Regions Bank 2008 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

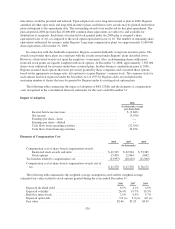

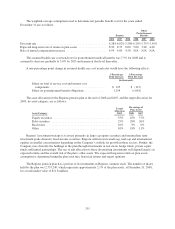

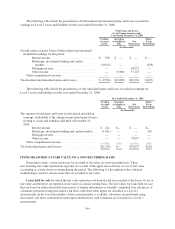

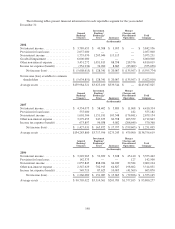

2007

Notional

Amount

Fair

Value

Hedged

Item

Weighted-

Average

Maturity

Pay

Structure

(Dollars in millions)

Fair Value Hedges

Forward sale commitments ................. $ 905 $ (4.5) Loans Held for Sale 0.1 yrs. n/a

Interest rate swaps (a) ...................... 3,125 122.4 Debt 4.0 yrs. Variable

$4,030 $117.9

Cash Flow Hedges

Interest rate swaps (a) ...................... $3,960 $133.1 Loans 2.6 yrs. Variable

Interest rate options ....................... 2,000 41.5 Loans 1.6 yrs. n/a

$5,960 $174.6

(a) The weighted-average pay and receive rates on interest rate swaps were 5.76% and 6.05%, respectively.

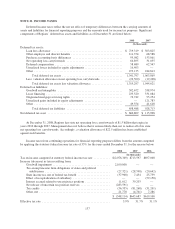

The ineffectiveness recognized on both fair value hedges and cash flow hedges was immaterial for years

ending December 31, 2008, 2007 and 2006.

Regions reported an after-tax gain of $25.8 million and an after-tax loss of $1.7 million in other

comprehensive income at December 31, 2008, and 2007, respectively, related to terminated cash flow hedges of

loan and debt instruments which will be amortized into earnings in conjunction with the recognition of interest

payments through 2011. Regions recognized pre-tax income of $10.7 million during 2008 related to this

amortization. During 2009, Regions expects to reclassify out of other comprehensive income and into earnings

approximately $272.9 million in pre-tax income due to the receipt of interest payments on all cash flow hedges.

Of this amount, $30.9 million relates to the amortization of discontinued cash flow hedges.

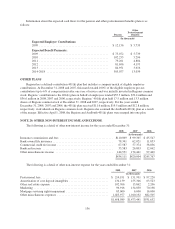

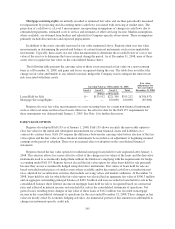

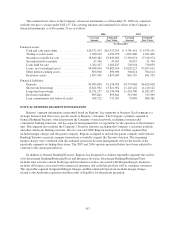

TRADING AND OTHER DERIVATIVES

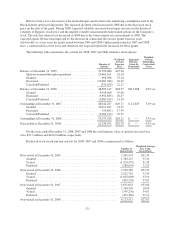

The following table summarizes the trading and other derivative positions held by Regions as of

December 31:

2008 2007

Contract or

Notional

Amount

Contract or

Notional

Amount

(In millions)

Interest rate swaps ........................................................ $60,210 $30,952

Interest rate options ....................................................... 3,761 3,484

Futures and forward commitments ........................................... 9,164 6,193

Other .................................................................. 903 424

$74,038 $41,053

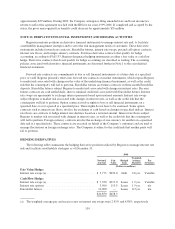

Credit risk, defined as all positive exposures not collateralized with cash or other assets, at December 31,

2008 and 2007, totaled approximately $1,617.3 million and $501.1 million, respectively. These amounts

represent the net credit risk on all trading and other derivative positions held by Regions.

Prior to 2008, Regions designated forward contracts to hedge the fair value of specific pools of residential

mortgage loans held for sale against changes in interest rates. Beginning January 1, 2008, Regions elected the fair

value option on new originations of residential mortgages held for sale (see Note 23) but continued to

economically hedge these loans with forward rate commitments. At December 31, 2008, Regions had $1,492.1

million in notional amounts of forward rate commitments with a net negative fair value of ($12.1) million. In

140