Regions Bank 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Counterparty exposure may result from a variety of transaction types and may include exposure to

commercial banks, savings and loans, insurance companies, broker/dealers, institutions that provide credit

enhancements, and corporate debt issuers. Because transactions with a counterparty may be generated in one or

more departments, credit limits are established for use by various areas of the Company including treasury,

capital markets, finance, the mortgage division and lines of business.

To manage counterparty risk, Regions has a centralized approach to approval, management and monitoring

of exposure. To that end, Regions has a dedicated counterparty credit group and credit officer, as well as a

documented counterparty credit policy. Exposures to counterparties are regularly aggregated across departments

and reported to senior management.

CREDIT RISK

Regions’ objective regarding credit risk is to maintain a high-quality credit portfolio that provides for stable

credit costs with acceptable volatility through an economic cycle.

Management Process

Regions employs a credit risk management process with defined policies, accountability and regular

reporting to manage credit risk in the loan portfolio. Credit risk management is guided by credit policies that

provide for a consistent and prudent approach to underwriting and approvals of credits. Within the Credit Policy

department, procedures exist that elevate the approval requirements as credits become larger and more complex.

Generally, consumer credits and smaller commercial credits are centrally underwritten based on custom credit

matrices and policies that are modified as appropriate. Larger commercial and commercial real estate

transactions are individually underwritten, risk-rated, approved and monitored.

Responsibility and accountability for adherence to underwriting policies and accurate risk ratings lies in the

lines of business. For consumer and small business portfolios, the risk management process focuses on managing

customers who become delinquent in their payments and managing performance of the credit scorecards, which

are periodically adjusted based on credit performance. Commercial business units are responsible for

underwriting new business and, on an ongoing basis, monitoring the credit of their portfolios, including a

complete review of the borrower semi-annually or more frequently as needed.

To ensure problem commercial credits are identified on a timely basis, several specific portfolio reviews

occur each quarter to assess the larger adversely rated credits for accrual status and, if necessary, to ensure such

individual credits are transferred to Regions’ Special Assets Group, which specializes in managing distressed

credit exposures.

Separate and independent commercial credit and consumer credit risk management organizational groups

exist, which report to the Chief Credit Officer. These organizational units partner with the business line to assist

in the processes described above, including the review and approval of new business and ongoing assessments of

existing loans in the portfolio. Independent commercial and consumer credit risk management provides for more

accurate risk ratings and the timely identification of problem credits, as well as oversight for the Chief Credit

Officer on conditions and trends in the credit portfolios.

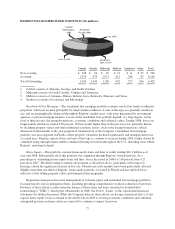

Credit quality and trends in the loan portfolio are measured and monitored regularly and detailed reports, by

product, business unit and geography, are reviewed by line of business personnel and the Chief Credit Officer.

The Chief Credit Officer reviews summaries of these credit reports with executive management and the Board of

Directors. Finally, the Credit Review department provides ongoing independent oversight of the credit portfolios

to ensure policies are followed, credits are properly risk-rated and that key credit control processes are

functioning as intended.

74