Regions Bank 2008 Annual Report Download - page 59

Download and view the complete annual report

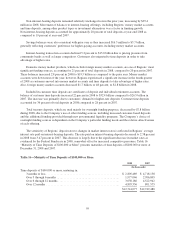

Please find page 59 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Real Estate Owned Expense

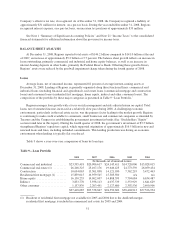

Other real estate owned (“OREO”) expenses include the cost of adjusting foreclosed properties to fair value

after these assets have been classified as OREO, as well as other costs to maintain the property. OREO expense

increased $86.9 million to $102.8 million in 2008 compared to $15.9 million in 2007, driven by steep valuation

declines and losses on the sale of foreclosed properties resulting from continued decline of the housing market.

Another contributing factor is increased costs related to operating and maintaining the foreclosed properties

during the holding period. Despite Regions’ aggressive and successful efforts to sell foreclosed properties,

balances increased $122.5 million to $243.0 million in 2008. See Note 11 “Other Real Estate” to the consolidated

financial statements.

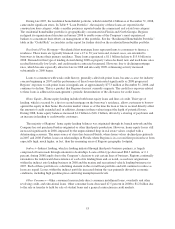

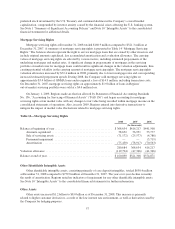

Marketing

Marketing expense decreased $37.1 million during 2008, including a reduction of $30.2 million of merger-

related charges, to $96.9 million from $134.1 million in 2007. In 2007, marketing expense was higher due to

post-merger rebranding initiatives and marketing campaigns which ran to coincide with branch conversions, as

well as customer communications associated with branch conversions and consolidations.

Goodwill Impairment

Regions incurred a $6.0 billion non-cash goodwill impairment charge as a result of a goodwill evaluation

performed in the fourth quarter of 2008. This evaluation indicated the estimated implied fair value of the General

Banking/Treasury reporting unit’s goodwill was less than its book value, therefore requiring the impairment

charge. Refer to Note 1 “Summary of Significant Accounting Policies” and Note 10 “Intangible Assets” to the

consolidated financial statements for further discussion.

Mortgage Servicing Rights Impairment

Mortgage servicing rights impairment increased $79.0 million to $85.0 million in 2008. The increase was

driven by the effects of changes in the interest rate environment in 2008.

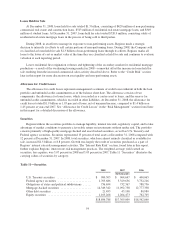

Other Miscellaneous Expenses

Other miscellaneous expenses include communications, valuation impairment charges, business

development services, and FDIC insurance. Other miscellaneous expenses increased slightly in 2008 compared to

2007. Included in other miscellaneous expenses are $49.4 million and $38.5 million write-downs on the

investment in two Morgan Keegan mutual funds during 2008 and 2007, respectively. Also in 2008, Regions

incurred a $65.4 million loss on early extinguishment of debt related to the redemption of subordinated notes.

Other miscellaneous expenses benefited from the recognition of a $28.4 million litigation expense reduction

related to Visa’s IPO during the first quarter of 2008. Regions had recorded a $51.5 million expense for Visa

litigation during the fourth quarter of 2007.

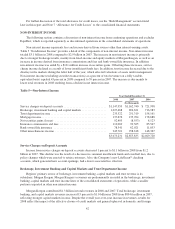

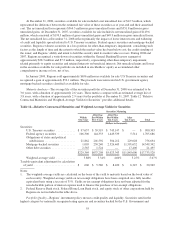

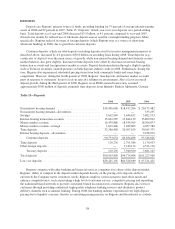

INCOME TAXES

Regions’ 2008 provision for income taxes from continuing operations decreased $993.8 million to a tax

benefit to $348.1 million compared to expense of $645.7 million in 2007, primarily due to lower consolidated

earnings combined with the $275 million benefit from settlement of uncertain tax positions resulting from the

resolution with the IRS of the Company’s federal uncertain tax positions for tax years 1999-2006.

Periodically, Regions invests in pass-through investment vehicles that generate tax credits, principally

low-income housing credits and non-conventional fuel source credits, which directly reduce Regions’ federal

income tax liability. Congress has enacted these tax credit programs to encourage capital inflows to these

49