higher average debt level and higher interest rates. Interest capitalized

during 2004 decreased to $7.2 million from $15.9 million in 2003 due

to a lower average level of investment in ships under construction.

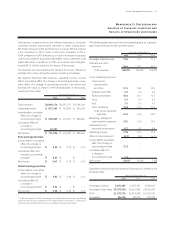

Liquidity and Capital Resources

Cash flow generated from operations provides us with a significant

source of liquidity. Net cash provided by operating activities was

$1.1 billion in each of 2005 and 2004 and $0.9 billion in 2003. Net

cash provided by operating activities was positively impacted in

2005 by an increase in income before the cumulative effect of a

change in accounting principle compared to 2004. This increase was

primarily offset by a lower rate of increase in customer deposits in

2005 relative to 2004. The increase in net cash provided by operat-

ing activities in 2004 compared to 2003 was primarily due to an

increase in net income.

Net cash used in investing activities decreased to $89.0 million in

2005, from $632.5 million in 2004 and $1.1 billion in 2003. The

decrease in 2005 was primarily due to the receipt of $348.1 million

in connection with the redemption of our investment in First Choice

convertible preferred shares. In addition, our capital expenditures

were approximately $429.9 million for the year ended December 31,

2005 compared to approximately $630.1 million in 2004 and $1.0

billion in 2003. Capital expenditures were primarily related to ships

under construction and the lengthening of

Enchantment of the Seas

in 2005, the deliveries of

Jewel of the Seas

in 2004 and

Serenade of

the Seas

and

Mariner of the Seas

in 2003, as well as progress pay-

ments for ships under construction in all years.

Net cash used in financing activities increased to $1.5 billion in 2005

compared to $0.1 billion in 2004 and net cash provided by financ-

ing activities was $0.3 billion in 2003. The increase in 2005 was pri-

marily due to payments made on various debt instruments and an

Accelerated Share Repurchase (“ASR”) transaction. We made pay-

ments on various term loans, senior notes, revolving credit facilities

and capital leases totaling approximately $931.9 million, $361.4 mil-

lion and $471.1 million in 2005, 2004 and 2003, respectively. In

addition, in 2005, we paid $335.8 million in connection with the

exercise of purchase options on our capital lease obligations for

Legend of the Seas

and

Splendour of the Seas

and we prepaid a

total of $297.0 million on secured and unsecured term loans. We

also purchased 5.5 million shares of our common stock in 2005 from

an investment bank at an initial price of $45.40 per share as part of

an ASR transaction. Total consideration paid to repurchase such

shares, including commissions and other fees, was approximately

$249.1 million (see Note 6.

Shareholders’ Equity

to our consolidat-

ed financial statements). In 2005, we drew $200.0 million on unse-

cured variable rate term loans due 2010 and $190.0 million on our

revolving credit facility. In 2004, we drew $225.0 million on an unse-

cured variable rate term loan due 2006 through 2012. In 2003, we

received net cash proceeds of $590.5 million from the issuance of

senior unsecured notes due through 2013 (see Note 5.

Long-Term

Debt

to our consolidated financial statements) and we drew $240.0

24 Royal Caribbean Cruises Ltd.

Management’s Discussion and

Analysis of Financial Condition

and Results of Operations (continued)