Proctor and Gamble 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysisTheProcter&GambleCompanyandSubsidiaries

26

StrategicFocus

P&G isfocusedonstrategies thatwe believearerightforthe

long-termhealthoftheCompanyandthatwillincreasereturnsfor

ourshareholders.TheCompany'sfinancialtargetsare(excludingthe

impactsofthependingGilletteacquisition):

• Salesgrowthof4%to6%excludingtheimpactofchangesin

foreignexchangeratesfromyear-over-yearcomparisons.Onaverage,we

expectapproximately2%ofsalesgrowthtocomefrommarket

growth;1%to3%fromthecombinationofmarketsharegrowth,

expansiontonewgeographiesandnewbusinesscreation;andthe

remaining1%tocomefromsmaller,“tack-on”acquisitionstoaccess

marketsorcomplementcurrentbusinessportfolios.

• Dilutednetearningspersharegrowthof10%orbetter.

• Freecashflowproductivityof90%orgreater(definedastheratioof

operatingcashflowlesscapitalexpendituresdividedbynetearnings).

Inordertoachievethesetargets,wefocusonourcorestrengths

ofbranding,innovation,go-to-marketcapabilityandscaleagainstthe

followinggrowthareas:

•DrivingourcorebusinessesofBabyCare,FabricCare,FeminineCare

andHairCareintostrongergloballeadershippositions.

•Growingourleadingbrandsinourbiggestmarketswithour

largestcustomers.

•Investinginfaster-growingbusinesseswithhighergrossmargins

thatarelessasset-intensive,primarilyintheBeautyandHealth

Carebusinesses.

•Buildingonopportunitiesinselectdevelopingmarketsandwith

lower-incomeconsumers.

Sustainability

Tosustainconsistentandreliablesalesandearningsgrowthinlinewith

ourfinancialtargets,wehaveidentifiedfourkeyenablers:

•Buildingadiversifiedandbalancedportfolioconsistingoffoundation

businessesandhighergrowthbusinesses.Foundationbusinesses

includemanyofourestablishedproductcategories–FabricCare,

HomeCare,BabyCare,FamilyCare,SnacksandCoffee.These

businessesprovideabaseforsteadygrowth,strongoperating

cashflowsandanexcellenttraininggroundforfutureleaders.We

arefocusedonexpandingthesecategoriesthroughinnovative

products,offeringourbrandsinmorepartsoftheworldandtailoring

ourproductstomeettheneedsofmoreconsumers(including

lower-incomeconsumers).Tocomplementthesteadygrowthof

foundationbusinesses,weareexpandingourportfolioofBeautyand

Healthbrands.Thesebusinessesgenerallyhavehighergrossmargins

andlowercapitalrequirementsthanthebalanceoftheCompany’s

portfolio.Overthepastseveralyears,wehaveincreasedthesize

ofourBeautyandHealthbusinessesbygrowingbasebrandsand

throughacquisitions,includingClairolin2002andWellain2004.

Bothoftheseacquisitionsexpandedourpresenceintheretailand

professionalhaircarecategories.InJanuaryof2005,weannounced

ouragreementtoacquireTheGilletteCompany,whichwillfurther

expandourportfolioofBeautyandHealthbrands.Gilletteisaleader

inseveralglobalproductcategoriesincludingbladesandrazors,

oralcareandbatteries.Pendingregulatoryapproval,weexpect

thisacquisitiontocloseinFallof2005.Weexpectourportfolioof

BeautyandHealthbrandstocontinuetoprovideadisproportionate

percentageofgrowthfortheCompany.

• Investingininnovationandcapabilitytoreachmoreoftheworld’s

consumerswithquality,affordableproducts.Thisincludesexpanding

ourpresenceinmarketsandreachingmoreconsumerswherewe

areunder-representedincludinglower-incomeandvalue-conscious

consumers.

• LeveragingtheCompany’sorganizationalstructuretodriveclear

focus,accountabilityandimprovedgo-to-marketcapability.Wehave

anorganizationalstructurethatworkstogethertoleverageour

knowledgeandscaleatthegloballevelwithadeepunderstanding

oftheconsumerandcustomeratthelocallevel.

°TheGBUsleveragetheirconsumerunderstandingtodevelop

the overall strategyfor ourbrands.Theyidentifycommon

consumerneeds,developnewproductsandbuildourbrandsthrough

effectivemarketinginnovations.

°TheMDOdevelopsgo-to-marketplansatthelocallevel,

leveragingtheirunderstandingofthelocalconsumerandcustomer.

TheMDOisfocusedonwinningthe“firstmomentoftruth”–when

aconsumerstandsinfrontoftheshelfandchoosesaproductfrom

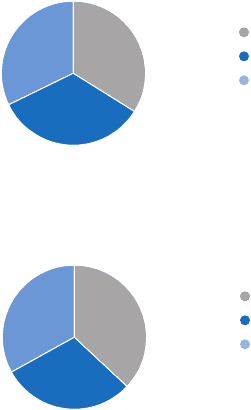

34%

32%

34%

2005 Net Sales

(by GBU)

P&G Beauty

P&G Family Health

P&G Household Care

37%

33%

30%

2005 Net Earnings

(by GBU)

P&G Beauty

P&G Family Health

P&G Household Care