Red Lobster 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DARDEN RESTAURANTS, INC. | 2015 ANNUAL REPORT 57

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN

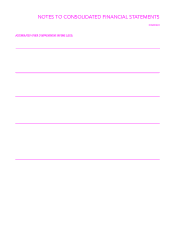

The following table presents a summary of our stock option activity as of and for the year ended May 31, 2015:

Weighted-Average Weighted-Average Aggregate

Options Exercise Price Remaining Intrinsic Value

(in millions) Per Share Contractual Life (Yrs) (in millions)

Outstanding beginning of period 11.23 $41.66 5.57 $ 91.0

Options granted 1.15 45.51

Options exercised (4.16) 37.20

Options canceled (0.51) 48.47

Outstanding end of period 7.71 $44.18 6.08 $164.6

Exercisable 4.97 $42.15 5.00 $116.2

The total intrinsic value of options exercised during fiscal 2015, 2014

and 2013 was $90.2 million, $39.9 million and $47.1 million, respectively.

Cash received from option exercises during fiscal 2015, 2014 and 2013 was

$154.6 million, $50.9 million and $57.0 million, respectively. Stock options

have a maximum contractual period of 10 years from the date of grant. We

settle employee stock option exercises with authorized but unissued shares

of Darden common stock or treasury shares we have acquired through our

ongoing share repurchase program.

As of May 31, 2015, there was $11.7 million of unrecognized

compensation cost related to unvested stock options granted under our

stock plans. This cost is expected to be recognized over a weighted-average

period of 1.3 years. The total fair value of stock options that vested during

fiscal 2015 was $22.7 million.

Restricted stock and RSUs are granted at a value equal to the market

price of our common stock on the date of grant. Restrictions lapse with

regard to restricted stock, and RSUs are settled in shares, at the end of their

vesting periods, which is generally four years.

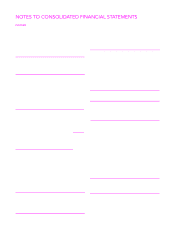

The following table presents a summary of our restricted stock and RSU

activity as of and for the fiscal year ended May 31, 2015:

Weighted-Average

Shares Grant Date Fair

(in millions) Value Per Share

Outstanding beginning of period 0.23 $39.04

Shares granted 0.04 54.20

Shares vested (0.14) 33.57

Shares canceled (0.03) 47.02

Outstanding end of period 0.10 $51.19

As of May 31, 2015, there was $2.7 million of unrecognized compensation

cost related to unvested restricted stock and RSUs granted under our stock

plans. This cost is expected to be recognized over a weighted-average period

of 2.4 years. The total fair value of restricted stock and RSUs that vested

during fiscal 2015, 2014 and 2013 was $4.8 million, $2.3 million and

$5.5 million, respectively.

Darden stock units are granted at a value equal to the market price of

our common stock on the date of grant and will be settled in cash at the end

of their vesting periods, which range between four and five years, at the then

market price of our common stock. Compensation expense is measured

based on the market price of our common stock each period, is amortized

over the vesting period and the vested portion is carried as a liability on our

accompanying consolidated balance sheets. We also entered into equity

forward contracts to hedge the risk of changes in future cash flows associated

with the unvested, unrecognized Darden stock units granted (see Note 10 –

Derivative Instruments and Hedging Activities for additional information).

The following table presents a summary of our Darden stock unit activity

as of and for the fiscal year ended May 31, 2015:

Units Weighted-Average

(All units settled in cash) (in millions) Fair Value Per Unit

Outstanding beginning of period 2.14 $49.55

Units granted 0.43 45.54

Units vested (0.44) 48.51

Units canceled (0.76) 46.31

Outstanding end of period 1.37 $65.54

As of May 31, 2015, our total Darden stock unit liability was $46.1 million,

including $16.2 million recorded in other current liabilities and $29.9 million

recorded in other liabilities on our consolidated balance sheets. As of May 25,

2014, our total Darden stock unit liability was $57.3 million, including

$32.8 million recorded in other current liabilities and $24.5 million recorded

in other liabilities on our consolidated balance sheets.

Based on the value of our common stock as of May 31, 2015, there was

$34.0 million of unrecognized compensation cost related to Darden stock units

granted under our incentive plans. This cost is expected to be recognized

over a weighted-average period of 3.0 years. The total fair value of Darden

stock units that vested during fiscal 2015 was $21.5 million.