Royal Caribbean Cruise Lines 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

were issued under the ESPP at a weighted-average price of $40.83,

$39.34 and $19.56 during 2005, 2004 and 2003, respectively.

Under an executive compensation program approved in 1994, we

will award to a trust 10,086 shares of common stock per quarter, up

to a maximum of 806,880 shares. We issued 40,344 shares each

year under the program during 2005, 2004 and 2003.

We have three Employee Stock Option Plans which provide for

awards to our officers, directors and key employees of options to

purchase shares of our common stock. The plans consist of a 1990

Employee Stock Option Plan, a 1995 Incentive Stock Option Plan and

a 2000 Stock Award Plan. The 1990 Stock Option Plan and the 1995

Incentive Stock Option Plan terminated by their terms in March 2000

and February 2005, respectively. The 2000 Stock Award Plan, as

amended, provides for the issuance, in addition to nonqualified

stock options, of (i) incentive stock options, (ii) stock appreciation

rights, (iii) restricted stock, (iv) restricted stock units and (v) perform-

ance shares of up to 13,000,000 shares of our common stock.

During any calendar year, no one individual shall be granted awards

with respect to more than 500,000 shares. We awarded 160,574,

331,756 and 14,025 restricted stock units in 2005, 2004 and 2003,

respectively. Options and restricted stock units outstanding as of

December 31, 2005, vest over three to five years and four to five

years, respectively, from the date of grant. Generally, the shares are

forfeited if the recipient ceases to be a director or employee before

the shares vest. Options are granted at a price not less than the fair

value of the shares on the date of grant and expire not later than ten

years after the date of grant.

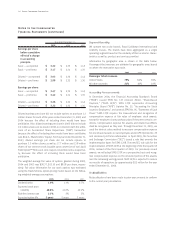

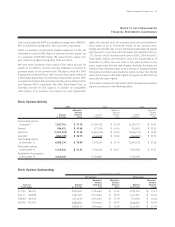

Stock options activity and information about stock options outstand-

ing are summarized in the following tables:

Stock Options Activity

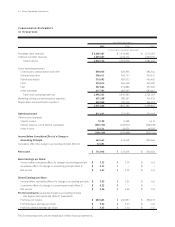

2005 2004 2003

Weighted- Weighted- Weighted-

Average Average Average

Number Exercise Number EXercise Number Exercise

of options Price of Options Price of Options Price

Outstanding options

at January 1 7,592,741 $ 27.76 11,994,522 $ 23.28 15,234,577 $ 21.63

Granted 634,621 $ 47.69 973,769 $ 40.34 536,991 $ 25.59

Exercised (1,027,503) $ 21.49 (5,064,496) $ 19.39 (3,064,355) $ 14.89

Canceled (341,725) $ 38.70 (311,054) $ 30.02 (712,691) $ 25.72

Outstanding options

at December 31 6,858,134 $ 30.00 7,592,741 $ 27.76 11,994,522 $ 23.28

Exercisable options

at December 31 5,156,340 $ 27.34 5,368,655 $ 25.47 7,949,284 $ 23.53

Available for future grants

at December 31 3,432,602 5,766,889 6,793,185

Stock Options Outstanding

As of December 31, 2005

Outstanding Exercisable

Weighted- Weighted- Weighted-

Average Average Average

Exercise Number Remaining Exercise Number Exercise

Price Range of Options Life Price of Options Price

$ 9.55 - $ 20.30 2,050,467 5.38 years $ 13.45 1,934,742 $ 13.13

$ 21.71 - $ 28.88 1,667,021 4.57 years $ 25.95 1,413,259 $ 26.36

$28.88 - $ 40.06 1,274,139 6.91 years $ 37.39 551,986 $ 36.26

$40.06 - $ 52.95 1,866,507 5.65 years $ 46.74 1,256,353 $ 46.40

6,858,134 5.54 years $ 30.00 5,156,340 $ 27.34

Royal Caribbean Cruises Ltd 39

Notes to the Consolidated

Financial Statements (continued)