Regions Bank 2008 Annual Report Download - page 134

Download and view the complete annual report

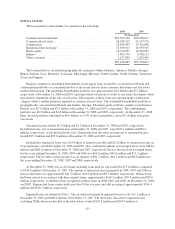

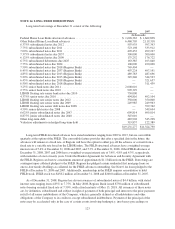

Please find page 134 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reorganization of the Company. The subordinated notes described above qualify as Tier 2 capital under Federal

Reserve guidelines.

The 6.50% and the 6.45% subordinated notes due 2018 were called during 2008, with Regions recognizing a

loss of approximately $65.4 million upon extinguishment in other non-interest expense. The 6.125% subordinated

notes due 2009 may be redeemed by Regions prior to March 1, 2009, at the greater of 100% of the principal

amount or an amount based on a preset formula. All other subordinated notes are not redeemable prior to maturity.

As of December 31, 2008, Regions had senior notes totaling $4.8 billion. In October 2008, the Federal

Deposit Insurance Corporation (“FDIC”) announced a new program – the Temporary Liquidity Guarantee

Program (“TLGP”) – to strengthen confidence and encourage liquidity in the banking system by guaranteeing

newly issued senior unsecured debt of banks, thrifts and certain holding companies, and by providing full

coverage of non-interest bearing deposit transaction accounts, regardless of dollar amount. Under the final rules,

certain newly issued senior unsecured debt with maturities greater than 30 days issued on or before June 30,

2009, would be backed by the “full faith and credit” of the U.S. government through June 30, 2012. The FDIC’s

payment obligation under the guarantee for eligible senior unsecured debt would be triggered by a payment

default. The guarantee is limited to 125% of senior unsecured debt as of September 30, 2008 that is scheduled to

mature before June 30, 2009. This includes federal funds purchased, promissory notes, commercial paper and

certain types of inter-bank funding. Participants will be charged a 50-100 basis point fee to protect their new debt

issues which varies depending on the maturity date (amounts paid as a non-refundable fee will be applied to

offset the guarantee fee until the non-refundable fee is exhausted). In December 2008, Regions Bank completed

an offering of $3.75 billion of qualifying senior bank notes covered by the TLGP to include $2.0 billion of 3.25%

senior notes due December 9, 2011; $1.0 billion of 2.75% senior notes due December 10, 2010; $500 million of

floating rate senior notes due December 10, 2010 and $250 million of floating rate senior bank notes due June 11,

2010. Payment of principal and interest on the notes will be guaranteed by the full faith and credit of the United

States pursuant to the TLGP. The Company has remaining capacity under the TLGP to issue up to an additional

$4.0 billion. Approximately $750 million of senior debt notes matured during the third quarter of 2008. The $250

million of notes that mature on June 26, 2009 currently have an interest rate of LIBOR plus 3 basis points. None

of the senior notes are redeemable prior to maturity.

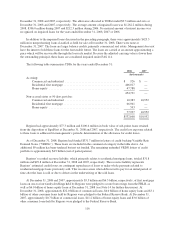

In April 2008, Regions issued $345 million of junior subordinated notes (“JSNs”) bearing an initial fixed

interest rate of 8.875%. These junior subordinated notes have a scheduled maturity of June 15, 2048 and a final

maturity of June 15, 2078, and are redeemable at Regions’ option on or after June 15, 2013. The JSNs were

issued to affiliated trusts, which contemporaneously issued trust preferred securities which Regions guaranteed.

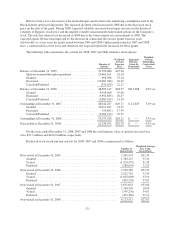

Other long-term debt at December 31, 2008, 2007 and 2006 had weighted-average interest rates of 2.9%,

6.1% and 6.4%, respectively, and a weighted-average maturity of 4.9 years at December 31, 2008. Regions has

$62.8 million included in other long-term debt in connection with a seller-lessee transaction with continuing

involvement (see Note 25 to the consolidated financial statements for further information).

Regions uses derivative instruments, primarily interest rate swaps, to manage interest rate risk by converting

a portion of its fixed-rate debt to a variable-rate. The effective rate adjustments related to these hedges are

included in interest expense on long-term borrowings. The weighted-average interest rate on total long-term debt,

including the effect of derivative instruments, was 4.6%, 5.7% and 5.6% for the years ended December 31, 2008,

2007 and 2006, respectively. Further discussion of derivative instruments is included in Note 22 to the

consolidated financial statements.

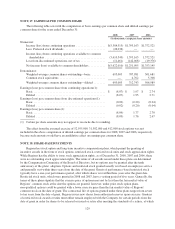

The aggregate amount of contractual maturities of all long-term debt in each of the next five years and

thereafter is as follows: 2009–$2.7 billion; 2010–$5.5 billion; 2011–$5.4 billion; 2012–$0.9 billion; 2013–$1.0

billion; and thereafter–$3.7 billion.

In May 2007, Regions filed a new shelf registration statement with the U.S. Securities and Exchange

Commission. This shelf registration does not have a capacity limit and can be utilized by Regions to issue

various debt and/or equity securities.

124