Proctor and Gamble 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis TheProcter&GambleCompanyandSubsidiaries 47

CurrencyTranslation

FinancialstatementsofoperatingsubsidiariesoutsidetheUnitedStates

ofAmerica(U.S.)generallyaremeasuredusingthelocalcurrencyasthe

functionalcurrency.AdjustmentstotranslatethosestatementsintoU.S.

dollarsarerecordedinothercomprehensiveincome.Forsubsidiaries

operatinginhighlyinflationaryeconomies,theU.S.dollaristhefunctional

currency.Remeasurementadjustmentsforfinancialstatementsinhighly

inflationaryeconomiesandothertransactionalexchangegainsand

lossesarereflectedinearnings.

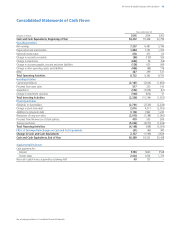

CashFlowPresentation

TheStatementofCashFlowsispreparedusingtheindirectmethod,

whichreconcilesnetearningstocashflowfromoperatingactivities.

Theseadjustmentsincludetheremovaloftimingdifferencesbetween

theoccurrenceofoperatingreceiptsandpaymentsandtheirrecognition

innetearnings.Theadjustmentsalsoremovefromoperatingactivities

cashflowsarisingfrominvestingandfinancingactivities,whichare

presentedseparatelyfromoperatingactivities.Cashflowsfromforeign

currencytransactionsandoperationsaretranslatedatanaverage

exchangeratefortheperiod.Cashflowsfromhedgingactivitiesare

includedinthesamecategoryastheitemsbeinghedged.Cashflows

fromderivativeinstrumentsdesignatedasnetinvestmenthedges

areclassifiedasfinancingactivities.Cashflowsfromotherderivative

instrumentsusedtomanageinterest,commodityorcurrencyexposures

areclassifiedasoperatingactivities.Cashpaidforacquisitionsis

classifiedasinvestingactivities.

CashEquivalents

Highlyliquidinvestmentswithremainingstatedmaturitiesofthree

monthsorlesswhenpurchasedareconsideredcashequivalentsand

recordedatcost.

Investments

Investmentsecuritiesconsistofauctionratesecuritiesthatapproximate

fairvalueandreadily-marketabledebtandequitysecuritiesthatare

classifiedastradingwithunrealizedgainsorlosseschargedtoearnings.

Otherinvestmentsthatarenotcontrolledandoverwhichwedonot

havetheabilitytoexercisesignificantinfluenceareaccountedforunder

thecostmethod.

InventoryValuation

Inventoriesarevaluedatcost,whichisnotinexcessofcurrentmarket

prices.Product-relatedinventoriesareprimarilymaintainedonthe

first-in,first-outmethod.Minoramountsofproductinventories,

includingcertaincosmeticsandcommodities,aremaintainedonthe

last-in,first-outmethod.Thecostofsparepartinventoriesismaintained

usingtheaveragecostmethod.

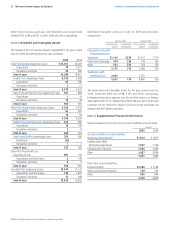

GoodwillandOtherIntangibleAssets

Thecostofintangibleassetswithdeterminableusefullivesisamortized

toreflectthepatternofeconomicbenefitsconsumed,principallyona

straight-linebasisovertheestimatedperiodsbenefited.Goodwilland

indefinite-livedintangibles,primarilybrandnamesandtrademarks,

arenotamortized,butareevaluatedannuallyforimpairment.Our

impairmenttestingforgoodwillisperformedseparatelyfromour

impairmenttestingofindividualindefinite-livedintangibles.Theannual

evaluationforimpairmentofgoodwillandindefinite-livedintangibles

isbasedonvaluationmodelsthatincorporateinternalprojectionsof

expectedfuturecashflowsandoperatingplans.Weevaluateanumber

offactorstodeterminewhetheranindefinitelifeisappropriate,

includingthecompetitiveenvironment,marketshare,brandhistory,

operatingplanandthemacroeconomicenvironmentofthecountriesin

whichthebrandsaresold.Wherecertaineventsorchangesinoperating

conditionsoccur,indefinite-livedintangiblesmaybeadjustedtoa

determinablelifeandanimpairmentassessmentmaybeperformed.

Duetothenatureofourbusiness,thereareanumberofbrand

intangiblesthathavebeendeterminedtohaveindefinitelives.Ifit

isdeterminedthatabrandintangibledoesnothaveanindefinite

life,ourpolicyistoamortizetheintangibleassetovertheexpected

usefullife.Patents,technologyandotherintangibleswithcontractual

termsareamortizedovertheirrespectivecontractuallives.Othernon-

contractualintangibleassetswithdeterminablelivesareamortizedover

periodsgenerallyrangingfrom5to20years.Wherecertaineventsor

changesinoperatingconditionsoccur,livesonintangibleassetswith

determinablelivesmaybeadjustedandanimpairmentassessmentmay

beperformedontherecoverabilityofthecarryingamounts.

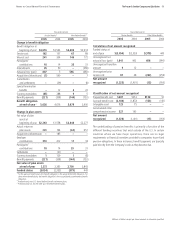

Property,PlantandEquipment

Property,plantandequipmentarerecordedatcostreducedby

accumulateddepreciation.Depreciationexpenseisrecognizedoverthe

assets’estimatedusefullivesusingthestraight-linemethod.Machinery

andequipmentincludesofficefurnitureandequipment(15-yearlife),

computerequipmentandcapitalizedsoftware(3to5-yearlives)and

manufacturingequipment(3to20-yearlives).Buildingsaredepreciated

overanestimatedusefullifeof40years.Estimatedusefullivesare

periodicallyreviewedand,whereappropriate,changesaremade

prospectively.Wherecertaineventsorchangesinoperatingconditions

occur,assetlivesmaybeadjustedandanimpairmentassessmentmay

beperformedontherecoverabilityofthecarryingamounts.

FairValuesofFinancialInstruments

Certainfinancialinstrumentsarerequiredtoberecordedatfairvalue.

Theestimatedfairvaluesofsuchfinancialinstruments,includingcertain

debtinstruments,investmentsecuritiesandderivatives,havebeen

determinedusingmarketinformationandvaluationmethodologies,

primarilydiscountedcashflowanalysis.Theseestimatesrequire

NotestoConsolidatedFinancialStatements TheProcter&GambleCompanyandSubsidiaries

Millionsofdollarsexceptpershareamountsorotherwisespecified.