Proctor and Gamble 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis TheProcter&GambleCompanyandSubsidiaries 57

offavorablereturnsontheCompany’sstockrelativetobroadermarket

indices(e.g.,S&P500).

Assumedhealthcarecosttrendratescouldhaveasignificanteffecton

theamountsreportedfortheotherretireebenefitplans.Aone-percentage

pointchangeinassumedhealthcarecosttrendrateswouldhavethe

followingeffects:

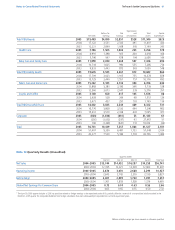

PlanAssets.OurtargetassetallocationfortheyearendingJune30,

2006andactualassetallocationbyassetcategoryasofJune30,2005,

and2004,areasfollows:

Ourinvestmentobjectivefordefinedbenefitplanassetsistomeetthe

plans’benefitobligations,whileminimizingthepotentialforfuture

requiredCompanyplancontributions.Theinvestmentstrategiesfocus

onassetclassdiversification,liquiditytomeetbenefitpaymentsand

anappropriatebalanceoflong-terminvestmentreturnandrisk.Target

rangesforassetallocationsaredeterminedbymatchingtheactuarial

projectionsoftheplan’sfutureliabilitiesandbenefitpaymentswith

expectedlong-termratesofreturnontheassets,takingintoaccount

investmentreturnvolatilityandcorrelationsacrossassetclasses.Plan

assetsarediversifiedacrossseveralinvestmentmanagersandaregenerally

investedinliquidfundsthatareselectedtotrackbroadmarketequity

andbondindices.Investmentriskiscarefullycontrolledwithplan

assetsrebalancedtotargetallocationsonaperiodicbasisand

continualmonitoringofinvestmentmanagersperformancerelativeto

theinvestmentguidelinesestablishedwitheachinvestmentmanager.

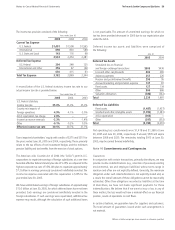

CashFlows.

Management’sbestestimateofourcashrequirementsfor

thedefinedbenefitplansandotherretireebenefitplansfortheyear

endingJune30,2006is$241and$18,respectively.Forthedefined

benefitplans,thisiscomprisedofexpectedbenefitpaymentsof$83,

whicharepaiddirectlytoparticipantsofunfundedplansfromemployer

assets,aswellasexpectedcontributionstofundedplansof$158.For

otherretireebenefitplans,thisiscomprisedofexpectedcontributions

thatwillbeuseddirectlyforbenefitpayments.Expectedcontributions

aredependentonmanyvariables,includingthevariabilityofthe

marketvalueoftheplanassetsascomparedtothebenefitobligation

andothermarketorregulatoryconditions.Inaddition,wetakeinto

considerationourbusinessinvestmentopportunitiesandresultingcash

requirements.Accordingly,actualfundingmaydiffersignificantlyfrom

currentestimates.

Totalbenefitpaymentsexpectedtobepaidtoparticipants,which

includepaymentsfundedfromtheCompany’sassets,asdiscussed

above,aswellaspaymentspaidfromtheplansareasfollows:

EmployeeStockOwnershipPlan

TheCompanymaintainstheESOPtoprovidefundingforcertain

employeebenefitsdiscussedintheprecedingparagraphs.

TheESOPborrowed$1.00billionin1989andtheproceedswereused

topurchaseSeriesAESOPConvertibleClassAPreferredStocktofunda

portionofthedefinedcontributionretirementplanintheU.S.Principal

andinterestrequirementswerepaidbytheTrustfromdividendson

thepreferredsharesandfromadvancesfromtheCompany.Thefinal

paymentfortheoriginalborrowingof$1.00billionwasmadein2004

andtheremainingdebtoftheESOPconsistsofamountsowedtothe

Company.Eachshareisconvertibleattheoptionoftheholderintoone

shareoftheCompany’scommonstock.Thedividendforthecurrent

yearwas$1.03pershare.Theliquidationvalueis$6.82pershare.

NotestoConsolidatedFinancialStatements TheProcter&GambleCompanyandSubsidiaries

Millionsofdollarsexceptpershareamountsorotherwisespecified.

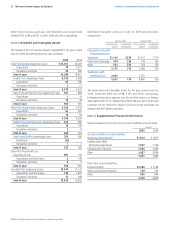

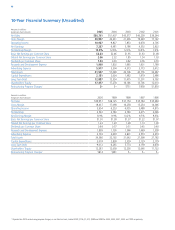

TargetAllocation

OtherRetiree

PensionBenefits Benefits

AssetCategory

2006 2006

Equitysecurities1

58% 99%

Debtsecurities

38% 1%

Realestate

4% –%

100% 100%

PlanAssetAllocationatJune30

PensionBenefits OtherRetireeBenefits

AssetCategory

20042004

Equitysecurities1

64% 99%

Debtsecurities

32% 1%

Realestate

4% –%

100% 100%

1 EquitysecuritiesforotherretireeplanassetsincludeCompanystock,netofSeriesBESOP

debt(seeNote5),of$2,604and$2,744,asofJune30,2005and2004,respectively.

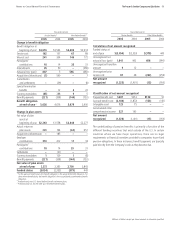

One-Percentage One-Percentage

PointIncrease PointDecrease

Effectontotalservice

andinterestcostcomponents

Effectonpostretirement

benefitobligation

YearsendedJune30

OtherRetiree

PensionBenefits Benefits

2006 $191 $152

2007 209 164

2008 226 177

2009 243 188

2010 255 198

2011–2015 1,489 1,150