Regions Bank 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

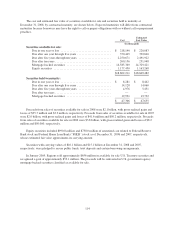

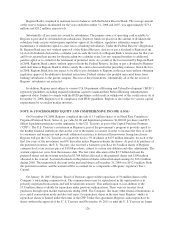

Directors and executive officers of Regions and its principal subsidiaries, including the directors’ and

officers’ families and affiliated companies, are loan and deposit customers and have other transactions with

Regions in the ordinary course of business. Total loans to these persons (excluding loans which in the aggregate

do not exceed $60,000 to any such person) at December 31, 2008 and 2007 were approximately $319 million and

$367 million, respectively. These loans were made in the ordinary course of business and on substantially the

same terms, including interest rates and collateral, as those prevailing at the same time for comparable

transactions with other persons and involve no unusual risk of collectibility.

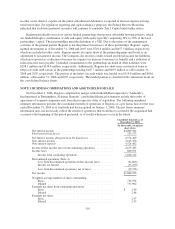

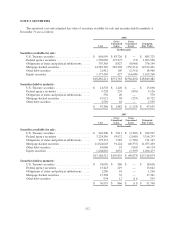

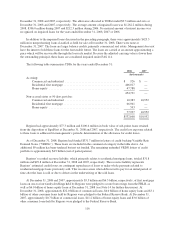

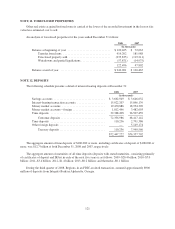

NOTE 7. ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses consists of the allowance for loan losses, which is presented on the

consolidated balance sheets as a contra-asset to loans, and the reserve for unfunded credit commitments, which is

included in other liabilities in the consolidated balance sheets.

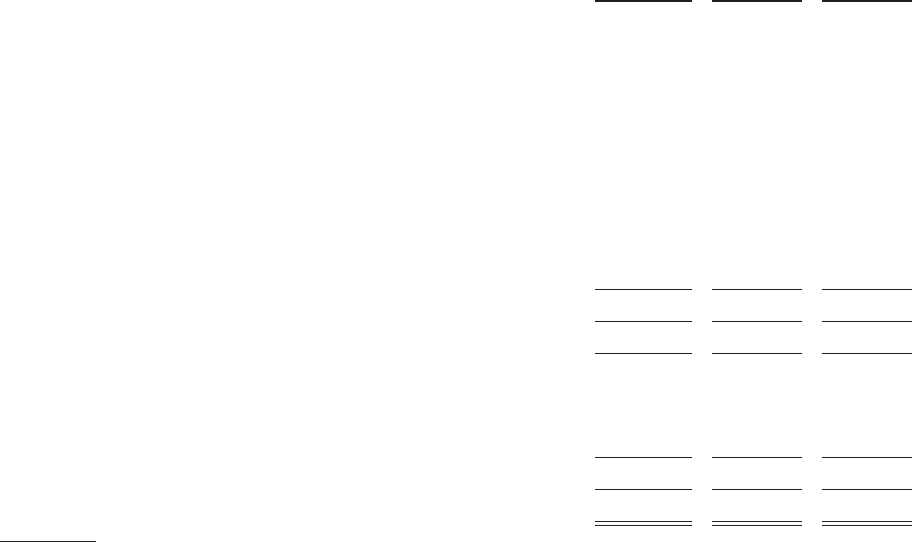

An analysis of the allowance for credit losses for the years ended December 31 follows:

2008 2007 2006

(In thousands)

Allowance for loan losses:

Balance at beginning of year .............................. $1,321,244 $1,055,953 $ 783,536

Allowance of purchased institutions at acquisition date ......... — — 335,833

Transfer to/from reserve for unfunded commitments (1) ........ — — (51,835)

Allowance allocated to sold loans and loans transferred to loans

held for sale ......................................... (5,010) (19,369) (14,140)

Provision for loan losses—continuing operations .............. 2,057,000 555,000 142,373

Provision for loan losses—discontinued operations ............ — 182 127

Loan losses:

Charge-offs ....................................... (1,639,474) (367,565) (219,479)

Recoveries ........................................ 92,389 97,043 79,538

Net loan losses ..................................... (1,547,085) (270,522) (139,941)

Balance at end of year ................................... $1,826,149 $1,321,244 $1,055,953

Reserve for unfunded credit commitments:

Balance at beginning of year .............................. 58,254 51,835 —

Transfer from allowance for loan losses (1) .................. — — 51,835

Provision for unfunded credit commitments .................. 15,276 6,419 —

Balance at end of year ................................... $ 73,530 $ 58,254 $ 51,835

Total allowance for credit losses ............................... $1,899,679 $1,379,498 $1,107,788

(1) During the fourth quarter of 2006, Regions transferred a portion of the allowance for loan losses related to

unfunded credit commitments to other liabilities.

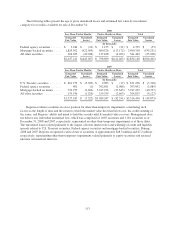

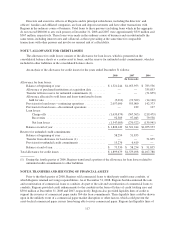

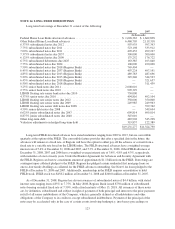

NOTE 8. TRANSFERS AND SERVICING OF FINANCIAL ASSETS

Prior to the third quarter of 2008, Regions sold commercial loans to third-party multi-issuer conduits, of

which Regions retained servicing responsibilities. As of December 31, 2008, Regions had discontinued the sale

and securitization of commercial loans to conduits. As part of the sale and securitization of commercial loans to

conduits, Regions provided credit enhancements to the conduits in the form of letters of credit totaling zero and

$50.0 million at December 31, 2008 and 2007, respectively. Regions also provided liquidity lines of credit to

support the issuance of commercial paper under 364-day loan commitments. These liquidity lines could be drawn

upon in the unlikely event of a commercial paper market disruption or other factors, which could prevent the

asset-backed commercial paper issuers from being able to issue commercial paper. Regions had liquidity lines of

117