Regions Bank 2008 Annual Report Download - page 63

Download and view the complete annual report

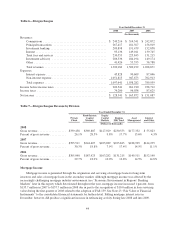

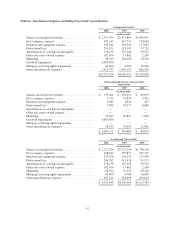

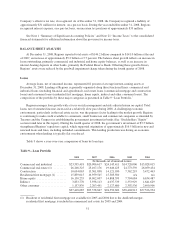

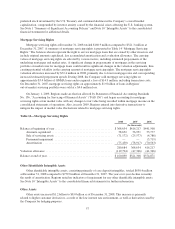

Please find page 63 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During late 2007, the residential homebuilder portfolio, which totaled $4.4 billion as of December 31, 2008,

came under significant stress. In Table 9 “Loan Portfolio”, the majority of these loans are reported in the

construction loan category, while a smaller portion is reported under the commercial real estate loan category.

The residential homebuilder portfolio is geographically concentrated in Florida and North Georgia. Regions

realigned its organizational structure in January 2008 to enable some of the Company’s most experienced

bankers to concentrate their efforts on management of this portfolio. See the “Residential Homebuilder Portfolio”

table in the “Credit Risk” section later in this report for further detail on the residential homebuilder portfolio.

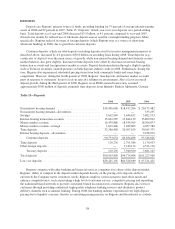

Residential First Mortgage—Residential first mortgage loans represent loans to consumers to finance a

residence. These loans are typically financed over a 15 to 30 year term and, in most cases, are extended to

borrowers to finance their primary residence. These loans experienced a $1.1 billion decline to $15.8 billion in

2008. Demand for this type of lending slowed during 2008 as property values declined, new and used home sales

reached historically low levels, and credit markets contracted in general. However, due to declining mortgage

rates, which became especially attractive late in 2008 and into early 2009, refinancing activity increased

substantially as 2009 began.

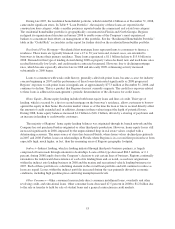

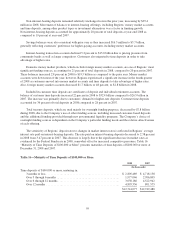

Loans to consumers with weak credit history, generally called sub-prime loans, became a cause for industry

concern beginning in 2007 and the performance of these loans deteriorated significantly as 2008 progressed.

Regions’ exposure to sub-prime loans is insignificant, at approximately $77.3 million at December 31, 2008, and

continues to decline. This is a product that Regions does not currently originate. The credit loss exposure related

to these loans is addressed in management’s periodic determination of the allowance for credit losses.

Home Equity—Home equity lending includes both home equity loans and lines of credit. This type of

lending, which is secured by a first or second mortgage on the borrower’s residence, allows customers to borrow

against the equity in their home. Real estate market values as of the time the loan or line is secured directly affect

the amount of credit extended and, in addition, changes in these values impact the depth of potential losses.

During 2008, home equity balances increased $1.2 billion to $16.1 billion, driven by a slowing of paydowns and

an increase in lending to creditworthy customers.

The majority of Regions’ home equity lending balances was originated through its branch network and the

Company has not purchased broker-originated or other third-party production. However, home equity losses still

increased significantly in 2008, impacted by the unprecedented drop in real estate values coupled with a

deteriorating economy. The main source of stress has been in Florida, where home values declined precipitously

in 2007 and 2008. Further, losses on relationships in Florida where Regions is in a second lien position have been

especially high; much higher, in fact, than the remaining areas of Regions geographic footprint.

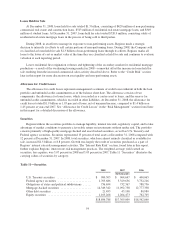

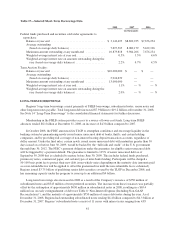

Indirect—Indirect lending, which is lending initiated through third-party business partners, is largely

comprised of loans made through automotive dealerships. Loans of this type decreased $84.3 million, or 2.1

percent, during 2008 largely due to the Company’s decision to exit certain lines of business. Regions continually

rationalizes the risk/reward characteristics of each of its lending lines and, as noted, ceased new originations

within the indirect auto lending business in 2008 and the marine and recreational vehicle lending businesses in

2007. Each of these portfolios is a declining element in the overall loan portfolio and will continue to reduce as

loans are repaid. Losses within the indirect portfolio increased during the year primarily driven by economic

conditions, including high gasoline prices and rising unemployment levels.

Other Consumer—Other consumer loans include direct consumer installment loans, overdrafts and other

revolving credit, and educational loans. Other consumer loans decreased 47.5 percent in 2008 to $1.2 billion due

to the sale or transfer to held for sale of student loans and a general contraction in credit markets.

53