Royal Caribbean Cruise Lines 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

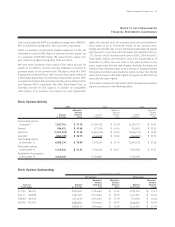

Year Ended December 31,

2005 2004 2003

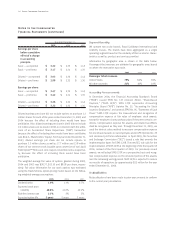

Earnings per share

before cumulative

effect of a change

in accounting

principle:

Basic — as reported $ 3.22 $ 2.39 $ 1.45

Basic — pro forma $ 3.17 $ 2.34 $ 1.39

Diluted — as reported $ 3.03 $ 2.26 $ 1.42

Diluted — pro forma $ 2.99 $ 2.22 $ 1.36

Earnings per share:

Basic — as reported $ 3.47 $ 2.39 $ 1.45

Basic — pro forma $ 3.42 $ 2.34 $ 1.39

Diluted — as reported $ 3.26 $ 2.26 $ 1.42

Diluted — pro forma $ 3.22 $ 2.22 $ 1.36

Diluted earnings per share did not include options to purchase 1.3

million shares for each of the years ended December 31, 2005 and

2004 because the effect of including them would have been

antidilutive. Also, diluted earnings per share in 2005 did not include

0.2 million shares we received in 2006 in connection with the settle-

ment of an Accelerated Share Repurchase (“ASR”) transaction

because the effect of including them would have been antidilutive

(see Note 6.

Shareholders’ Equity

). For the year ended December 31,

2003, diluted earnings per share did not include options to

purchase 5.3 million shares as well as 17.7 million and 13.8 million

shares of our common stock issuable upon conversion of our Liquid

Yield Option™ Notes and zero coupon convertible notes, respective-

ly, because the effect of including them would have been

antidilutive.

The weighted-average fair value of options granted during 2005,

2004 and 2003 was $20.37, $13.10 and $8.18 per share, respec-

tively. Fair value information for our stock options was estimated

using the Black-Scholes option-pricing model based on the follow-

ing weighted-average assumptions:

2005 2004 2003

Dividend yield 1.0% 1.1% 2.7%

Expected stock price

volatility 48.8% 41.6% 42.4%

Risk-free interest rate 3.5% 3% 3%

Expected option life 5 years 5 years 5 years

We operate two cruise brands, Royal Caribbean International and

Celebrity Cruises. The brands have been aggregated as a single

operating segment based on the similarity of their economic charac-

teristics as well as product and services provided.

Information by geographic area is shown in the table below.

Passenger ticket revenues are attributed to geographic areas based

on where the reservation was made.

2005 2004 2003

Passenger ticket revenues:

United States 79% 82% 81%

All other countries 21% 18% 19%

In December 2004, the Financial Accounting Standards Board

(“FASB”) issued SFAS No. 123 (revised 2004), “Share-Based

Payment,” (“SFAS 123R”). SFAS 123R supersedes Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for Stock

Issued to Employees,” and amends SFAS No. 95, “Statement of Cash

Flows.” SFAS 123R requires the measurement and recognition of

compensation expense at fair value of employee stock awards,

except for employee share purchase plans if they meet certain con-

ditions. Compensation expense for awards and related tax effects

shall be recognized as they vest. Through December 31, 2005, we

used the intrinsic value method to measure compensation expense

for stock based awards to our employees under APB Opinion No. 25

and disclosed pro forma information. In April 2005, the Securities

and Exchange Commission (“SEC”) issued a rule that amends the

implementation dates for SFAS 123R. The new SEC rule calls for the

implementation of SFAS 123R at the beginning of the first quarter of

2006, instead of the third quarter of 2005. For previously issued

awards, we will adopt SFAS 123R on a prospective basis and recog-

nize compensation expense on the unvested portion of the awards

over the remaining vesting period. SFAS 123R is expected to reduce

our results of operations by approximately $12 million for the year

ended December 31, 2006.

Reclassifications have been made to prior year amounts to conform

to the current year presentation.

36 Royal Caribbean Cruises Ltd.

Notes to the Consolidated

Financial Statements (continued)