Regions Bank 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

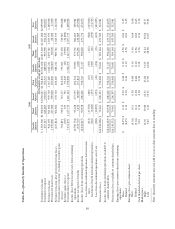

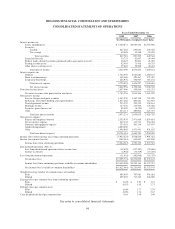

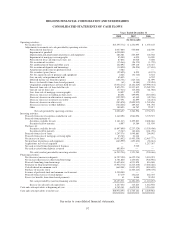

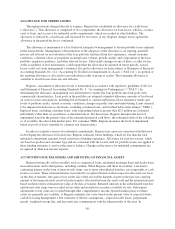

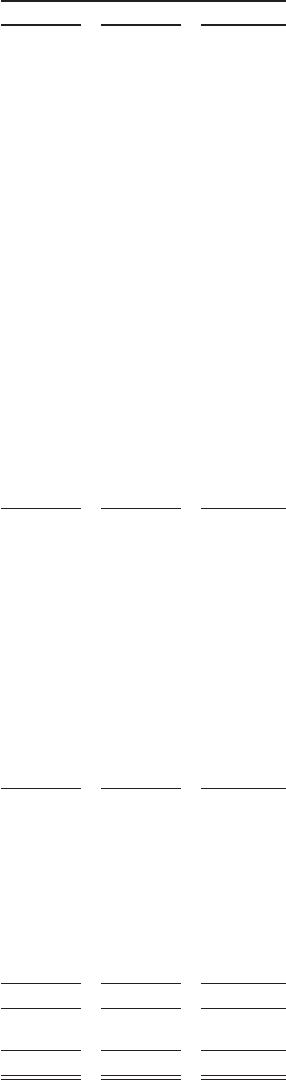

REGIONS FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31

2008 2007 2006

(In thousands)

Operating activities:

Net income (loss) ......................................................... $(5,595,774) $ 1,251,095 $ 1,353,145

Adjustments to reconcile net cash provided by operating activities:

Provision for loan losses ................................................ 2,057,000 555,000 142,500

Impairment of goodwill ................................................ 6,000,000 — —

Depreciation and amortization of premises and equipment ..................... 286,381 263,409 144,038

Impairment of mortgage servicing rights ................................... 85,000 6,000 16,000

Provision for losses on other real estate, net ................................. 87,836 10,010 5,698

Net accretion of securities .............................................. (15,366) (26,173) (1,720)

Net amortization of loans and other assets .................................. 122,092 259,110 178,347

Net accretion of deposits and borrowings .................................. (14,850) (58,504) (17,894)

Amortization of discount on preferred stock ................................ 3,382 — —

Net securities (gains) losses ............................................. (92,495) 8,553 (8,123)

Net loss (gain) on sale of premises and equipment ........................... 2,426 (32,746) 8,522

Loss on early extinguishment of debt ...................................... 65,405 — 6,532

Deferred income tax (benefit) expense ..................................... (406,751) (123,744) 61,099

Excess tax benefits from share-based payments .............................. (61) (8,484) (32,454)

Originations and purchases of loans held for sale ............................ (5,054,174) (8,181,669) (15,990,331)

Proceeds from sales of loans held for sale .................................. 5,823,723 11,537,812 15,282,578

Gain on sale of loans, net ............................................... (57,313) (65,632) (81,088)

Loss from sale of mortgage servicing rights ................................. 14,857 4,429 —

Decrease (increase) in trading account assets ................................ 88,491 439,094 (510,696)

(Increase) decrease in other interest-earning assets ........................... (392,292) 65,449 (42,746)

Decrease (increase) in interest receivable ................................... 157,591 44,899 (46,451)

(Increase) decrease in other assets ........................................ (583,878) (2,899,912) 1,762,856

(Decrease) increase in other liabilities ..................................... (764,266) 189,813 501,792

Other ............................................................... 189,493 48,787 22,917

Net cash provided by operating activities ............................... 2,006,457 3,286,596 2,754,521

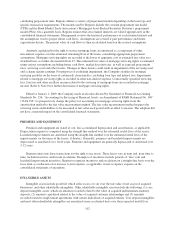

Investing activities:

Proceeds from sale of securities available for sale ................................ 2,142,296 1,964,096 3,770,572

Proceeds from maturity of:

Securities available for sale ............................................. 3,181,213 2,495,803 2,608,866

Securities held to maturity .............................................. 8,997 14,384 151,939

Purchases of:

Securities available for sale ............................................. (6,847,899) (2,237,529) (5,550,408)

Securities held to maturity .............................................. (5,367) (40,812) (161,796)

Proceeds from sales of loans ................................................. 1,247,378 1,049,881 294,992

Proceeds from sales of mortgage servicing rights ................................ 43,763 21,148 —

Net increase in loans ....................................................... (6,433,052) (1,495,559) (2,467,777)

Net purchase of premises and equipment ....................................... (463,999) (453,832) (94,661)

Acquisitions, net of cash acquired ............................................ — — 1,217,587

Net cash received from disposition of business .................................. — 5,700 —

Net cash received from deposits assumed ...................................... 893,934 — —

Net cash (used in) provided by investing activities ........................... (6,232,736) 1,323,280 (230,686)

Financing activities:

Net (decrease) increase in deposits ............................................ (4,757,190) (6,422,374) 3,310,923

Net increase (decrease) in short-term borrowings ................................ 4,701,840 1,453,051 (944,956)

Proceeds from long-term borrowings .......................................... 11,605,418 6,933,828 816,048

Payments on long-term borrowings ........................................... (3,954,776) (4,223,810) (3,204,486)

Cash dividends on common stock ............................................ (669,001) (1,035,432) (894,805)

Purchase of treasury stock .................................................. — (1,363,213) (490,370)

Issuance of preferred stock and common stock warrant ............................ 3,500,000 — —

Proceeds from exercise of stock options ....................................... 27,179 154,813 264,335

Excess tax benefits from share-based payments .................................. 61 8,484 32,454

Net cash provided by (used in) financing activities ........................... 10,453,531 (4,494,653) (1,110,857)

Increase in cash and cash equivalents ...................................... 6,227,252 115,223 1,412,978

Cash and cash equivalents at beginning of year ...................................... 4,745,141 4,629,918 3,216,940

Cash and cash equivalents at end of year ........................................... $10,972,393 $ 4,745,141 $ 4,629,918

See notes to consolidated financial statements.

97