Regions Bank 2008 Annual Report Download - page 32

Download and view the complete annual report

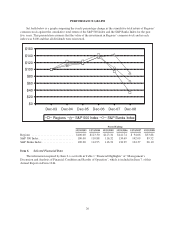

Please find page 32 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The market price of shares of our common stock will fluctuate.

The market price of our common stock could be subject to significant fluctuations due to a change in

sentiment in the market regarding our operations or business prospects. Such risks may be affected by:

• Operating results that vary from the expectations of management, securities analysts and investors;

• Developments in our businesses or in the financial sector generally;

• Regulatory changes affecting our industry generally or our businesses and operations;

• The operating and securities price performance of companies that investors consider to be comparable

to us;

• Announcements of strategic developments, acquisitions and other material events by us or our

competitors;

• Changes in the credit, mortgage and real estate markets, including the markets for mortgage-related

securities; and

• Changes in global financial markets and global economies and general market conditions, such as

interest or foreign exchange rates, stock, commodity, credit or asset valuations or volatility.

Stock markets in general and our common stock in particular have, over the past year, and continue to be

experiencing significant price and volume volatility. As a result, the market price of our common stock may

continue to be subject to similar market fluctuations that may be unrelated to our operating performance or

prospects. Increased volatility could result in a decline in the market price of our common stock.

Industry competition may have an adverse effect on our success.

Our profitability depends on our ability to compete successfully. We operate in a highly competitive

environment. Certain of our competitors are larger and have more resources than we do. In our market areas, we

face competition from other commercial banks, savings and loan associations, credit unions, internet banks,

finance companies, mutual funds, insurance companies, brokerage and investment banking firms, and other

financial intermediaries that offer similar services. Some of our non-bank competitors are not subject to the same

extensive regulations that govern Regions or Regions Bank and may have greater flexibility in competing for

business. Regions expects competition to intensify among financial services companies due to the recent

consolidation of certain competing financial institutions and the conversion of certain investment banks to bank

holding companies. Should competition in the financial services industry intensify, Regions’ ability to market its

products and services may be adversely affected.

Changes in the policies of monetary authorities and other government action could adversely affect our

profitability.

The results of operations of Regions are affected by credit policies of monetary authorities, particularly the

Federal Reserve. The instruments of monetary policy employed by the Federal Reserve include open-market

operations in U.S. government securities, changes in the discount rate or the federal funds rate on bank

borrowings, and changes in reserve requirements against bank deposits. In view of changing conditions in the

national economy and in the money markets, we cannot predict possible future changes in interest rates, deposit

levels, and loan demand on our businesses and earnings. Furthermore, ongoing military operations in the Middle

East or elsewhere around the world, including those in response to terrorist attacks, may result in currency

fluctuations, exchange controls, market disruption and other adverse effects.

Anti-takeover laws and certain agreements and charter provisions may adversely affect share value.

Certain provisions of state and federal law and our certificate of incorporation may make it more difficult

for someone to acquire control of us without our Board of Directors’ approval. Under federal law, subject to

certain exemptions, a person, entity or group must notify the federal banking agencies before acquiring control of

22