Royal Caribbean Cruise Lines 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million on our revolving credit facility. During 2005, 2004 and 2003,

we received $22.0 million, $98.3 million and $46.0 million, respec-

tively, in connection with the exercise of common stock options and

we paid quarterly cash dividends on our common stock of $118.8

million, $104.5 million and $98.3 million, respectively. These events

contributed to improve our net debt-to-capital percentage to 42.0%

in 2005 from 51.5% in 2004 and 56.4% in 2003.

Our future capital commitments consist primarily of new ship orders.

As of December 31, 2005, we had three Freedom-class ships desig-

nated for Royal Caribbean International and one Solstice-class ship,

Celebrity Solstice

, on order for an additional capacity of approxi-

mately 13,800 berths. The aggregate cost of the ships is approxi-

mately $3.2 billion, of which we have deposited $311.4 million as of

December 31, 2005. (See Note 10.

Financial Instruments

to our con-

solidated financial statements.)

As of December 31, 2005, we anticipated overall capital expenditures,

including the four ships on order, will be approximately $1.1 billion for

2006, $1.1 billion for 2007, $1.6 billion for 2008 and $0.3 billion for 2009.

In February 2006, we exercised an option to purchase an additional

Solstice-class ship for Celebrity Cruises,

Celebrity Equinox

, for an

additional capacity of approximately 2,850 berths, with scheduled

delivery in the third quarter of 2009. Also, in February 2006, we

entered into an agreement with a shipyard to build a new class of

ship for Royal Caribbean International, subject to certain conditions,

for an additional capacity of approximately 5,400 berths, with

scheduled delivery in the third quarter of 2009. Including these two

additional ships, our anticipated overall capital expenditures at

December 31, 2005 will increase to approximately $1.2 billion for

2006, $1.3 billion for 2007, $1.8 billion for 2008 and $1.9 billion in

2009. We have an option to purchase an additional ship for Royal

Caribbean International, exercisable through mid-March 2007, for

an additional capacity of approximately 5,400 berths. If ordered, the

optional ship will be delivered in the third quarter of 2010. (See Note

13.

Subsequent Events

to our consolidated financial statements.)

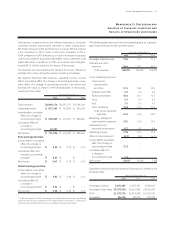

Contractual Obligations and Off-Balance Sheet Arrangements

As of December 31, 2005, our contractual obligations were as follows (in thousands):

Payments due by period

Less than 1 1-3 3-5 More than 5

Total year years years years

Long-term debt obligations 1,2 $4,106,455 $ 594,956 $ 568,539 $ 1,043,115 $ 1,899,845

Capital lease obligations 348,320 5,927 6,211 5,710 30,472

Operating lease obligations 4,5 513,499 47,262 89,171 83,175 293,891

Ship purchase obligations 62,583,200 725,396 1,857,804 – –

Other 7291,387 78,559 115,016 38,663 59,149

Total $7,542,861 $1,452,100 $ 2,636,741 $ 1,170,663 $ 2,283,357

1Amounts exclude interest, except for the accreted value of our zero coupon convertible notes and Liquid Yield Option™ Notes.

2The $137.9 million accreted value of the zero coupon convertible notes at December 31, 2005 is included in the three to five years category. The $531.9 million accreted value of the Liquid

Yield Option™ Notes at December 31, 2005 is included in the more than five years category. The holders of our zero coupon convertible notes and our Liquid Yield Option™ Notes may

require us to purchase any notes outstanding at an accreted value of $161.7 million on May 18, 2009 and $679.5 million on February 2, 2011, respectively. These accreted values were cal-

culated based on the number of notes outstanding at December 31, 2005. We may choose to pay any amounts in cash or common stock or a combination thereof (see Note. 5

Long-Term

Debt

to our consolidated financial statements).

3 Amounts exclude interest. Amounts include a capital lease for a reservation call center in Springfield, Oregon, entered into in January 2005. The lease commenced on December 29, 2005.

4We are obligated under noncancelable operating leases primarily for a ship, offices, warehouses and motor vehicles.

5Under the

Brilliance of the Seas

lease agreement, we may be required to make a termination payment of approximately £126 million, or approximately $216.7 million based on the

exchange rate at December 31, 2005, if the lease is canceled in 2012. This is analogous to a guaranteed residual value. This amount is included in the more than five years category. (See

Note 11.

Commitments and Contingencies

to our consolidated financial statements.)

6Amounts represent contractual obligations with initial terms in excess of one year.

7Amounts represent future commitments with remaining terms in excess of one year to pay for our usage of certain port facilities, marine consumables, services and maintenance contracts.

Under the

Brilliance of the Seas

operating lease, we have agreed to

indemnify the lessor to the extent its after-tax return is negatively

impacted by unfavorable changes in corporate tax rates and capital

allowance deductions. These indemnifications could result in an

increase in our lease payments. We are unable to estimate the max-

imum potential increase in such lease payments due to the various

circumstances, timing or combination of events that could trigger

such indemnifications. Under current circumstances we do not

believe an indemnification is probable.

Royal Caribbean Cruises Ltd. 25

Management’s Discussion and

Analysis of Financial Condition and

Results of Operations (continued)