Regions Bank 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

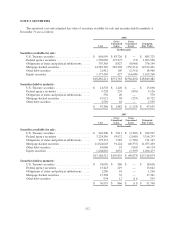

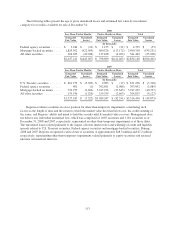

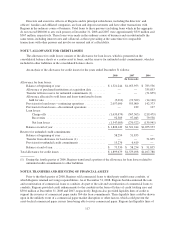

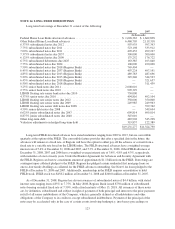

The following tables present the age of gross unrealized losses and estimated fair value by investment

category for securities available for sale at December 31:

2008

Less Than Twelve Months Twelve Months or More Total

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

(In thousands)

Federal agency securities ....... $ 3,184 $ (22) $ 1,155 $ (31) $ 4,339 $ (53)

Mortgage-backed securities ..... 1,829,992 (422,059) 660,326 (117,172) 2,490,318 (539,231)

All other securities ............ 204,035 (20,946) 137,428 (4,262) 341,463 (25,208)

$2,037,211 $(443,027) $ 798,909 $(121,465) $2,836,120 $(564,492)

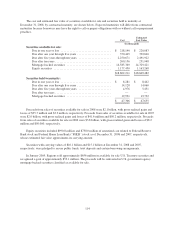

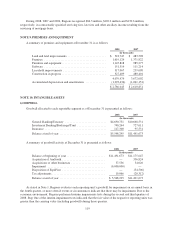

2007

Less Than Twelve Months Twelve Months or More Total

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

Estimated

Fair Value

Unrealized

Losses

(In thousands)

U.S. Treasury securities ........ $ 661,273 $ (3,303) $ 9,983 $ (17) $ 671,256 $ (3,320)

Federal agency securities ....... 401 (1) 702,691 (2,088) 703,092 (2,089)

Mortgage-backed securities ..... 729,973 (2,694) 3,017,234 (37,643) 3,747,207 (40,337)

All other securities ............ 135,536 (1,524) 259,339 (2,603) 394,875 (4,127)

$1,527,183 $ (7,522) $3,989,247 $ (42,351) $5,516,430 $ (49,873)

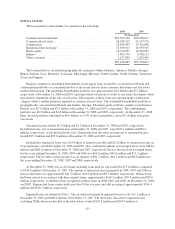

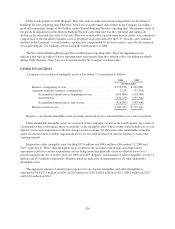

Regions evaluates securities in a loss position for other-than-temporary impairment, considering such

factors as the length of time and the extent to which the market value has been below cost, the credit standing of

the issuer, and Regions’ ability and intent to hold the security until its market value recovers. Management does

not believe any individual unrealized loss, which was comprised of 1,065 securities and 1,021 securities as of

December 31, 2008 and 2007, respectively, represented an other-than-temporary impairment as of those dates.

The unrealized losses related primarily to the impact of lower interest rates and widening of credit and liquidity

spreads related to U.S. Treasury securities, Federal agency securities and mortgage-backed securities. During

2008 and 2007, Regions recognized a write-down of securities of approximately $28.3 million and $7.2 million,

respectively, representing other-than-temporary impairment, related primarily to equity securities and retained

interests on beneficial interests.

113