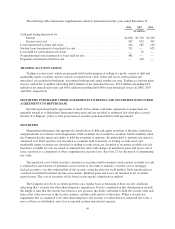

Regions Bank 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FUTURE APPLICATION OF ACCOUNTING STANDARDS

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007),

“Business Combinations” (“FAS 141(R)”). FAS 141(R) requires the acquiring entity in a business combination to

recognize all (and only) the assets acquired and liabilities assumed in the transaction; establishes the acquisition-

date fair value as the measurement objective for all assets acquired and liabilities assumed; and requires the acquirer

to disclose to investors and other users all of the information needed to evaluate and understand the nature and

financial effect of the business combination. FAS 141(R) is effective for fiscal years beginning after December 15,

2008. Regions is in the process of reviewing the potential impact of FAS 141(R). The adoption of FAS 141(R)

could have a material impact to the consolidated financial statements for business combinations entered into after

the effective date of FAS 141(R). Also, any tax contingencies related to acquisitions prior to the effective date of

FAS 141(R) that are resolved after the adoption of FAS 141(R) would be recorded through current earnings, and

also could have a material impact to the consolidated financial statements.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

“Noncontrolling Interests in Consolidated Financial Statements” (“FAS 160”), which requires all entities to

report noncontrolling (minority) interests in subsidiaries as equity in the consolidated financial statements.

Additionally, FAS 160 requires that transactions between an entity and noncontrolling interests be treated as

equity transactions. FAS 160 is effective for fiscal years beginning after December 15, 2008. Regions is in the

process of reviewing the potential impact of FAS 160; however, the adoption of FAS 160 is not expected to have

a material impact to the consolidated financial statements.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, “Disclosures about

Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires entities to provide enhanced

disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and

related hedged items are accounted for under Statement of Financial Accounting Standards No. 133, “Accounting

for Derivative Instruments and Hedging Activities” (“FAS 133”) and its related interpretations, and (c) how

derivative instruments and related hedged items affect an entity’s financial position, financial performance and

cash flows. FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008, and

early adoption is permitted. Regions is in the process of reviewing the potential impact of FAS 161; however, the

adoption of FAS 161 is not expected to have a material impact to the consolidated financial statements.

In December 2008, the FASB issued FASB Staff Position No. 132(R)-1, “Employers’ Disclosures about

Postretirement Benefit Plan Assets” (“FSP 132(R)-1”). This FSP amends FASB Statement No. 132(R),

“Employer’s Disclosures about Pensions and Other Postretirement Benefits” (“FAS 132(R)”), to require

additional disclosures about assets held in an employer’s defined benefit pension or other postretirement plan.

This FSP is applicable to an employer that is subject to the disclosure requirements of FAS 132(R) and is

generally effective for fiscal years ending after December 15, 2009. Regions is in the process of reviewing the

potential impact of FSP 132(R)-1; however, the adoption of FSP 132(R)-1 is not expected to have a material

impact to the consolidated financial statements.

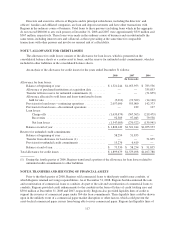

NOTE 2. VARIABLE INTEREST ENTITIES

Regions is involved in various entities that are considered to be VIEs, as defined by FASB Interpretation

No. 46(R) (“FIN 46 (R)). Generally, a VIE is a corporation, partnership, trust or other legal structure that either

does not have equity investors with substantive voting rights or has equity investors that do not provide sufficient

financial resources for the entity to support its activities.

Regions owns the common stock of subsidiary business trusts, which have issued mandatorily redeemable

preferred capital securities (“trust preferred securities”) in the aggregate of approximately $1 billion at the time

of issuance. These trusts meet the definition of a VIE of which Regions is not the primary beneficiary; the trusts’

only assets are junior subordinated debentures issued by Regions, which were acquired by the trusts using the

proceeds from the issuance of the trust preferred securities and common stock. The junior subordinated

debentures are included in long-term borrowings and Regions’ equity interests in the business trusts are included

109