Proctor and Gamble 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysisTheProcter&GambleCompanyandSubsidiaries

52

InterestRateManagement

Ourpolicyistomanageinterestcostusingamixtureoffixed-rateand

variable-ratedebt.Tomanagethisriskinacostefficientmanner,we

enterintointerestrateswapsinwhichweagreetoexchangewiththe

counterparty,atspecifiedintervals,thedifferencebetweenfixedand

variableinterestamountscalculatedbyreferencetoanagreed-upon

notionalprincipalamount.

InterestrateswapsthatmeetspecificconditionsunderSFASNo.133are

accountedforasfairvalueandcashflowhedges.Forfairvaluehedges,

thechangesinthefairvalueofboththehedginginstrumentsandthe

underlyingdebtobligationsareimmediatelyrecognizedininterest

expenseasequalandoffsettinggainsandlosses.Thefairvalueofthese

fairvaluehedgeswasanetassetof$17and$45atJune30,2005and

2004,respectively.Allexistingfairvaluehedgesare100%effective.As

aresult,thereisnoimpacttoearningsduetohedgeineffectiveness.

Forcashflowhedges,theeffectiveportionofthechangesinfairvalue

isreportedinothercomprehensiveincomeandreclassifiedintointerest

expenseoverthelifeoftheunderlyingdebt.Thefairvalueofthesecash

flowhedgeswasanassetof$3atJune30,2005.Therewerenosuch

interestratecashflowhedgesatJune30,2004.

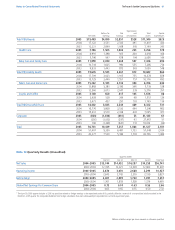

ForeignCurrencyManagement

Wemanufactureandsellourproductsinanumberofcountries

throughouttheworldand,asaresult,areexposedtomovementsin

foreigncurrencyexchangerates.Thepurposeofourforeigncurrency

hedgingprogramistoreducetheriskcausedbyshort-termchangesin

exchangerates.

Weprimarilyutilizeforwardcontractsandoptionswithmaturitiesof

lessthan18monthsandcurrencyswapswithmaturitiesupto5years.

Theseinstrumentsareintendedtooffsettheeffectofexchangerate

fluctuationsonforecastedsales,inventorypurchases,intercompany

royaltiesandintercompanyloansdenominatedinforeigncurrencies

andarethereforeaccountedforascashflowhedges.Thefairvalue

oftheseinstrumentsatJune30,2005and2004was$47and$47in

assetsand$131and$140inliabilities,respectively.Theeffectiveportion

ofthechangesinfairvaluefortheseinstrumentsisreportedinother

comprehensiveincomeandreclassifiedintoearningsinthesame

financialstatementlineitemandinthesameperiodorperiodsduring

whichthehedgedtransactionsaffectearnings.Theineffectiveportion,

whichisnotmaterialforanyyearpresented,isimmediatelyrecognized

inearnings.

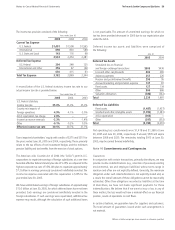

Certaininstrumentsusedtomanageforeignexchangeriskdonotmeet

therequirementsforhedgeaccountingtreatment.Inthesecases,the

changeinvalueoftheinstrumentsisdesignedtooffsettheforeign

currencyimpactofintercompanyfinancingtransactions,incomefrom

internationaloperationsandotherbalancesheetrevaluations.Thefair

valueoftheseinstrumentsatJune30,2005and2004was$57and

$71inassetsand$108and$26inliabilities,respectively.Thechange

invalueoftheseinstrumentsisimmediatelyrecognizedinearnings.

Thenetimpactofsuchinstruments,includedinselling,generaland

administrativeexpense,was$18,$80and$264ofgainsin2005,

2004and2003,respectively,whichsubstantiallyoffsetforeigncurrency

transactionandtranslationlossesoftheexposuresbeinghedged.

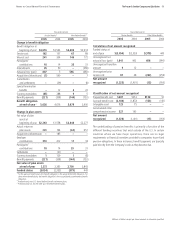

NetInvestmentHedging

Wehedgecertainofournetinvestmentpositionsinmajorforeign

subsidiaries.Toaccomplishthis,weeitherborrowdirectlyinforeign

currencyanddesignateaportionofforeigncurrencydebtasahedge

ofnetinvestmentsinforeignsubsidiariesorenterintoforeigncurrency

swapsthataredesignatedashedgesofourrelatedforeignnet

investments.UnderSFASNo.133,changesinthefairvalueofthese

instrumentsareimmediatelyrecognizedinothercomprehensiveincome,

tooffsetthechangeinthevalueofthenetinvestmentbeinghedged.

Currencyeffectsofthesehedgesreflectedinothercomprehensive

incomewerea$135after-taxgain,a$348after-taxlossanda$418

after-taxlossin2005,2004and2003,respectively.Accumulatednet

balanceswerea$451and$586after-taxlossin2005and2004,

respectively.

CommodityPriceManagement

Rawmaterialsaresubjecttopricevolatilitycausedbyweather,supply

conditions,politicalandeconomicvariablesandotherunpredictable

factors.Tomanagethevolatilityrelatedtocertainanticipatedinventory

purchases,weusefuturesandoptionswithmaturitiesgenerallyless

thanoneyearandswapcontractswithmaturitiesuptofiveyears.These

marketinstrumentsaredesignatedascashflowhedgesunderSFAS

No.133.Accordingly,themark-to-marketgainorlossonqualifying

hedgesisreportedinothercomprehensiveincomeandreclassified

intocostofproductssoldinthesameperiodorperiodsduringwhich

thehedgedtransactionsaffectearnings.Qualifyingcashflowhedges

currentlyrecordedinothercomprehensiveincomearenotconsidered

material.Themark-to-marketgainorlossonnon-qualifying,excluded

andineffectiveportionsofhedgesisimmediatelyrecognizedincost

ofproductssold.Commodityhedgingactivitywasnotmaterialtoour

financialstatementsforanyoftheyearspresented.

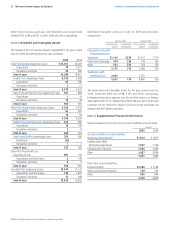

Note7EarningsPerShareandStockOptions

NetEarningsPerCommonShare

Netearningslesspreferreddividends(netofrelatedtaxbenefits)are

dividedbytheweightedaveragenumberofcommonsharesoutstanding

duringtheyeartocalculatebasicnetearningspercommonshare.

NotestoConsolidatedFinancialStatementsTheProcter&GambleCompanyandSubsidiaries

Millionsofdollarsexceptpershareamountsorotherwisespecified.