Regions Bank 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Characteristics of the Loan Portfolio

In order to assess the risk characteristics of the loan portfolio, it is appropriate to consider the current U.S.

economic environment and that of Regions’ primary banking markets, as well as risk factors within the major

categories of loans.

Economic Environment in Regions’ Banking Markets

The largest factor influencing the credit performance of Regions’ loan portfolio is the overall economic

environment in the U.S. and the primary markets in which it operates. The U.S. economy is in the midst of an

official recession that began in December 2007. Overall output of goods and services is currently experiencing

the sharpest decline since the early 1980s. Consumer spending, two-thirds of all recorded spending, has been

hobbled by declining inflation-adjusted income, low additional credit capacity, historically high required monthly

payments, a negative employment outlook and historically low consumer confidence. The business sector is

struggling with weak domestic and foreign demand, and underutilized operating capacity.

As 2008 evolved, the outlook shifted rapidly from general concern about inflation to general concern about

deflation. The latter, if sustained, can lead to continuing declines in overall demand, and a deepening, prolonged

recession. However, current and pending additional monetary and fiscal policy packages could prevent a period

of sustained deflation.

Housing continued to weaken considerably throughout 2008 and the risk of a deepening recession is

significantly increasing due to the negative impact housing is having on the overall economy. Within the Regions

footprint, the housing slowdown has been modest in some areas and severe in Florida and selected other

geographical areas, including Atlanta, Georgia. Florida has experienced above-average price increases and

construction activity in recent years. The slowdown is evident in many areas, including steeply declining sales

and prices, and high levels of excess unsold inventory on the market. Management anticipates that the housing

industry will remain weak throughout 2009. Housing-related issues have been exacerbated by a sharp increase in

unemployment across Regions’ footprint, particularly in Florida.

Portfolio Characteristics

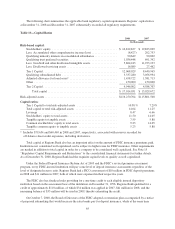

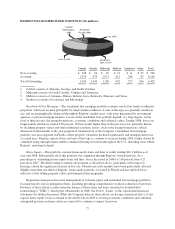

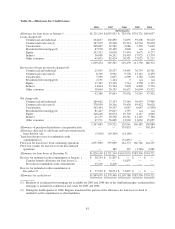

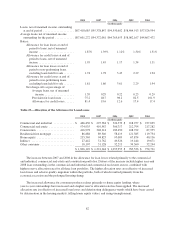

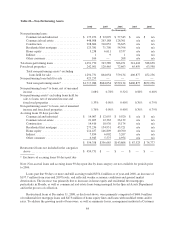

Regions has a well-diversified loan portfolio, in terms of product type, collateral and geography. At

December 31, 2008, commercial and industrial loans represented 24 percent of total loans, net of unearned

income, commercial real estate loans represented 27 percent, construction loans were 11 percent, residential first

mortgage loans totaled 16 percent and consumer loans, largely home equity lending, comprised the remaining 22

percent.

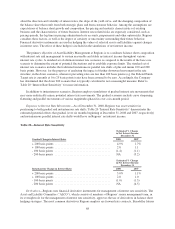

Commercial and Industrial—The commercial and industrial loan portfolio totaled $23.6 billion at year-end

2008 and primarily consists of loans to middle market commercial customers doing business in Regions’

geographic footprint. Loans in this portfolio are generally underwritten individually and usually secured with the

assets of the company and/or the personal guarantee of the business owners. Net charge-offs on commercial and

industrial loans were 0.92 percent of average commercial loans in 2008 compared to 0.33 percent in 2007.

Regions expects that losses on these types of loans will continue to be at elevated levels during 2009.

Commercial Real Estate—The commercial real estate portfolio totaled $26.2 billion at year-end 2008 and

includes various loan types. A large portion is owner-occupied loans to businesses for long-term financing of

land and buildings. These loans are generally underwritten and managed in the commercial business line.

Regions attempts to minimize risk on owner-occupied properties by requiring collateral values that exceed the

loan amount, adequate cash flow to service the debt, and, in many cases, the personal guarantees of principals of

the borrowers.

Another large component of commercial real estate loans is loans to real estate developers and investors for

the financing of land or buildings, where the repayment is generated from the sale of the real estate or income

75